Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto News

- Thread starter nycfan

- Start date

- Replies: 320

- Views: 11K

- Politics

- Messages

- 41,710

It Was Supposed to Be ‘Crypto Week’ in Congress. Then It Unraveled.

The crypto industry was headed for a landmark moment in the House with three bills that it helped push going to a vote. But a coalition of ultraconservative House Republicans staged a mutiny.

It Was Supposed to Be ‘Crypto Week’ in Congress. Then It Unraveled.

The crypto industry was headed for a landmark moment in the House with three bills that it helped push going to a vote. But a coalition of ultraconservative House Republicans staged a mutiny.

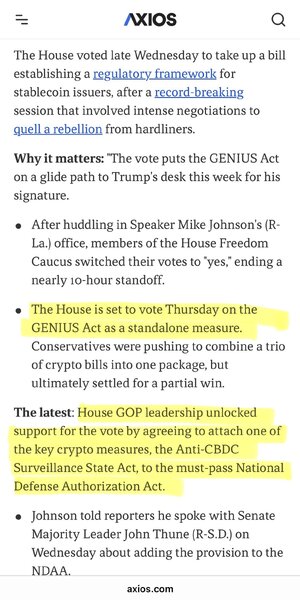

“… A coalition of ultraconservative House Republicans staged a mutiny on the House floor and voted to kill a procedural motion, demanding that lawmakers engineer a way to combine certain aspects of the legislation. A process meant to be a formality had thrust the House into chaos.

Now the crypto industry’s ambitious legislative agenda is in limbo.

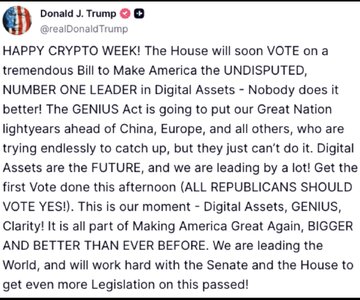

House Republicans had scheduled a final vote on the Genius Act, a key crypto bill that had already been passed by the Senate and appeared to be on a glide path to President Trump’s desk. It is no longer clear whether that legislation, which would create rules for a type of digital currency known as a stablecoin, will go to the House floor for a vote this week.

An even more expansive bill, titled the Clarity Act and laying out an entirely new regulatory framework for crypto, also faces potential delays.

Both had been slated for votes alongside a third bill backed by the industry that would stop the U.S. government from issuing its own digital currency.…”

- Messages

- 41,710

“… In addition to the Genius Act and the Clarity Act, Republicans were scheduled to vote on the bill stopping the Federal Reserve from issuing its own cryptocurrency.It Was Supposed to Be ‘Crypto Week’ in Congress. Then It Unraveled.

The crypto industry was headed for a landmark moment in the House with three bills that it helped push going to a vote. But a coalition of ultraconservative House Republicans staged a mutiny.

It Was Supposed to Be ‘Crypto Week’ in Congress. Then It Unraveled.

The crypto industry was headed for a landmark moment in the House with three bills that it helped push going to a vote. But a coalition of ultraconservative House Republicans staged a mutiny.www.nytimes.com

“… A coalition of ultraconservative House Republicans staged a mutiny on the House floor and voted to kill a procedural motion, demanding that lawmakers engineer a way to combine certain aspects of the legislation. A process meant to be a formality had thrust the House into chaos.

Now the crypto industry’s ambitious legislative agenda is in limbo.

House Republicans had scheduled a final vote on the Genius Act, a key crypto bill that had already been passed by the Senate and appeared to be on a glide path to President Trump’s desk. It is no longer clear whether that legislation, which would create rules for a type of digital currency known as a stablecoin, will go to the House floor for a vote this week.

An even more expansive bill, titled the Clarity Act and laying out an entirely new regulatory framework for crypto, also faces potential delays.

Both had been slated for votes alongside a third bill backed by the industry that would stop the U.S. government from issuing its own digital currency.…”

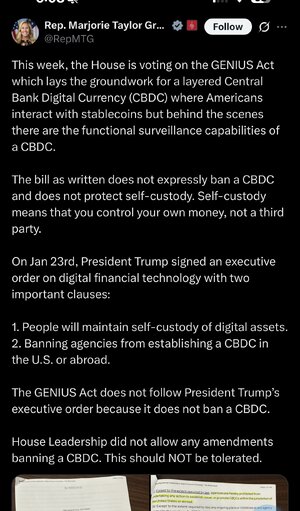

Crypto investors have long objected to the creation of a “central bank digital currency,” arguing that it would raise privacy issues. But the threat is purely hypothetical. Nothing along those lines has ever been seriously proposed by a U.S. official.

Still, a group of Republicans that included Representative Marjorie Taylor Greene of Georgia announced on Tuesday that it would not support the stablecoin legislation without language banning central bank digital currencies, or C.B.D.C.s.…”

Centerpiece

Inconceivable Member

- Messages

- 3,394

So the crypto world doesn't want the U.S. Government to issue it's on version of a crypto currency?

Want the cake and eat it too.

Want the cake and eat it too.

- Messages

- 41,710

When your goal is to supplant government issued currencies, you can’t have the government of the largest economy in the world issue its own digital currency — that would likely swamp all the “democratic non-state competition.So the crypto world doesn't want the U.S. Government to issue it's on version of a crypto currency?

Want the cake and eat it too.

- Messages

- 41,710

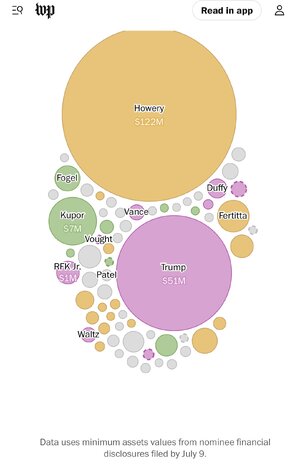

Over 1 in 5 high-level Trump picks held crypto, Post analysis finds

The unprecedented level of digital assets highlights an enormous reversal of fortune for the cryptocurrency industry.

“… And the appointment of multiple officials with crypto holdings comes at a time when the administration has taken a hands-off approach to regulation of digital currencies. The administration has also backed policies supported by the crypto industry, including legislation in Congress. The industry has prospered: The price of bitcoin hit an all-time high this week, doubling its value from last year.

The disclosures indicate that a wide range of Trump officials and allies could financially benefit from that approach.

The filings highlight how widespread crypto investments were among the people Trump picked for senior positions….”

- Messages

- 41,710

- Messages

- 5,221

Trump’s Meme Coin Empire Is About to Explode With Millions of New Tokens

Entities linked to the president can now sell up to nearly $1 billion worth of $TRUMP. The question is: will they?

If CIC Digital and its partners choose to sell the newly unlocked tokens, it would dramatically increase the $TRUMP coin supply, testing the strength of demand and the staying power of Trump’s crypto brand. The timing is crucial. $TRUMP has already seen wild fluctuations. It briefly hit $73.43 the day before Trump’s second inauguration, giving it a market cap of $14.7 billion. Today, it has crashed to around $2 billion, wiping out more than $12 billion in market value.

Despite the collapse, the Trump crypto ecosystem has been a moneymaker. The initial $TRUMP launch earned Trump-linked companies more than $350 million in transaction fees, according to blockchain analytics firm Chainalysis. Like credit card processors or ticketing platforms, the entities behind $TRUMP take a cut every time someone buys or sells the token.

The coin itself has no underlying utility. Like all meme coins, $TRUMP has no intrinsic value or real-world use case. Its price is driven almost entirely by hype, fandom, and political alignment.

lawtig02

Legend of ZZL

- Messages

- 5,942

I'll never understand how (1) every single literate person in this country doesn't see all of this as the Ponzi scheme it is, and (b) almost half of the electorate voted for the primary architect of the obvious Ponzi scheme to be our president. As with any Ponzi scheme, some people will get filthy rich. But SOOOO many people will lose their asses on this over the next few years, and by that time, Trump will be either dead or hooked up to a ventilator in his bedroom at Bedminster.

Trump’s Meme Coin Empire Is About to Explode With Millions of New Tokens

Entities linked to the president can now sell up to nearly $1 billion worth of $TRUMP. The question is: will they?gizmodo.com

- Messages

- 5,221

I am guessing the vast amount of transactions are just bribery; fleecing suckers is just the cherry on top.I'll never understand how (1) every single literate person in this country doesn't see all of this as the Ponzi scheme it is, and (b) almost half of the electorate voted for the primary architect of the obvious Ponzi scheme to be our president. As with any Ponzi scheme, some people will get filthy rich. But SOOOO many people will lose their asses on this over the next few years, and by that time, Trump will be either dead or hooked up to a ventilator in his bedroom at Bedminster.

lawtig02

Legend of ZZL

- Messages

- 5,942

Or money laundering.I am guessing the vast amount of transactions are just bribery; fleecing suckers is just the cherry on top.

1moretimeagain

Inconceivable Member

- Messages

- 4,175

Share: