“… Since the arrival of a team from Elon Musk’s Department of Government Efficiency, Social Security is in a far more precarious place than has been widely understood, according to Leland Dudek, the acting commissioner of the Social Security Administration.

“I don’t want the system to collapse,” Dudek said in a closed-door meeting last week, according to a recording obtained by ProPublica.

He also said that it “would be catastrophic for the people in our country” if DOGE were to make changes at his agency that were as sweeping as

those at USAID, the Treasury Department and elsewhere.

Dudek’s comments, delivered to a group of senior staff and Social Security advocates attending both in person and virtually, offer an extraordinary window into the thinking of a top agency official in the volatile early days of the second Trump administration.

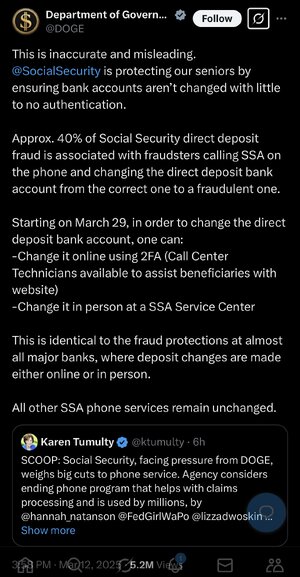

The Washington Post first reportedDudek’s acknowledgement that DOGE is calling the shots at Social Security and quoted several of his statements.

But the full recording reveals that he went much further, citing not only the actions being taken at the agency by the people he repeatedly called “the DOGE kids,” but also extensive input he has received from the White House itself.

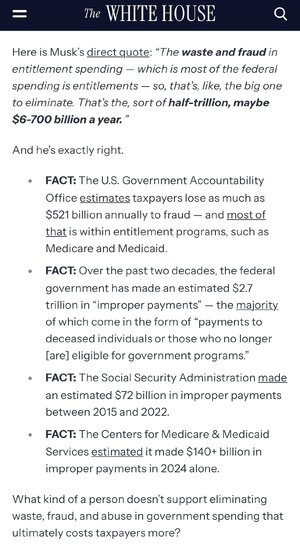

When a participant in the meeting asked him why he wouldn’t more forcefully call out President Donald Trump’s

continued false claims about widespread Social Security fraud as “BS,” Dudek answered, “So we published, for the record, what was actually the numbers there on our website. This is dealing with — have you ever worked with someone who’s manic-depressive?” …”