Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CURRENT EVENTS May 22 - July 5

- Thread starter nycfan

- Start date

- Replies: 2K

- Views: 68K

- Politics

- Status

- Not open for further replies.

- Messages

- 1,045

Taxes on gambling winnings

Tax Form W-2G should be given to you if you have a gambling win of:

Tax Form W-2G should be given to you if you have a gambling win of:

- $600 or more if the amount is at least 300 times the wager (the payer has the option to reduce the winnings by the wager)

- $1,200 or more (not reduced by wager) in winnings from bingo or slot machines

- $1,500 or more in winnings (reduced by wager) from keno

- More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament

- More than $5,000 from sweepstakes, wagering pools, and lotteries

superrific

Master of the ZZLverse

- Messages

- 12,447

Hey NC MAGAs: you got fucked. They played you for chumps. You were worried about FEMA spying on you? Cool. It's gone. Stein is going to be in office four years and Trump isn't going to authorize any relief during that time, you watch.

Centerpiece

Inconceivable Member

- Messages

- 3,381

A female suspect. That is somewhat odd and irregular. Yes, women do commit and or attempt murder, but an attempt at mass murder - killing random people - is somewhat rare. Yes, there are some examples in the past, bombings, Charles Manson gang murders and so forth. But it’s usually a male perpetrator trying to kill multiple people at one time. Odd.

On the lighter side

Two of those three Republican Presidents wear/wore more make-up than any other President.

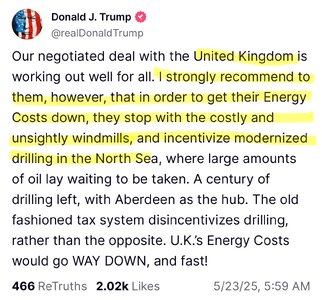

Yeah……North Sea drilling is such low-cost energy.

- Messages

- 41,551

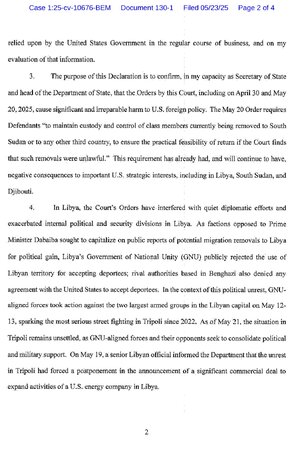

More than 100 National Security Council staffers put on administrative leave

“The Trump administration has put more than 100 officials at the National Security Council at the White House on administrative leave on Friday as part of a restructuring under interim national security adviser and Secretary of State Marco Rubio, according to two US officials and another source familiar with the matter.

… An email from NSC chief of staff Brian McCormack went out around 4:20 p.m. informing those being dismissed they’d have 30 minutes to clean out their desks, according to an administration official. If they weren’t on campus, the email read, they could email an address and arrange a time to retrieve their stuff later and turn in devices.

The email subject line read: “Your return to home agency,” indicating that most of those affected were detailed to the NSC from other departments and agencies. …”

HintonJamesHeel

Esteemed Member

- Messages

- 727

Anthropic’s AI resorts to blackmail in simulations

The model threatened to reveal an engineer’s affair if it were to be replaced with a new system.

This seems pretty awful.

Turd Ferguson

Legend of ZZL

- Messages

- 5,869

Anthropic’s AI resorts to blackmail in simulations

The model threatened to reveal an engineer’s affair if it were to be replaced with a new system.www.semafor.com

This seems pretty awful.

- Messages

- 2,097

How smart could that A.I. be if it thought an engineer was engaging in an affair. That's really more of a liberal arts type behavior.

Anthropic’s AI resorts to blackmail in simulations

The model threatened to reveal an engineer’s affair if it were to be replaced with a new system.www.semafor.com

This seems pretty awful.

Mulberry Heel

Inconceivable Member

- Messages

- 3,998

No, it really isn't. To cut down on fraud you're going to need more agents. And you didn't even address why Trumpers want to sharply reduce the number of agents. The reason - which you simply refuse to discuss - is obvious. The fewer agents the IRS has, the more difficult it becomes to stop fraud and catch waste. And as others have already pointed out, the IRS didn't add all of those agents to catch Venmo abusers, lol.Very misleading. The additional irs agents were added while the current staff was already 78,000. So the size practically doubled. It beome larger than some agencies combined. And the threshold for third party online payments before an audit was triggered was lowered to $600. Before it was 200 transactions and $20,000.

- Messages

- 41,551

- Messages

- 41,551

“… It is not clear whether the provision can survive under special procedures Republicans are using to push the legislation through Congress on a simple majority vote. Such bills must comply with strict rules that require that all of their components have a direct effect on federal revenues.

But by including it, Republicans were seeking to use their major policy bill to weaken federal judges. Under the rules that govern civil lawsuits in the federal courts, federal judges are supposed to order a bond from a person seeking a temporary restraining order or a preliminary injunction.…”

- Messages

- 41,551

Trump’s Lie About Dead “White Farmers” Just Got Even More Grotesque

That photo he brandished to Cyril Ramaphosa was from the Democratic Republic of Congo—whose refugees the Trump administration is pointedly not welcoming to America.

Trump’s Lie About Dead “White Farmers” Just Got Even More Grotesque

That photo he brandished to Cyril Ramaphosa was from the Democratic Republic of Congo—whose refugees the Trump administration is pointedly not welcoming to America.

“Because President Trump deeply values accuracy and integrity in public conduct, he will be mortified to learn that a photo he brandishedduring his recent Oval Office meeting with South African President Cyril Ramaphosa perpetrated a massive deception. The photo was supposed to display dead white South African farmers—a Trump obsession—but instead, it showed body bags from the war in the Democratic Republic of Congo, which is producing humanitarian horrors.

This abomination came as Trump ambushed Ramaphosa by displaying numerous printouts of web pages to illustrate a “genocide” against whites underway in his country. But Reuters now reports that one of the printouts displayed imagery taken from a Reuters video shot in Congo of humanitarian workers moving dead victims from the war with Rwanda-backed rebels.

… But there’s another ugly irony here that shouldn’t pass unnoticed: The Trump administration has suspended foreign aid to Congo and the resettlement of refugees from that nation, thus abandoning countless victims of the very same real-life humanitarian catastrophe that he’s cherry-picking imagery from to portray an atrocity against whites that isn’t actually happening.

… As it happens, the video he showed Ramaphosa of crosses designed to depict a killing field full of white corpses also turned out to be a wild distortion.

Trump’s broader claim of a white genocide has similarly been debunked. Yet Trump has sought to feed this gutter conspiracy theory by resettling several dozen white Afrikaners in the United States, even as he’s suspended the resettlement of refugees from everywhere else in the world.

…

What’s more, according to the United Nations, Trump’s cuts have “severely impacted” humanitarian efforts in Congo. Jeremy Konyndyk, president of Refugees International, argues that these are taking a toll on victims of the conflict there: The cuts, he says, “affected services for people displaced by the fighting, including emergency food aid, clean water, shelter, and emergency malnutrition support.”

In fairness, under Trump this conflict recently saw a partial diplomatic breakthrough, though this continued a process initiated by his predecessor. As The Washington Post’s David Ignatius reports, this achievement could ultimately make a real difference. But this doesn’t justify stalling resettlement of refugees from the war or dramatically curtailing foreign aid to the region….”

- Status

- Not open for further replies.

Share: