I don't even pay taxes in the US so I have no feeling about the value I get or don't get for taxes paid.

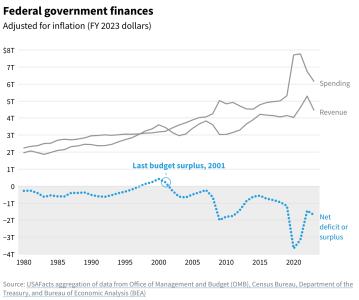

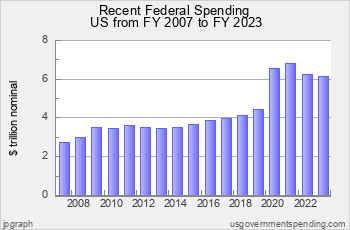

There is a staggering amount of interest being paid out to service the debt created by the federal deficit. That deficit can be attacked by one of two ways, raising taxes or reducing spending.

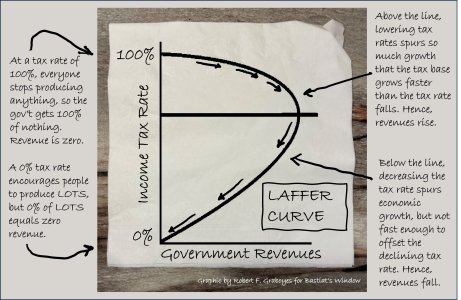

Since Ronald Reagan was President, the GOP has pushed and pushed the idea that tax cuts will increase revenue both in the short-term AND the long-term.

Sometimes, revenue goes up in the short-term; then, in the long-term revenue drops.

Republicans squawked about deficits in the ‘60’s and ‘70’s; Reagan ran on tax cuts and cutting the deficit; then his tax cuts and defense spending EXPLODED the deficit.

Right-wingers such as Grover Norquist***, founder and president of Americans for Tax Reform, knew the Reagan tax cuts would dramatically increase the deficit. They were good with this.

Cut taxes, increase the deficit, whine about deficits and the debt, cut taxes the next opportunity, increase the deficit and debt, whine about deficits and the debt.

Eventually, spending will be cut, especially spending on social programs. Don’t cut spending on defense or corporate welfare (support for corporate agriculture or oil/gas “exploration,” etc.).

That’s where we are today. The GOP and the Grover Norquists have bled the government dry and they want massive spending cuts in the EPA, FDA, CDC, NIH, NOAA, Education (at federal, state, and local levels), Medicaid, Medicare, Social Security, any welfare programs, State Department, etc. to cut the deficit.

Bill Clinton turned over an annual surplus to Dubya.

Dubya spent the surplus on tax cuts for the wealthy and well-off. This exploded the deficit. Then, he compounded matters by launching two wars.

America can certainly cut some programs; but, that’s tiny numbers on the margins.

America needs to reduce the deficit by taxing those that can afford it.

***Grover Norquist is also the leading proponent of the Taxpayer Protection Pledge - a promise that 90-95% of GOP Congressmen and Senators sign. A promise to not raise taxes. He’s also on the National Rifle Association board.