Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 201K

- Politics

1moretimeagain

Inconceivable Member

- Messages

- 3,895

“One Big Beautiful Bill” phrasing was drilled home too strongly for them to have the option of a course change.“… Some advisers to the president are trying to hone Republican talking points to emphasize the GOP’s efforts to help the middle class.

During an August dinner in Jackson Hole, Wyo., with Republican donors, Trump’s pollster Tony Fabrizio and longtime Trump political adviser Chris LaCivita told attendees they had briefed the president on their internal surveys showing how the “One Big Beautiful Bill” moniker wasn’t appealing to voters. Trump’s signature legislation might need a rebrand, they said, according to a person at the event. Instead, Republicans should start referring to the law as a tax cut for working families. Republicans have since embraced that framing….”

——

Jackson Hole is just the place to hone your message to the middle class …

It would be like trying to change Rubio’s name to “Big Marco.”

- Messages

- 8,133

The cult doesn't know the definition of socialism.Remind me: what is it called when government owns the means of production?

Ddseddse

Iconic Member

- Messages

- 1,381

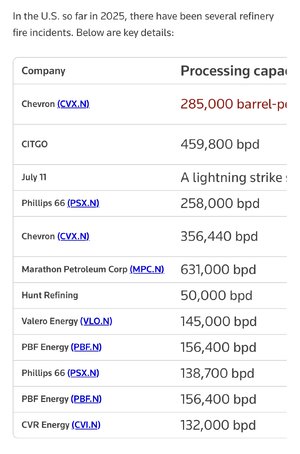

There have been several suspicious fires in fairly strategic industry sectors recently. Probably coincidence but worth having antennas up for this sort of thing in the future, imo.

ChileG

Inconceivable Member

- Messages

- 3,056

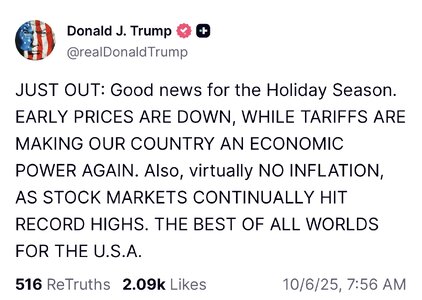

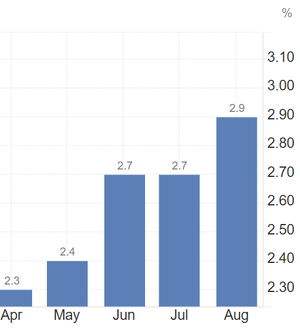

MAGA loves to be lied to for some reason.

- Messages

- 39,161

Yeah, there was a fire at a Dow chemical plant in Texas last nightThere have been several suspicious fires in fairly strategic industry sectors recently. Probably coincidence but worth having antennas up for this sort of thing in the future, imo.

Last week:

Might just be shark attack syndrome but hopefully law enforcement authorities are taking note just in case …

- Messages

- 39,161

Yeah, there was a fire at a Dow chemical plant in Texas last night

Last week:

Might just be shark attack syndrome but hopefully law enforcement authorities are taking note just in case …

Reuters has noticed w/r/t refinery

US refinery fire incidents so far in 2025

A fire broke out in a jet fuel unit at Chevron's 285,000 barrel-per-day El Segundo refinery near Los Angeles on Thursday, sending flames and smoke into the air.

But I don’t know the stats on whether that is significantly above normal.

- Messages

- 39,161

Oil & Gas News (OGN)- Deadly fires, blasts and spills mark alarming rise in 2025 accidents

The definitive news source for the energy markets of the Middle East with a unique global perspective. OGN provides authoritative information, OGN media platform is dedicated to deliver the latest news on industry developments in carbon and non-carbon sources of energy, contract information...

[This report is citing incidents worldwide]

“From catastrophic pipeline explosions to industrial plant fires and fuel tanker disasters, the first half of 2025 witnessed a spate of serious workplace and energy-related incidents across the globe.

These accidents have raised concerns over ageing infrastructure, weak regulatory oversight, and the growing risk posed by climate volatility and hazardous materials. …

… 2. Moss landing battery fire (California, US, January 31, 2025): A lithium-ion battery blaze at a power plant led to a mass evacuation amid toxic smoke, with no injuries reported….”

- Messages

- 2,886

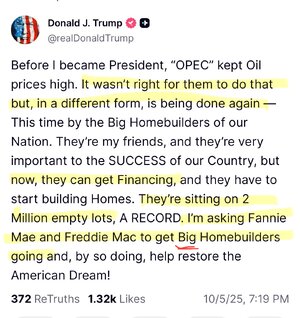

He's such a moron. Home builders aren't sitting on anything they wouldn't love to build and get rid of. However, they cannot build at current costs and be competitive with resale homes which largely are not moving either. Builders are not going to throw up houses that they have to sell for less than their construction costs.

lawtig02

Legend of ZZL

- Messages

- 5,743

Wish I had saved that post you did a couple of years ago, I think on the old ZZLP, with creative ideas to get the housing market unstuck. I remember thinking it was immensely more productive than anything we've been hearing from any part of our government.He's such a moron. Home builders aren't sitting on anything they wouldn't love to build and get rid of. However, they cannot build at current costs and be competitive with resale homes which largely are not moving either. Builders are not going to throw up houses that they have to sell for less than their construction costs.

- Messages

- 39,161

“… Trump officials have been envisioning IPOs that value the combined firms at roughly $500 billion and raise roughly $30 billion, The Wall Street Journal previously reported. While Fannie and Freddie could have separate offerings, if they raise that amount together, they would eclipse the Saudi Arabia Aramco IPO as the largest offering ever.

(At least one bank displeased some administration officials when it suggested that the firms should be valued below $500 billion, according to a person familiar with the matter.)

… In drafting their pitches, bankers have to contend with the vital role Fannie and Freddie play in the U.S. economy. The two firms, which have been under government conservatorship since being bailed out in 2008, together implicitly back nearly half of mortgages. Some industry players worry that poorly conceived IPOs could send mortgage rates up, which Bessent has stressed needs to be avoided.

The bankers have also been watching their every move, knowing Trump could punish their banks for any perceived slight against him, banking lobbyists said. Solomon and his team laid low after Trump called for the bank’s top economist to be replaced because of his stance on the impacts of tariffs.

… Banks have also been trying to game out who has been pitching what. When Trump shared on social media what appeared to be an AI-generated image of himself ringing the New York Stock Exchange bell for the IPO of the “Great American Mortgage Corporation,” bankers chattered among themselves trying to figure out if he had lifted it from one of their decks.

It turns out the image came from Pulte, a person familiar with the matter said.“

Molotov Mocktail

Distinguished Member

- Messages

- 307

Not really worried about these fires until I hear about any bird deaths. Bird deaths are unacceptable!

- Messages

- 8,133

This should probably say Trump Admin/USA acquires stake, but maybe the Trump family bought in advance?

I'm sure the grifter's whole family purchased in advance.

Would have been nice for an average person to be able to play these games and get rich, while not doing ones job and fucking the country.

Share: