Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto News

- Thread starter nycfan

- Start date

- Replies: 172

- Views: 5K

- Politics

- Messages

- 18,945

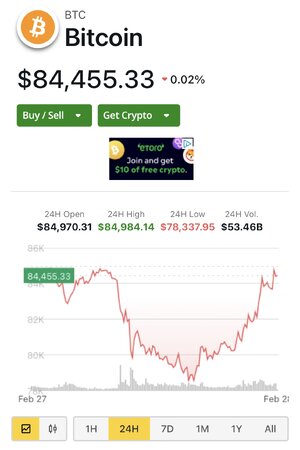

That reminder that the Trump Admin will be super cozy with crypto and dip buyers seem to have stabilized Bitcoin prices, at least for nowWhat a load of crap.

Bitcoin Price (BTC) Returns to $84K as Crypto Fear & Greed Index Hits "Extreme Fear" Levels.

Punitive tariffs against Mexico, Canada and China could go into effect on Tuesday.

“… The Crypto Fear & Greed Index overnight dipped to 10 — a level not seen since the depths of the 2022 bear market — but has also bounced, now residing at 16. That's still in the "extreme fear" range and well below last week's 55 (in the "greed" range). Levels above 75 are considered "extreme greed" and the index hasn't been there since around the time of Trump inauguration.

… Alone in the green among the major cryptos is solana (SOL), ahead 5% as the CME announced plans to add SOL futuresto its crypto platform on March 17. SOL, however, remains off by 36% over the past month and well beneath the levels it was at prior to the November election victory of Donald Trump. …”

Crypto trades 24/7, and for whatever reason typically declines during weekends (when other markets are closed) — the lack of a fixed break could be a problem if there is any more bad economic news going into a weekend, but the link notes that maybe the bad news is already baked into the current crypto correction …

- Messages

- 18,945

Merged two crypto threads, expected it to maintain the author of the one that “survived” the merger, retained but it did not function that way. Bluntly I was trying to combine two threads on the same topic and not have me be the author.

@uncgriff — I was trying to have you still show as the author.

@uncgriff — I was trying to have you still show as the author.

Last edited:

1moretimeagain

Iconic Member

- Messages

- 1,322

Cutting spending, but buying crypto coins!

superrific

Legend of ZZL

- Messages

- 7,209

These are solid investments, not just weird and environmentally destructive gambling tokens. After all, what security doesn't jump 20% on a random tweet outlaying a plan that makes no sense for which he has no statutory authority?

- Messages

- 18,945

“… Alongside plans to create a bitcoin reserve, Trump and his family—led by Trump’s sons Don Jr and Eric—have been expanding their businesses into the world of bitcoin, crypto and blockchain-based decentralized finance (DeFi).

In January, Trump and his wife Melania launched twin memecoins, a form of cryptocurrency that’s traded on community interest, which both surged before crashing back. Both memecoins are now trading down more than 80% from their all-time highs.

The Trump family-backed World Liberty Financial, a crypto platform that is expected to facilitate users earning yield through stablecoin and allow them to borrow bitcoin and crypto, also began buying up various cryptocurrencies, including the ethereum-based wrapped bitcoin.

Meanwhile, Trump’s social media company Trump Media and Technology Group (TMTG), which runs the Truth Social platform and has recently announced its expanding into the world of crypto and finance, has taken steps toward launching a bitcoin exchange-traded fund (ETF)—putting on course to compete with the likes of Wall Street giants BlackRock and Fidelity. …”

www.forbes.com

www.forbes.com

In January, Trump and his wife Melania launched twin memecoins, a form of cryptocurrency that’s traded on community interest, which both surged before crashing back. Both memecoins are now trading down more than 80% from their all-time highs.

The Trump family-backed World Liberty Financial, a crypto platform that is expected to facilitate users earning yield through stablecoin and allow them to borrow bitcoin and crypto, also began buying up various cryptocurrencies, including the ethereum-based wrapped bitcoin.

Meanwhile, Trump’s social media company Trump Media and Technology Group (TMTG), which runs the Truth Social platform and has recently announced its expanding into the world of crypto and finance, has taken steps toward launching a bitcoin exchange-traded fund (ETF)—putting on course to compete with the likes of Wall Street giants BlackRock and Fidelity. …”

‘More To Come’—Crypto Braced For Another Trump Shock After Bitcoin, XRP, Solana And Cardano Price Boom

Ripple’s XRP and ethereum rivals solana and cardano—all regarded as U.S.-made cryptocurrencies—each rose between 20% and 50%...

www.forbes.com

www.forbes.com

- Messages

- 18,945

“… Alongside plans to create a bitcoin reserve, Trump and his family—led by Trump’s sons Don Jr and Eric—have been expanding their businesses into the world of bitcoin, crypto and blockchain-based decentralized finance (DeFi).

In January, Trump and his wife Melania launched twin memecoins, a form of cryptocurrency that’s traded on community interest, which both surged before crashing back. Both memecoins are now trading down more than 80% from their all-time highs.

The Trump family-backed World Liberty Financial, a crypto platform that is expected to facilitate users earning yield through stablecoin and allow them to borrow bitcoin and crypto, also began buying up various cryptocurrencies, including the ethereum-based wrapped bitcoin.

Meanwhile, Trump’s social media company Trump Media and Technology Group (TMTG), which runs the Truth Social platform and has recently announced its expanding into the world of crypto and finance, has taken steps toward launching a bitcoin exchange-traded fund (ETF)—putting on course to compete with the likes of Wall Street giants BlackRock and Fidelity. …”

‘More To Come’—Crypto Braced For Another Trump Shock After Bitcoin, XRP, Solana And Cardano Price Boom

Ripple’s XRP and ethereum rivals solana and cardano—all regarded as U.S.-made cryptocurrencies—each rose between 20% and 50%...www.forbes.com

- Messages

- 18,945

Somebody bought the dip … meanwhile, David Sacks is Trump’s crypto czar

- Messages

- 18,945

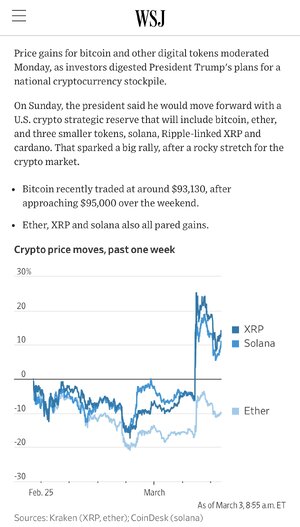

Crypto Prices Pare Gains After Spiking on Trump's 'Strategic Reserve' Plan

Price gains for bitcoin and other digital tokens moderated Monday, as investors digested President Trump's plans for a national cryptocurrency stockpile. On Sunday, the president said he would move forward with a U.S. crypto strategic reserve that will include bitcoin, ether, and three smaller toke

- Messages

- 18,945

The ‘Hustling Expert’ Behind Argentina’s $250 Million Crypto Scandal

Hayden Davis had a string of short-lived business ventures when he met Javier Milei. Together they pumped a crypto token that’s shaking Milei’s presidency.

GIFT LINK

“… Davis, his family and their venture-capital firm, Kelsier Ventures, were behind the Feb. 14 launch of $LIBRA, a meme coin that was intended to help fund the development of the Argentine economy, according to a website describing the project. When Milei promoted $LIBRA on social media, the price soared—until it crashed, eviscerating up to roughly $1 billion in market value, according to DEX Screener, a crypto data provider.

More than 10,000 investors have lost a total of at least $250 million, according to blockchain analytics firm Nansen. Davis, though, has acknowledged that he walked away with close to $100 million by quickly selling before the crash.

Davis, who didn’t respond to numerous requests for an interview, said in podcast interviews after $LIBRA’s crash that while he regretted that investors had lost so much, meme coins are inherently hazardous. …”

gtyellowjacket

Iconic Member

- Messages

- 1,858

Still can't understand how people are still falling for the scam. Bitcoin, ethereum, Litecoin, maybe another couple, I get. I don't really get it but I get that they've been around for a while and the odds of a rug pull scam at this point might be pretty low.The ‘Hustling Expert’ Behind Argentina’s $250 Million Crypto Scandal

Hayden Davis had a string of short-lived business ventures when he met Javier Milei. Together they pumped a crypto token that’s shaking Milei’s presidency.

GIFT LINK—> The ‘Hustling Expert’ Behind Argentina’s $250 Million Crypto Scandal

“… Davis, his family and their venture-capital firm, Kelsier Ventures, were behind the Feb. 14 launch of $LIBRA, a meme coin that was intended to help fund the development of the Argentine economy, according to a website describing the project. When Milei promoted $LIBRA on social media, the price soared—until it crashed, eviscerating up to roughly $1 billion in market value, according to DEX Screener, a crypto data provider.

More than 10,000 investors have lost a total of at least $250 million, according to blockchain analytics firm Nansen. Davis, though, has acknowledged that he walked away with close to $100 million by quickly selling before the crash.

Davis, who didn’t respond to numerous requests for an interview, said in podcast interviews after $LIBRA’s crash that while he regretted that investors had lost so much, meme coins are inherently hazardous. …”

But I don't get how people keep plowing money into these new meme coins. For folks that are immersed in crypto, have any of them worked? I.e have any of them gone up and stayed valuable from the introductory price and not had a rug pull? I truly don't know and perhaps I'm just hearing about the multiple, multiple scams.

MOUNTAINH33L

Esteemed Member

- Messages

- 557

Hey, board Trumpers. Do you consider this to be a good use of your taxpayer funds?

You know they do. They'll tell us that he's playing chess like a Grand Master. We're just too dumb and liberal to recognize his unrivaled brilliance. If Dear Leader does it then it must be right. Always.

1moretimeagain

Iconic Member

- Messages

- 1,322

Did I see the headline correctly that Trump is issuing an EO to exempt crypto from capital gains taxes?

Share: