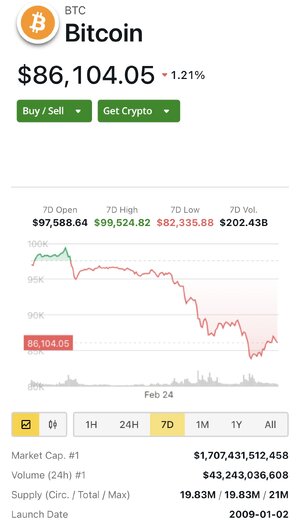

Again, in this fantasy world of "generally accepted" crypto...I think there can't be all these numbers of coins out there...memecoins, if you will. They're all basically "pump and dump" schemes, I agree with that part. I think you'd have to setting on one or two. One that is actually scalable (maybe ETH or ADA) and one "store of value" (Bitcoin). I know it still doesn't address all the issues you are laying out.It seems to me that you've been getting some crypto "education." The first and only rule about crypto education is that it's bullshit top to bottom. Anyone who is a crypto enthusiast, or any site trying to explain how to invest in crypto, is telling you lies.

Let's look at these properties of money. A unit of account? That's not an independent property. It follows from a medium of exchange. If you can trade with it, it means it has cardinality (i.e. it can be counted and manipulated arithmetically), and cardinality is all that is needed for being a unit of account. I can't think of anything that can't be a unit of account. You can quote prices in oak-tree equivalents, or the price of weather derivatives traded on the Singapore futures market. I suppose you can't quote prices in "dreams" but you can't use dreams for exchange either.

So why is it there? Because having three properties of money makes it seem more professional. The old rule of three. If there are only two, people might ask, "why is store of value important?" But people don't always want to put mental effort into debunking two requirements. They are more willing to accept a list of three as an expert evaluation rather than a list of two. And this isn't about stupidity. Not everyone is a weirdo like me who scrutinizes virtually every statement made to me or I make for its truth. Most people like to chill sometimes, and they don't necessarily like to spend their free time thinking about currencies (note: being a professor meant that I could get paid for thinking about them). But the upshot of this is that people are vulnerable to scams from con artists who present a veneer of respectable theory when it's all bullshit.

All right, so the unit of account is silly, and maybe the list is more marketing than science, but so what? It's that store of value piece. Why is that important? Because it leads to the next step: scarcity is the store of value. This is supposedly why bitcoin is so great: its supply is limited. There are many problems here:

1. Let's assume that scarcity is necessary for having value. That doesn't mean scarcity is the source of value, which is what the crypto people want you to believe. It doesn't mean that everything that is scarce is valuable. I've never seen anyone create a sculpture out of human vomit, and I doubt one exists. So if I made one, it would be extremely scarce. I also think I would have a lot of trouble selling it.

2. It is not in fact true that scarcity is necessary for value. I suppose that we could say that something that is truly infinite might not be valuable, but aside from weird math hypotheticals, let's look. There are way more shares of Apple stock in circulation now than 30 years ago. Does that mean they are less valuable? Of course not. Leaded gasoline is much rarer than it once was. Is it more valuable? It is not.

The "scarcity creates value" line is the most pernicious and fraudulent of the contentions. So much "analysis" is premised on this nonsense. Invariably that analysis tells you how to use all sorts of bizarre metrics that have no bearing on the real world to determine that crypto will go up in value.

3. As a technical matter, there's no sense in which crypto is "scarce." First, there are no limitations on the number of crypto tokens that can be started. In what way are crypto tokens not fungible? What value do I get out of DOGE coin that I wouldn't get our of Litecoin or any number of other tokens? None. As importantly, everything that is infinitely divisible (which bitcoin promoters love to trumpet) has no intrinsic scarcity. The set of rational numbers between 0 and 1 is countably infinite, the same as the set of all rational numbers period. So if there's an infinite number of values that a currency can have, there's the same number of values for bitcoin.

Put it all together, and there's only one criterion for money: it's a medium of exchange. In fact, it works better when its value is entirely set by fiat as opposed to having "intrinsic" value. Intrinsic value gold coins, for instance, tend to get smaller and smaller over the years. Why? Because everyone has incentive to scrape off just a bit of the coin before using it. If the coin is 10 cents because the government says it's 10 cents, we don't have this problem.

But the idea that money is nothing but a medium of exchange destroys a lot of crypto narratives about its "value" so they wrap it in all this bullshit and ask people to slurp it up.

I read a couple books back in 2018 while I was laid up after surgery, which kept me interested. They were mostly "pro crypto" but were also very clear about the drawbacks and reasons why it couldn't work. I'm not interested in listening to crypto bros. They're just another reason why I think it could never work, just parasites, trying to make a quick buck.