Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto News

- Thread starter nycfan

- Start date

- Replies: 320

- Views: 11K

- Politics

- Messages

- 4,148

I just hope that no one is inferring that Trump is doing this because he is the presidential king of crypto currency. Do people really believe that this will put tens of millions in Trump's pocket ?

I don't think so. I think he did this to help working and middle class families.

Can we just get back to Hunter paying Sleepy Joe $12,000 in order to pay back the loan he gave him to make car payments ?

I don't think so. I think he did this to help working and middle class families.

Can we just get back to Hunter paying Sleepy Joe $12,000 in order to pay back the loan he gave him to make car payments ?

- Messages

- 4,148

Now I'm posting this but please don't infer that our president is benefitting in any way from the market rally in Bitcoin and crypto

- Messages

- 41,710

“… The U.S. GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins—formalizes this transformation of money by creating a framework for regulated U.S. banks to issue dollar-backed stablecoins: digital tokens designed to reliably trade near their $1 par value because they are backed by real dollars or safe assets held in reserve.

These tokens can move instantly across the internet, often bypassing the traditional banking system and its know-your-customer rules. Many operate on decentralized blockchains where transactions are recorded on public ledgers maintained by distributed computer networks that span the globe—beyond the practical reach of any sovereign authority.

This removes the biggest obstacle holding back the development of stablecoins: the lack of a fully credible peg. Historically, stablecoin issuers lacked the financial wherewithal to credibly maintain their peg to the U.S. dollar and had no liquidity support from the U.S. Federal Reserve, unlike banks. As a result, stablecoins rarely lived up to their moniker: Several collapsed outright, while others have frequently depegged, trading below their $1 par value during periods of volatility.

Yet with banks potentially guaranteeing 1:1 redemption of stablecoins for dollars, these tokens would become functionally equivalent to other financial assets, such as time deposits or commercial paper, that are already recognized “cash equivalents” under international accounting standards. The largest U.S. banks are already working on plans to issue stablecoins….”

- Messages

- 41,710

“…“… The U.S. GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins—formalizes this transformation of money by creating a framework for regulated U.S. banks to issue dollar-backed stablecoins: digital tokens designed to reliably trade near their $1 par value because they are backed by real dollars or safe assets held in reserve.

These tokens can move instantly across the internet, often bypassing the traditional banking system and its know-your-customer rules. Many operate on decentralized blockchains where transactions are recorded on public ledgers maintained by distributed computer networks that span the globe—beyond the practical reach of any sovereign authority.

This removes the biggest obstacle holding back the development of stablecoins: the lack of a fully credible peg. Historically, stablecoin issuers lacked the financial wherewithal to credibly maintain their peg to the U.S. dollar and had no liquidity support from the U.S. Federal Reserve, unlike banks. As a result, stablecoins rarely lived up to their moniker: Several collapsed outright, while others have frequently depegged, trading below their $1 par value during periods of volatility.

Yet with banks potentially guaranteeing 1:1 redemption of stablecoins for dollars, these tokens would become functionally equivalent to other financial assets, such as time deposits or commercial paper, that are already recognized “cash equivalents” under international accounting standards. The largest U.S. banks are already working on plans to issue stablecoins….”

China’s leadership views these developments with considerable apprehension—and for good reason. Bank-issued dollar stablecoins present a powerful use case as an infinitely divisible, programmable form of digital money that combines the dollar’s core strength—global liquidity—with the security and anonymity of blockchain-based ownership, akin to holding physical gold.

… The result is a new channel for transacting in dollars that the Chinese state cannot fully monitor, throttle, or shut down.

From the perspective of the Chinese Communist Party (CCP), dollar stablecoins are not just a potentially disruptive economic issue but also a political threat.

One of the pillars of the party’s political power is its ability to control the flow of money and preferentially allocate capital using China’s system of financial repression. The architecture of this system relies on strict capital controls to hold the capital of the Chinese people captive and funnel it into state-owned banks.

If the government can no longer effectively police access to foreign currency, then capital will steadily leak out, and the whole system of ensuring the loyalty of China’s elites to the CCP by selectively granting them access to cheap capital will break down.

… China’s export-oriented business community would likely be receptive to using bank-issued dollar stablecoins because of their potential to lower international transaction costs. It is conceivable that after gaining traction among businesses, dollar stablecoins could begin to displace the yuan in more everyday transactions—just as printed U.S. dollars already circulate widely in parts of Latin America.

While the loss of monetary sovereignty in China may seem like a distant threat, it is nonetheless an existential one—and the CCP knows it.…”

- Messages

- 41,710

“… In May, Hong Kong’s Legislative Council passed the landmark Stablecoins Bill, allowing licensed entities to issue fiat-backed stablecoins, including those pegged to the Hong Kong dollar (itself pegged to the U.S. dollar) and the offshore renminbi (CNH). Oversight, licensing, and audits fall under the authority of the Hong Kong Monetary Authority.“…

China’s leadership views these developments with considerable apprehension—and for good reason. Bank-issued dollar stablecoins present a powerful use case as an infinitely divisible, programmable form of digital money that combines the dollar’s core strength—global liquidity—with the security and anonymity of blockchain-based ownership, akin to holding physical gold.

… The result is a new channel for transacting in dollars that the Chinese state cannot fully monitor, throttle, or shut down.

From the perspective of the Chinese Communist Party (CCP), dollar stablecoins are not just a potentially disruptive economic issue but also a political threat.

One of the pillars of the party’s political power is its ability to control the flow of money and preferentially allocate capital using China’s system of financial repression. The architecture of this system relies on strict capital controls to hold the capital of the Chinese people captive and funnel it into state-owned banks.

If the government can no longer effectively police access to foreign currency, then capital will steadily leak out, and the whole system of ensuring the loyalty of China’s elites to the CCP by selectively granting them access to cheap capital will break down.

… China’s export-oriented business community would likely be receptive to using bank-issued dollar stablecoins because of their potential to lower international transaction costs. It is conceivable that after gaining traction among businesses, dollar stablecoins could begin to displace the yuan in more everyday transactions—just as printed U.S. dollars already circulate widely in parts of Latin America.

While the loss of monetary sovereignty in China may seem like a distant threat, it is nonetheless an existential one—and the CCP knows it.…”

Hong Kong serves as China’s financial laboratory: It is legally distinct yet politically aligned, globally integrated yet institutionally loyal. While mainland regulators have not publicly endorsed the new framework, it is implausible that such a move could occur without Beijing’s approval.

By permitting CNH-based stablecoin trials in Hong Kong, Chinese authorities can explore tokenized renminbi circulation offshore while keeping mainland capital controls intact.

A renminbi-backed stablecoin would likely be fully traceable, linked to China’s digital ID system with real-name verification and facial recognition, enabling authorities to monitor every transaction in real time.

While this strengthens anti-money laundering efforts, it also poses risks of pervasive financial surveillance. At best, it allows precise macroeconomic policy; at worst, it becomes a tool for enforcing political discipline and restricting undesirable economic behavior.

For Beijing, blockchain’s value lies not in decentralization but in using code to refine state control. In this model, money is more than a medium of exchange; it becomes an instrument for implementing government policy and exercising social control.

The programmability of stablecoins could allow Chinese authorities to embed usage restrictions directly into the currency itself. Features already tested in the e-CNY—such as expiration dates, sector-specific spending limits, and geographic limitations—could be adapted to serve government objectives.

Moreover, geofencing could limit circulation of an offshore renminbi stablecoin to only licensed zones, such as Hong Kong and other financial centers, with transaction limits and user eligibility hard-coded on the blockchain. This would preserve China’s capital controls while allowing the stablecoin to circulate globally. Unlike the e-CNY, which remains primarily domestic despite ambitionsfor international use, an offshore stablecoin pegged to CNH could extend China’s global financial reach without exposing its capital account to outflow risks.

Momentum is growing among scholars and companies advocating that Beijing authorize a renminbi-backed stablecoin to proactively counter the influence of dollar stablecoins….”

sringwal

Iconic Member

- Messages

- 2,305

- Messages

- 41,710

Bitcoin just lost more than stocks did in the 1929 market crash. It won’t be the last time.

No investment is immune to sharp, painful downturns.

- Messages

- 46

Quite the clickbaity headline there.

Bitcoin just lost more than stocks did in the 1929 market crash. It won’t be the last time.

No investment is immune to sharp, painful downturns.www.marketwatch.com

- Messages

- 41,710

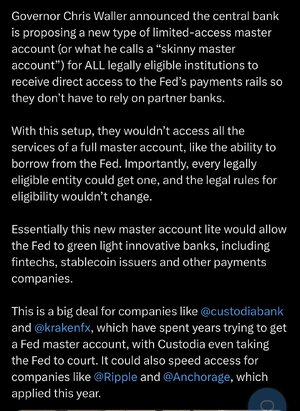

So the Fed will basically allow FinTechs and non-bank crypto exchanges to borrow directly from the Fed (rather than partner with a regulated bank for such access)? Sounds like another way to permit a Wild West unregulated financial system with the Fed left holding the bag if it flops, but I guess at least the stablecoin and FinTechs wouldn’t be taking down a regulated bank with them if they go belly up(??)

It also risks making regulated banks less competitive versus less regulated competing ways that will undermine regulation of the financial system (until some disaster ends in people demanding regulations they otherwise abhor as stifling innovation).

- Messages

- 41,710

The Year’s Hottest Crypto Trade Is Crumbling

Selloff in bitcoin and other digital tokens hits crypto-treasury companies

“… It was the move to make for much of the year: Sell shares or borrow money, then plow the cash into bitcoin, ether and other cryptocurrencies. Investors bid up shares of these “crypto-treasury” companies, seeing them as a way to turbocharge wagers on the volatile crypto market.

… But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks.

… Many of the companies that raised cash to buy cryptocurrencies are unlikely to face short-term crises as long as their crypto holdings retain value. Some have raised so much money that they are still sitting on a lot of cash they can use to buy crypto at lower prices or even acquire rivals.

But companies facing losses will find it challenging to sell new shares to buy more cryptocurrencies, analysts say, potentially putting pressure on crypto prices while raising questions about the business models of these companies….”

- Messages

- 1,630

I’ve shoveled some “Stable Coins” out of plenty of horse stalls back in the day! Maybe I should not be skeptical but this stuff reminds me of the “tulip bulb” market in the 1500-1600’s. Same with AI speculation market. Perhaps I am just an uninformed “old” but my family has always been fond of my father’s economic theory that “If your outgo exceeds your income then your upkeep will be your downfall!”

I like to invest in businesses that actually make money for the product they produce. If it has no income then in my opinion/experience it’s speculative.

I like to invest in businesses that actually make money for the product they produce. If it has no income then in my opinion/experience it’s speculative.

uncgriff

Honored Member

- Messages

- 900

Bitcoin crashes below $90k. I have a couple of friends who are banking their retirement on this ponzi scheme. I fully admit I don't understand it but I don't understand it. If it's really going to be worth over $1 million a coin as they have earnestly told me why is it not worth that now? Other than hype (which currently seems maximal with the POTUS pushing it publicly and loudly) what is going to drive this so the current bag holders have somebody stupid enough to pay more than what they did? Some poor sap paid $124k for it six weeks ago and has lost 27%

Last edited:

superrific

Master of the ZZLverse

- Messages

- 12,463

There's nothing to understand. The non-speculative value of a bitcoin is precisely zero. It has no intrinsic value (i.e. holding it generates no returns), and it has no option value (empty, undeveloped land has no current value but could have value in the future). So they are making it all up.Bitcoin crashes below $90k. I have a couple of friends who are banking their retirement on this ponzi scheme. I fully admit I don't understand it but I don't understand it. If it's really going to be worth over $1 million a coin as they have earnestly told me why is it not worth that now? Other than hype (which currently seems maximal with the POTUS pushing it publicly and loudly) what is going to drive this so the current bag holders have somebody stupid enough to pay more than what they did? Some poor sap paid $124k for it six weeks ago and has lost 27%

The only thing that drives bitcoin prices up is money flowing in. If enough money flows into bitcoin, it will trade for $1M but apparently we are not at that point.

Felt like a pump and dump but the dump took a long time.

Share: