They aren't extreme at all, in fact its a problem being talked about across the financial industry and subtly in Fed papers.

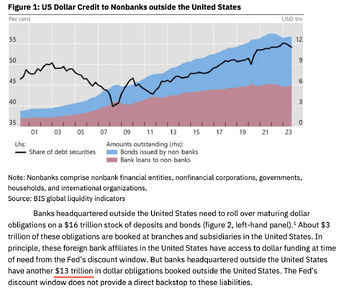

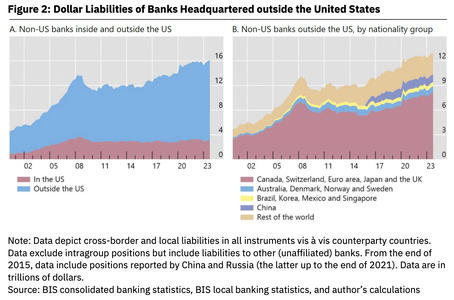

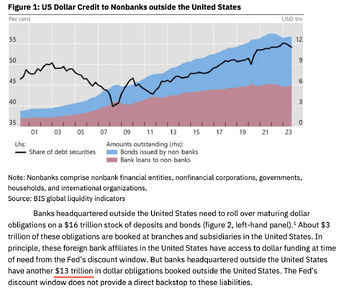

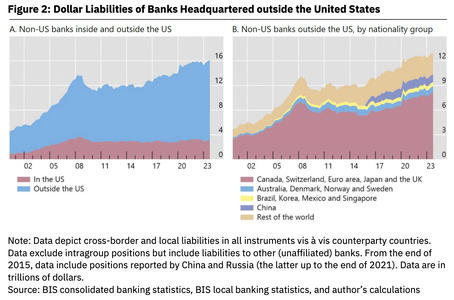

Let me just lay out the problem for you, foreign governments and corporations borrow in USD, even though most of their revenue is in their local currencies. The lender of these dollars is often not even a U.S. institution because foreign lenders often lend to foreign borrowers in USD. This exposes borrowers to currency risk due to a mismatch between the currency of their revenue and the currency of their debt. Borrowers often take this approach because they can secure a lower rate by borrowing in USD rather than in their local currency, effectively shifting the currency risk from the lender to themselves. Somtimes USD-denominated bonds and loans may be their only available option. The size of this market is enormous, $13 trillion, and is what keeps the USD in demand globally, its the bid for why people still want dollars as there is no other option. China is trying to build its own thing but China also loses control over their currency the more they internationalize it, so its a double edged sword like most things in finance.

To help supply liquidity for these markets are also the enormous FX swap markets that non-bank institutions around the world also participate in, its roughly $26 trillion for non-US nonbanks, and $39 trillion for US nonbanks, which btw is all off-balance sheet, its just enormous risk we're talking about here. These markets would be impacted by anything happened to the USD (like what I was saying before, it has to remain stable, it cannot get too weak or too strong) because if the USD became too strong it means non-US institutions with too much USD credit exposure could potentially default on that debt, which has ramifications that can't even adequately be modeled out you see. This is why the dollar getting too strong is a risk, its essentially creating the dynamic of an enormous global short squeeze on the USD. Look up Dollar Milkshake Theory on Youtube, that guy Brent Johnson lays it out for you in a more simplistic way.

My entire point is there are ways in which the Fed can manage this with Bitcoin rather than having to expand their balance sheet every time the world has a hiccup relating to dollar funding. If you'd like to discuss that point then first you need to educate yourself on just how much of a problem a dollar that is too weak or too strong is to global finance as it creates global financial instability, instability is bad for finance, and bad for the continuation of this system America created. Its bad for the stability of our own system too, its bad for our foreign allies if things go wrong. All of that is easy to understand why the USD being stable is the most important thing for the global system, if you're against the global system then that is an entirely different argument but you aren't making this. You wanted a strong dollar for cheaper vacations and consumption, which is paradoxical to the reality we now live in.

Here's a link to the paper I pulled the above from (

https://www.atlantafed.org/-/media/...4/05/15/02--offshore-dollar-and-us-policy.pdf)