growing rapidly, but still small

Milo, a financial technology company specializing in crypto mortgage lending, has exceeded $65 million in total loan volume, reflecting the increasing demand for alternative financing.

nationalmortgageprofessional.com

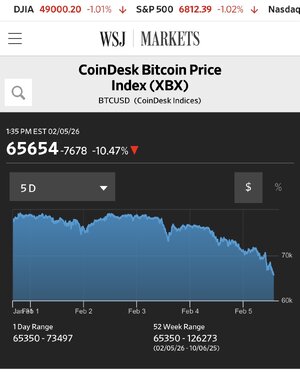

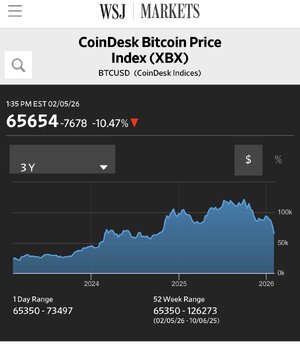

Mostly to the extent it is happening, the LTV is at a steep discount with a mandatory prepay obligation if the loan gets out of formula — so if you put up Bitcoin, you can only borrow at 50-60% of the value (calculated daily or weekly average or whatever) of the collateral (plus usually a fixed cap on aggregate borrowing regardless how much the price increases) and if you borrowed heavily when Bitcoin was $115,000, you’ve probably had to either provide more collateral and/or pay down the loan to get back in formula.

For example, say a borrower put up Bitcoin valued at $10 million (we’ll say 100 coins then trading at $100,000 each), the borrowing base is probably 50% of the collateral value and no more than 60% of the value of the collateral at that time (maybe based on a week/month/quarter average). So in that case, the borrower could borrow no more than $5 million against the collateral (50% of $10 million) at the time and no more than $6.5 million max outstanding at any time even if the value of the Bitcoin doubled.

So even if Bitcoin had jumped to $200,000 per coin, which would’ve meant you could borrow up to $10 million based on the 50% borrowing base, the borrower could only actually borrow up to $6.5 million (the hard cap), though might be allowed to remove some collateral if the value remains that high for a sustained period.

But if the borrower borrowed $5 million and now the coins are $67,000 each, then his/her borrowing cannot exceed $3.35 million, so he/she has a mandatory prepayment to reduce the borrowing to $3.35 million (or even less depending on the terms) or provide sufficient collateral to cover the 50% borrowing base.

Anyway, that is the simple version and some lenders are more aggressive than others and might be giving much riskier terms than I describe above. And most major lenders have yet to get comfortable with crypto has primary collateral for all kinds or reasons.