Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News | March CPI lower than expected

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 54K

- Politics

- Messages

- 17,352

Headline PPI decreased 0.4% in March, the first drop in 17 months, bringing the 12-month change down to 2.7%. A gauge of core prices, which excludes food and energy, rose 0.1%. Both were cooler than economists had expected. It followed a similarly cooler-than-expected reading on consumer-price inflation released Thursday.

lawtig02

Inconceivable Member

- Messages

- 2,911

Just to point out the obvious, all of these numbers show the strength of the economy Trump inherited from Biden. They do not yet show the results of Trump's unnecessary and inexplicable fuckery with said economy.Headline PPI decreased 0.4% in March, the first drop in 17 months, bringing the 12-month change down to 2.7%. A gauge of core prices, which excludes food and energy, rose 0.1%. Both were cooler than economists had expected. It followed a similarly cooler-than-expected reading on consumer-price inflation released Thursday.

- Messages

- 17,352

US consumer sentiment plummets to second-lowest level on records going back to 1952

“Americans are rarely this pessimistic about the economy.

Consumer sentiment plunged 11% this month to a preliminary reading of 50.8, the University of Michigan said in its latest survey released Friday, the second-lowest reading on records going back to 1952. April’s reading was lower than anything seen during the Great Recession.

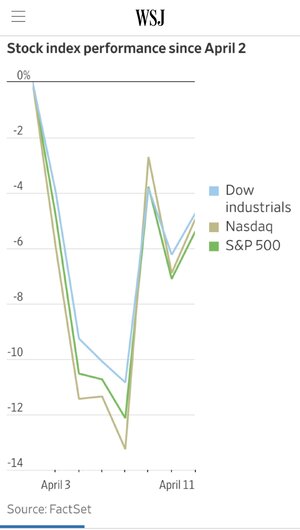

President Donald Trump’s volatile trade war, which threatens higher inflation, has significantly weighed on Americans’ moods these past few months. That malaise worsened leading up to Trump’s announcement last week of sweeping tariffs, according to the survey.

“This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation,” Joanne Hsu, the survey’s director, said in a release. …”

——

I think Trump is causing all kinds of unjustified self-inflicted wounds on the U.S. economy short term and like long term, BUT the economy is nowhere near the catastrophic state of the Great Recession. Inflation is reasonable and employment rates are strong …

I said it under Biden and it remains true under Trump a lot more than I actually expected, Americans seem to have lost sight of what a strong economy looks like. I get that when government officials predict “pain” and a need to “take your medicine” in the short term that was going to drive down sentiment and certainly the rational and erratic tariff nonsense that Trump has launched is scrambling the markets, which is in turn understandably freaking out Americans.

It really is shocking political malpractice by Trump, no matter how sure he is that he is always right (as he frequently insists everyone tells him), that he could have basked in an uptick in consumer confidence without tinkering with the economy at all just by replacing Biden. People had blamed Biden for real and perceived economic issues and were ready to give Trump a honeymoon. Businesses assumed his trade war rhetoric was mostly bluster and were ready for a deregulatory splurge. All Trump had to do was …. nothing! Just sit tight and take credit for improving trends and blame Biden for any negative blips.

Instead, he chose to radically remake the world trade system at the same time he was radically dismantling government at the same time he was radically reorienting foreign policy to invent disputes with neighbors and allies and promise 19th century Manifest Destiny expansionist plans out of the blue.

The big deal he made about Liberation Day means he owns all of it now. Just shockingly stupid from a purely political perspective.

heelinhell

Iconic Member

- Messages

- 1,335

I really really need for Calla and HY to come here and reassure me that all is well...

superrific

Legend of ZZL

- Messages

- 6,570

The economy was strong in advance of the Great Recession until the bottom fell out . . .I think Trump is causing all kinds of unjustified self-inflicted wounds on the U.S. economy short term and like long term, BUT the economy is nowhere near the catastrophic state of the Great Recession. Inflation is reasonable and employment rates are strong …

As I explained on the other thread, an increase in interest rates here is an almost inevitable result of more borrowing (per House/Senate budget) while cutting off our biggest creditor (because in absence of trade, China no longer has dollars to invest). And an increase in interest rates here will cause recession, in part because interest rates typically weigh on growth and in part because more domestic investment will have to go to Treasury debt.

So what we're seeing is the start, not the end game. That there are mass layoffs in the government and retaliatory tariffs and boycotts is the short-term factor. The medium-and-long-term effects are going to be demanded by the market in one way or the other, because it must necessarily happen as a matter of arithmetic (note the bit about arithmetic is a little bit oversimplifying but for present purposes it's fine).

The Fed is not magic. It controls interest rates by buying and selling bonds. To lower rates, it buys bonds. But if the market wants rates at 5% and the Fed wants them at 3%, the amount of money it would take to buy enough bonds to move rates there . . . well, it's more money than we have.

- Messages

- 17,352

- Messages

- 17,352

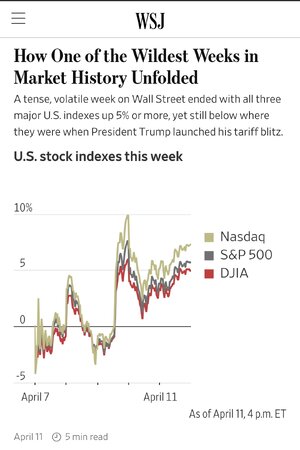

“… Friday also began on a down note, after the University of Michigan’s closely watched gauge of consumer sentiment nosedived from last month to register one of the weakest readings of the past decade on concerns about trade, employment and inflation.

But the declines didn’t last long. Solid first-quarter earnings from some of the country’s largest financial firms, including Morgan Stanley, JPMorgan Chase and BlackRock, offered a tailwind even as their executives warned that Trump’s trade restrictions put the economy at risk. …”

- Messages

- 17,352

‘I’m super worried’: fewer UK tourists visiting US amid Trump’s policies and rhetoric

Number of Brits crossing Atlantic down 14.3% from 2024 – and the travel industry fears decline could continue

‘I’m super worried’: fewer UK tourists visiting US amid Trump’s policies and rhetoric

Number of Brits crossing Atlantic down 14.3% from 2024 – and the travel industry fears decline could continue

“… Analysts believe that Donald Trump’s claims that other countries were “cheating” Americans and reports of deportations may have had a chilling effect on travel to the US. But the March dip may be simply an early warning of a bigger fall in the summer, because tourists typically book holidays months in advance.

…

Spring is difficult for travel companies to analyse because Easter moves in the calendar. So could the comparative drop simply be the effect of the Easter school holidays falling in March 2024? It seems unlikely, Edwards said, because the figures from the US National Travel and Tourism Office show an even bigger drop, of 16%, compared with March 2019 when Easter was on 21 April and Trump was nearing the end of his first term.

Travellers from other countries also seemed to avoid the US in March – visitors from western Europe who stayed at least one night in the US were down 17% in March, year on year. German visitors were down 28.2% and Spanish ones down 24.6% compared with 2024. Overall, global travel to the US was down 11.6%. UK residents make up the largest number of foreign visitors to the US, with 3.9 million a year. …”

Share: