Do you think I voted for trump because I thought he would bring down the cost of eggs on day 1, or day 30, or day 100? Overall, from a macro level, I'm quite happy with most of what has transpired so far. Not necessarily with the method, but the ideology. I voted for border security. I'm getting it. I voted for strengthening the military. I'm getting it. I voted to purge dei from the g'ment and as much of society as possible. I'm getting it. I voted for reducing the size of the fed g'ment. It's under way. I voted for a stronger foreign policy. I'm getting it. Not pleased with everything but overall I'm quite happy.

Oh lord. This might be the biggest self-own I've seen on here yet.

"I voted for border security. I'm getting it."

Actual numbers are virtually unchanged from the last several months of Biden's term.

"I voted for strengthening the military. I'm getting it."

LOf'ingL!!!! With PETE HEGSETH??? God, what an embarrassment.

"I voted to purge dei from the g'ment and as much of society as possible. I'm getting it."

Congrats. You can't even define DEI accurately, but I'm really glad you're succeeding in punching down on the 10 trans athletes who are trying to compete in women's sports.

"I voted for reducing the size of the fed g'ment. It's under way."

Sigh. The federal government is not being reduced. It's just being consolidated in the hands of a would-be emperor and his billionaire Rasputin.

"I voted for a stronger foreign policy. I'm getting it."

I can't imagine how you can possibly type this in good faith. Half the rest of the world is furious at us right now. The other half is laughing its ass off. Neither is even remotely indicative of strength.

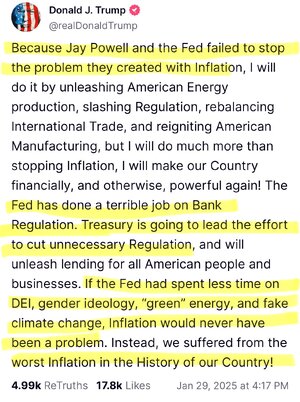

And while we're at it, don't gaslight us on not voting for Trump because of inflation and the economy. You posted on here a TON before the election. We all saw it. And MUCH of what you wrote was complaining about prices at the grocery store.