LeoBloom

Distinguished Member

- Messages

- 473

It is amazing how little coverage this story has garnered

Yeah, but Hunter Biden.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

It is amazing how little coverage this story has garnered

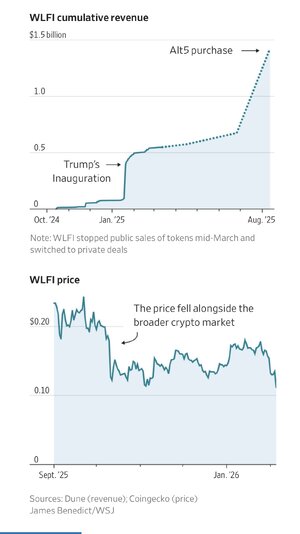

“… Alt5’s new owners also made little progress integrating the USD1 stablecoin, as Witkoff had said it would. No USD1 transactions have ever been processed on its payment platform, trading data on Alt5’s website show.“… Zach Witkoff was onto the next megadeal.

The plan: World Liberty would take over a publicly traded firm, raise money from investors by selling shares, and use the funds to buy World Liberty’s own WLFI token, people familiar with the proposal said. The stated approach was similar to that of crypto-fan-favorite stock Strategy, which uses shareholder money to buy bitcoin. By buying so much bitcoin, it helps push up the price of the cryptocurrency, and Strategy’s stock—a virtuous cycle, so long as bitcoin is rising.

World Liberty settled on a small Nasdaq-listed crypto payments firm called Alt5 Sigma. In August, World Liberty said it would use its tokens to buy a controlling stake in Alt5, which in turn would raise $750 million from investors at a price of $7.50 a share. Witkoff was named Alt5’s chairman and said the deal would benefit both companies, touting plans for Alt5 to incorporate World Liberty’s USD1 stablecoin into its payment products.

…

Flush with $750 million, Alt5 directed almost all that money into buying WLFI tokens at 20 cents apiece—60% above a price a private investor had recently paid.

But unlike when Strategy buys bitcoin, Alt5 didn’t buy the tokens on the open market—instead it bought tokens directly from World Liberty, according to Alt5’s securities filings.

It is similar to how a public company sells newly issued shares that dilute shareholders, but with a remunerative twist: Based on the terms disclosed by World Liberty, the money would go to the original owners of the company, meaning over $500 million to a Trump family-owned entity and $90 million to the Witkoff family.

At the time, holders of WLFI weren’t able to sell their tokens, since they were still “locked” in crypto parlance. But the Alt5 deal was allowing the Trumps and their fellow co-founders to cash out in a different way. …”

It is amazing how little coverage this story has garnered

I think it's a combination that right-wing media isn't going to cover anything remotely negative about Trump and Trump's corruption is so baked into how we perceive him at this point that other media focuses on other things.