Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 202K

- Politics

- Messages

- 39,189

Employers Cut More Than a Million Jobs This Year

The report from a private consulting firm shows a sharp rise in job losses in the first 10 months of the year compared with the same period last year

“… Through October, employers reported slashing 1,099,500 jobs, an increase of 65% from the first 10 months of last year. That is up 44% from the 761,358 cuts announced in all of 2024.

In October alone, U.S. companies’ job-cut announcements nearly tripled to 153,074 from 54,064 in September, with companies citing cost-cutting and artificial intelligence, the firm said. The warehousing sector led the increase in job-cutting announcements, slashing nearly 48,000 roles, while tech companies said they were eliminating more than 33,000 jobs.

“Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes,” Andy Challenger, chief revenue officer for Challenger, Gray and Christmas, said in a statement.…”

- Messages

- 39,189

“…The news comes a day after payroll processor ADP said the U.S. added 42,000 private-sector jobs in October, a rebound after two straight months of declines.Employers Cut More Than a Million Jobs This Year

The report from a private consulting firm shows a sharp rise in job losses in the first 10 months of the year compared with the same period last year

—> https://www.wsj.com/lifestyle/caree...3?st=9SwCJL&reflink=desktopwebshare_permalink

“… Through October, employers reported slashing 1,099,500 jobs, an increase of 65% from the first 10 months of last year. That is up 44% from the 761,358 cuts announced in all of 2024.

In October alone, U.S. companies’ job-cut announcements nearly tripled to 153,074 from 54,064 in September, with companies citing cost-cutting and artificial intelligence, the firm said. The warehousing sector led the increase in job-cutting announcements, slashing nearly 48,000 roles, while tech companies said they were eliminating more than 33,000 jobs.

“Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes,” Andy Challenger, chief revenue officer for Challenger, Gray and Christmas, said in a statement.…”

The government shutdown has paused the usual stream of official economic-data releases, meaning economists and investors are increasingly focused on alternative sources of data on hiring and job cuts from private companies.…”

- Messages

- 3,834

I posted this link on the blue wave thread but is related to the latest updates nyc as well.

- Messages

- 39,189

Trump Aides Raise Recession Fears, and Point Fingers at the Fed

Treasury Secretary Scott Bessent said some sectors were in a recession as he argued for more interest rate cuts.- Messages

- 39,189

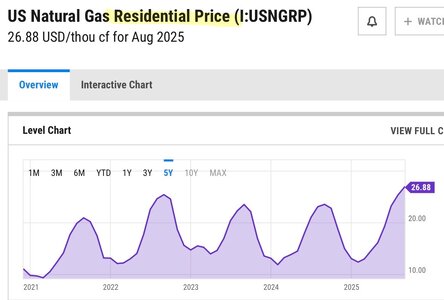

Surging Power Costs Are Putting the Squeeze on Customers

Data centers contribute to higher prices as fat energy bills electrify local politics

“…Retail power prices in New Jersey were up 19% in August from a year earlier, the latest state-by-state data from the U.S. Energy Information Administration show, on the leading edge of a 6% nationwide increase in the same time frame.

There are several driving forces, including a rapidly growing number of data centers pumping up demand in some regions. The slow addition of new power generators, retirement of old plants and costly grid upgrades are also playing a role.…”

- Messages

- 39,189

Surging Power Costs Are Putting the Squeeze on Customers

Data centers contribute to higher prices as fat energy bills electrify local politics

—> https://www.wsj.com/economy/consume...b?st=Eg7EsD&reflink=desktopwebshare_permalink

“…Retail power prices in New Jersey were up 19% in August from a year earlier, the latest state-by-state data from the U.S. Energy Information Administration show, on the leading edge of a 6% nationwide increase in the same time frame.

There are several driving forces, including a rapidly growing number of data centers pumping up demand in some regions. The slow addition of new power generators, retirement of old plants and costly grid upgrades are also playing a role.…”

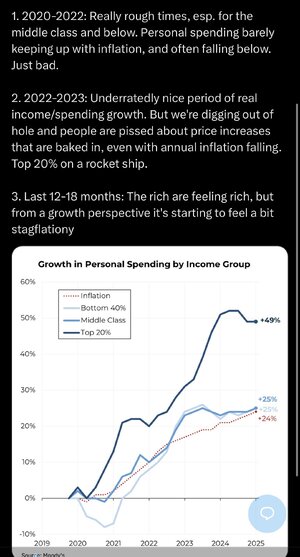

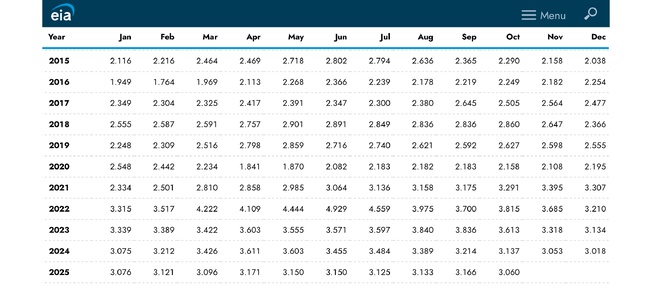

Meanwhile, avg price of regular gasoline is relatively stable hovering around $3.06 /gallon (with typical regional variations)

- Messages

- 3,473

- Messages

- 39,189

- Messages

- 8,138

I've listened to two podcast in the last few weeks about the over valuation of AI stock and some of the problems. One directly compared it to the dot.com bubble.I remember back in early 2000 during the dot.com bubble and having a discussion with my best friend who was a savvy investor and seeing these dot.coms losing money and some with a p/e of 400 and wondering why the market prices for those stocks were continuing to go through the roof. He said to me to wait and trust that this bubble will burst sooner than later. The bubble burst one year later.

I don't think we knew whether the dot.coms were overvalued at the time, but we soon found out . Maybe the AI stocks are being valued correctly this time around. 25 years later this feels to be the same to me.

In Dec. 1999 the Shiller p/e ratio was 44 and it came down to 32 in March 2001 ( historical average is a bit over 17 ). Today, the ratio is at 40 and trending up. Nvidia p/e is 58

Maybe it will be different this time.

- Messages

- 8,138

He must have been talking about average temps in October.We're the hottest country in the world!

His dentures sound loose and his forehead is growing.

JCTarheel82

Iconic Member

- Messages

- 2,423

aGDevil2k

Inconceivable Member

- Messages

- 4,584

hopefully it popsHis dentures sound loose and his forehead is growing.

1moretimeagain

Inconceivable Member

- Messages

- 3,900

Share: