“… One path requires full buy-in from Republican lawmakers to address the issue via budget reconciliation — a huge challenge thanks to the party’s fierce fiscal hawks. The other entails winning over Democrats, who for the most part rejected Trump’s initial debt-limit gambit last week.

“Whoever advised the president that it was even possible needs to better understand how this place works,” Sen. Thom Tillis (R-N.C.) said about Trump’s latest push to raise the debt limit.

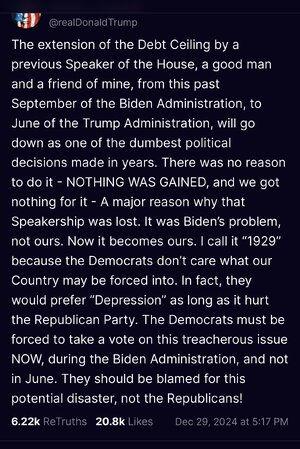

It’s going to be an urgent issue for Trump as soon as he takes office. The federal government will resume the cap on its borrowing authority on Jan. 1, as the U.S. sits on a national debt of more than $36 trillion, though the Treasury Department can buy time for a number of months with so-called extraordinary measures.

The fiscal time bomb illustrates the struggle Trump and Republican leaders face heading into 2025, as they consider whether to court Democrats who will want concessions or their own conservatives who are known for rigidly sticking to their demands to cut funding.

“I’ve told my caucus, if they try to do it under reconciliation, they’ll lose my vote,” Sen. Rand Paul (R-Ky.) said on Friday. “I told them: You want to kill reconciliation, put something on that we don’t like.” …”