Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 211K

- Politics

- Messages

- 4,041

Retail sales top Wall Street estimates in August

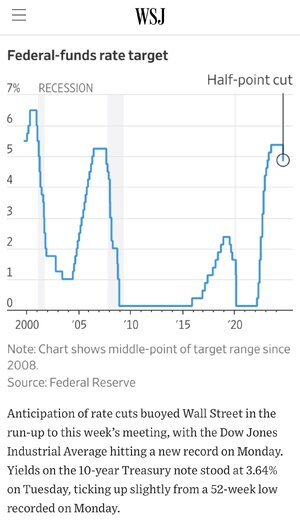

Tuesday's retail sales report serves as one of the final economic data points as the Federal Reserve mulls how much it will cut interest rates on Wednesday.

Ddseddse

Iconic Member

- Messages

- 1,407

When they declined to do the quarter BP cut last time, I posted that they were painting themselves in a corner because a half BP cut right before the election would be politically unpalatable. They chose to think they would rise above the political fray and do whatever was best when the time came so they didn't need to do the quarter point cut then, and could afford to wait and see and do the half point later if it was needed.I feel like a 25 bps cut is coming. Fed is always slow to react and they don't want to seem political, so a 25 bps cut will feel like a nice middle ground to them.

Whelp, the time is now here, and of course they will fold and do the politically expedient thing and only cut by a quarter point this time around and screw us all. That's my prediction at least.

This was easily foreseeable. They should have done the quarter point the last time around. Then they would have had the option of either doing another quarter point this time, or doing nothing, whichever made sense. This was all obvious back then, and so easily avoidable.

- Messages

- 40,888

Radio silence over on Truth Social since last night.Happy to be wrong! Any temper tantrum from Trump yet?

superrific

Master of the ZZLverse

- Messages

- 12,311

I thought this was coming. Not enough to pile into options or anything, but economically it was the right decision. And politically? They aren't supposed to be political, but I don't think it's "political" for central bankers to want to retain the independence of the central bank. And since we have one candidate who wants to remove that independence, it wouldn't surprise me if Powell et al were (subconsciously perhaps) willing to give all close calls to Kamala.

- Messages

- 1,938

ELECTION INTERFERENCE!!!

uncgriff

Honored Member

- Messages

- 896

This all worked out perfectly for both my kids. 2 years ago they had no chance at a home because every listing was a bidding war and they were on the waiting list to get on the waiting list for new construction.

When rates went up, they were able to both get houses albeit with mortgages higher than they would have preferred obviously but they plan to be in the houses for at least 10-15 years and they could wait to refinance. Which will happen soon.

They would still be renting without this exact scenario and I am so happy for both of them.

Thanks Joe Biden.

When rates went up, they were able to both get houses albeit with mortgages higher than they would have preferred obviously but they plan to be in the houses for at least 10-15 years and they could wait to refinance. Which will happen soon.

They would still be renting without this exact scenario and I am so happy for both of them.

Thanks Joe Biden.

- Messages

- 5,901

Maybe all the pre-whining he did about it will keep the temper-tantrum down a bit.Happy to be wrong! Any temper tantrum from Trump yet?

(Ok, who am I kidding?)

- Messages

- 4,041

but the voters will not "feel" it before the election...

If Trump wins he will claim credit when the positive impact is being felt in February.

If Trump wins he will claim credit when the positive impact is being felt in February.

Macksbrownies

Exceptional Member

- Messages

- 122

Wife and I over-extended ourselves a bit moving into our house last May. Luckily a new job helped ease the financial burden some but was really looking forward to refinancing when the time came. Now just need to decide how long to hold out to maximize the mortgage reduction given the proposed additional cuts this year and next.This all worked out perfectly for both my kids. 2 years ago they had no chance at a home because every listing was a bidding war and they were on the waiting list to get on the waiting list for new construction.

When rates went up, they were able to both get houses albeit with mortgages higher than they would have preferred obviously but they plan to be in the houses for at least 10-15 years and they could wait to refinance. Which will happen soon.

They would still be renting without this exact scenario and I am so happy for both of them.

Thanks Joe Biden.

Try to pay negative points when you refinance so that you do not have to come out of pocket and make sure you have no pre-payment penalty. As long as you stick to low costs and and no pre-payment penalty, you can refinance as many times as you like (save your own time and personal hassle). The banks are going to be overwhelmed by refinance customers in the next year, but there should be a lot of players jumping back into the market offering some good deals. I have found that Wells Fargo offers the best rates in my area -- especially if you can transfer to them a stock portfolio.Wife and I over-extended ourselves a bit moving into our house last May. Luckily a new job helped ease the financial burden some but was really looking forward to refinancing when the time came. Now just need to decide how long to hold out to maximize the mortgage reduction given the proposed additional cuts this year and next.

Share: