Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News Thread | Fed Quarter Point rate cut

- Thread starter nycfan

- Start date

- Replies: 659

- Views: 14K

- Politics

aGDevil2k

Inconceivable Member

- Messages

- 2,645

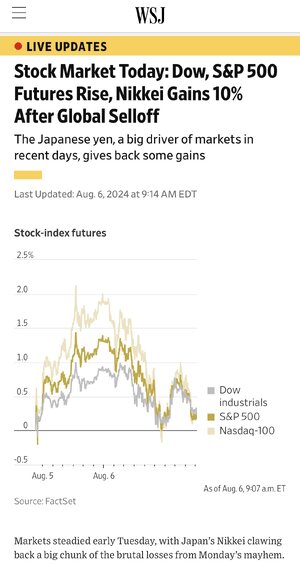

They already coined it. So when it bounces back she can say "See, I already fixed my recession"Yeah, while today’s storylines have focused on the slight rise in US unemployment, seems to me the real story is BOJ’s rate hike. And if that’s the case, this is highly likely to be a 3-5 day blip, and certainly nothing resembling a “Kamala Recession.”

maxcrowder

Distinguished Member

- Messages

- 330

The BOJ rate hike, that is correct. I'll give it four days.Yeah, while today’s storylines have focused on the slight rise in US unemployment, seems to me the real story is BOJ’s rate hike. And if that’s the case, this is highly likely to be a 3-5 day blip, and certainly nothing resembling a “Kamala Recession.”

- Messages

- 9,690

"

A previously popular hedge-fund strategy continued to unravel on Monday as global stocks slumped, prompting some on Wall Street to speculate that the two trades might be closely linked.

A surging Japanese yen further undermined a popular hedge-fund strategy known as the carry trade on Monday. At the same time, U.S. stocks headed for their worst day in nearly two years as a global stock-market rout accelerated.

Some concluded that the increasingly tightknit relationship between the rising yen and falling U.S. stocks likely wasn’t a coincidence. They argued that traders might have been directly fueling leveraged bets on U.S. stocks — particularly megacap names and technology stocks — with money borrowed in yen. Now these traders were being forced to cover their short-yen positions by selling their holdings in U.S. stocks.

“You can’t unwind the biggest carry trade the world has ever seen without breaking a few heads. That is the impression markets give us this morning,” said Kit Juckes, chief FX strategist at Société Générale, in emailed comments shared with MarketWatch early Monday.

... But others said the relationship was likely more complicated. While it is true that the yen’s rapid ascent may have contributed to the selloff in U.S. stocks, it likely wasn’t a major driver, said Dirk Willer of Citi Research. In fact, it was just as likely that the relationship was working in reverse. ..."

KishiKaisei

Distinguished Member

- Messages

- 349

“…

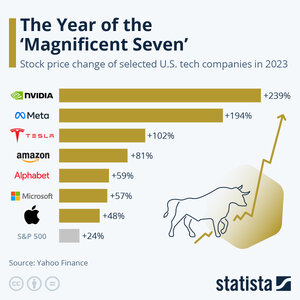

Magnificent Seven Tech Stocks Shed More Than $700 Billion in Market Value

https://www.wsj.com/news/author/hannah-miao

“Monday's stock-market selloff is hitting the Magnificent Seven stocks hard.

The Magnificent Seven—Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia and Tesla—have collectively lost about $753 billion in market capitalization , according to Dow Jones Market Data as of around 10:15 a.m. ET.

If that holds, it would mark the largest one-day market cap loss on record for the cohort.

Nvidia alone has lost around $288 billion in market value, on pace for the largest one-day market cap loss for any U.S. company on record.

Despite Monday's losses, all the Magnificent Stocks except for Tesla remain up year to date. Nvidia has roughly doubled in 2024.”

KishiKaisei

Distinguished Member

- Messages

- 349

Last edited:

BubbaOtis

Exceptional Member

- Messages

- 116

My recollection is that the surplus during Clinton's administration was due to a government shutdowns and the inability to pass an appropriations budget. Both Clinton and Gingrich supported a balanced budget but differences on the components. Gridlock is good for deficit hawks like me.The last Prez to do it was actually Clinton. In the last 3 years of his presidency he ran a surplus each year He cut the deficit from around 60% of GDP down to 30%. He did it by raising taxes AND cutting spending.

As far left as Hillary is, and as much as I dislike her, Clinton actually governed from the middle (at least fiscally.)

- Messages

- 1,468

Shutdowns rarely save much at all The money gets spent-just a little later Now the gridlock usually results in no increases in appropiations,My recollection is that the surplus during Clinton's administration was due to a government shutdowns and the inability to pass an appropriations budget. Both Clinton and Gingrich supported a balanced budget but differences on the components. Gridlock is good for deficit hawks like me.

The Clinton years showed the effects of a large tax increase that Clinton pushed through in his first year, and that Republicans incorrectly claim is the “largest tax increase in history.” It fell almost exclusively on upper-income taxpayers. Clinton’s fiscal 1994 budget also contained some spending restraints. An equally if not more powerful influence was the booming economy and huge gains in the stock markets, the so-called dot-com bubble, which brought in hundreds of millions in unanticipated tax revenue from taxes on capital gains and rising salaries.

heelinhell

Iconic Member

- Messages

- 1,026

Remember when economic expert Donald Trump called Mike Flynn at 3 am to ask him if a strong dollar was good or bad for the U.S. economy ?

good times...

finance.yahoo.com

finance.yahoo.com

President Donald Trump once called National Security Adviser Mike Flynn at 3 a.m. to ask about the economic impact of a strong US dollar, according to a report from The Huffington Post.

SV Date and Christina Wilke, citing sources with knowledge of the conversation, reported that Trump asked Flynn whether the strong dollar was good or bad for the US economy during the early-morning phone call. According to the sources, Flynn said he was not sure and Trump should ask an economist instead

good times...

Trump reportedly called his national security adviser at 3 a.m. to ask if the US wanted a strong or weak dollar

President Donald Trump once called National Security Adviser Mike Flynn at 3 a.m. to ask about...

President Donald Trump once called National Security Adviser Mike Flynn at 3 a.m. to ask about the economic impact of a strong US dollar, according to a report from The Huffington Post.

SV Date and Christina Wilke, citing sources with knowledge of the conversation, reported that Trump asked Flynn whether the strong dollar was good or bad for the US economy during the early-morning phone call. According to the sources, Flynn said he was not sure and Trump should ask an economist instead

- Messages

- 1,453

My recollection is that the surplus during Clinton's administration was due to a government shutdowns and the inability to pass an appropriations budget. Both Clinton and Gingrich supported a balanced budget but differences on the components. Gridlock is good for deficit hawks like me.

Nah. The Clinton surplus was driven by reductions in military spending (or at least reducing the rate of increase in military spending) due to the threat reduction created by the collapse of the Soviet Union.

heelinhell

Iconic Member

- Messages

- 1,026

'Brain hurts': Trump fact checker overwhelmed by 'fusillade of falsehoods' on Fox

Donald Trump was subjected to a brutal fact check Tuesday morning by a Washington Post analyst who admitted it made his "brain hurt" to hear the former president's "fusillade of falsehoods" on Fox. Glenn Kessler awarded Trump four Pinocchios, one for each inaccurate comment the former president...

www.rawstory.com

www.rawstory.com

Glenn Kessler awarded Trump four Pinocchios, one for each inaccurate comment the former president made in just under two minutes during a recent Fox Business Network interview with pundit Maria Bartiromo.

"Trump ran through a list of his incoherent claims," Kessler wrote. "Anyone with a passing familiarity with the federal budget might find their brain hurts after reading them."

"With Trump, it’s never clear whether he is truly ignorant about these issues or if he assuming he can skate by because he thinks his audience is ignorant," Kessler concluded. "But it’s clear he earned Four Pinocchios."

lawtig02

Iconic Member

- Messages

- 1,823

Thoughts and prayers to the GOP.

The GOP has become the political equivalent of Heaven’s Gate.

CFordUNC

Inconceivable Member

- Messages

- 3,458

They’ll always have the Great Depression of Monday, August 5, 2024 to remember fondly!The GOP has become the political equivalent of Heaven’s Gate.

- Messages

- 9,690

Plus the change in banking regulations really unleashed a torrent of capital in the leveraged finance market (not without eventual negative consequences in 2008). And the peace dividend funded a major infrastructure push and otherwise freed a lot of resources.Shutdowns rarely save much at all The money gets spent-just a little later Now the gridlock usually results in no increases in appropiations,

The Clinton years showed the effects of a large tax increase that Clinton pushed through in his first year, and that Republicans incorrectly claim is the “largest tax increase in history.” It fell almost exclusively on upper-income taxpayers. Clinton’s fiscal 1994 budget also contained some spending restraints. An equally if not more powerful influence was the booming economy and huge gains in the stock markets, the so-called dot-com bubble, which brought in hundreds of millions in unanticipated tax revenue from taxes on capital gains and rising salaries.

- Messages

- 9,690