Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 4,112

Without question the Biden economy was the envy of the world and handed over on a silver platter to TrumpOnly took Donald Trump six months to completely destroy the greatest economy in the world. SO. MUCH. WINNING!!!!!

Prior, Obama handed a strong economy to Trump, and Biden had to clean up his mess.

Is this coincidence or a pattern ? I am hoping it is a mere coincidence for the sake of my children and grandchildren.

lawtig02

Legend of ZZL

- Messages

- 5,893

LOLOLOLOL!

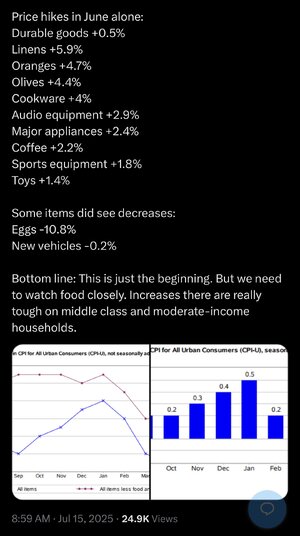

If there has ever been a report that shows the irrelevance of IT'S ALL ABOUT THE PRICE OF EGGS!!!!, it's this one.

Pattern. Republican have, on the whole been bad for the economy since before the Great Depression and have stepped up their damage since the early 50s.Without question the Biden economy was the envy of the world and handed over on a silver platter to Trump

Prior, Obama handed a strong economy to Trump, and Biden had to clean up his mess.

Is this coincidence or a pattern ? I am hoping it is a mere coincidence for the sake of my children and grandchildren.

- Messages

- 4,112

Given the the June CPI report I think the Fed stands pat on rates for now. The question is whether Trump's threats to implement and actually implement stupid tariffs continues into the fall. If the CPI continues to spike at this rate in July and August, we may see the Fed announce a 25 basis point rate hike as soon as September.

lawtig02

Legend of ZZL

- Messages

- 5,893

I'm cautiously optimistic that the aggressiveness and defensiveness of the Trump 2.0 economic plan can break this cycle, at least on the margins. Typically, Pubs plant the seeds of economic catastrophe in the hope they won't germinate for another 5-8 years, at which point the Dems will be back in power and will be blamed for what's sprouting at the time. That's exactly what the Pubs in Congress did with the BBB. But Trump's policies that do not require congressional approval (tariffs, pressure on the Fed, etc.) are so aggressive that their impacts are likely to be felt within the next 1-2 years. Which means he'll still be president and the Pubs will likely be in control of at least the Senate.Pattern. Republican have, on the whole been bad for the economy since before the Great Depression and have stepped up their damage since the early 50s.

If one could be a dispassionate observer of America's economic and political life for the next 3.5 years, the intersection of those two things would be as interesting as any period in recent history. Unfortunately, all of us who live here can't afford to be dispassionate, because we'll be profoundly impacted by it one way or another. This is the chaos MAGA has inflicted upon us.

- Messages

- 5,217

Japan Is Worrying the Bond Market. How Treasuries Can Avoid a Slump, for Now.

Looks like the Trump economy is officially a disaster! Hey, didn’t he promise to lower prices on everything on the campaign trail? Promise is made, promises NOT KEPT!!!!

Remember, gas is $1.99 and eggs are down 400%!

- Messages

- 41,453

Trump surrogates have signaled an interest in trying to have his new Fed Chair “reorganize” the Fed — so Trump would control it. SCOTUS already signaled once to Trump that they view the Fed as different from other executive agencies they are allowing him to gut (based on technicalities without determining the merits — basically a free pass for Trump to remake the executive branch as he pleases but leaving the option to slam that door behind him if the merits of those cases are eventually decided against the President — then his changes will have been realized and his successor limited in his or her ability to undo that without jumping through hoops that Trump was spared).

In any event, it looks like a battle is brewing and it will be interesting to see if SCOTUS draws the line at POTUS seizing control of the Fed.

- Messages

- 41,453

Dimon Defends Fed Independence After Trump Attacks

Many on Wall Street privately worry that political pressure will undermine the central bank’s credibility

Duke Mu

Iconic Member

- Messages

- 2,023

I'm cautiously optimistic that the aggressiveness and defensiveness of the Trump 2.0 economic plan can break this cycle, at least on the margins. Typically, Pubs plant the seeds of economic catastrophe in the hope they won't germinate for another 5-8 years, at which point the Dems will be back in power and will be blamed for what's sprouting at the time. That's exactly what the Pubs in Congress did with the BBB. But Trump's policies that do not require congressional approval (tariffs, pressure on the Fed, etc.) are so aggressive that their impacts are likely to be felt within the next 1-2 years. Which means he'll still be president and the Pubs will likely be in control of at least the Senate.

If one could be a dispassionate observer of America's economic and political life for the next 3.5 years, the intersection of those two things would be as interesting as any period in recent history. Unfortunately, all of us who live here can't afford to be dispassionate, because we'll be profoundly impacted by it one way or another. This is the chaos MAGA has inflicted upon us.

The classic poison pill.

Duke Mu

Iconic Member

- Messages

- 2,023

BillOfRights

Iconic Member

- Messages

- 1,589

Without question the Biden economy was the envy of the world and handed over on a silver platter to Trump

Prior, Obama handed a strong economy to Trump, and Biden had to clean up his mess.

Is this coincidence or a pattern ? I am hoping it is a mere coincidence for the sake of my children and grandchildren.

I think Pubs implement more extreme versions of "trickle down" economics every time they regain power. This isn't to make the economy better, or to make it worse, just to make themselves and their "constituents" (their rich donors, not the people they are supposed to represent) richer. The fact that it almost always ends up hurting the overall economy lets them complain about deficits and debt when Democrats try to clean up the mess.I'm cautiously optimistic that the aggressiveness and defensiveness of the Trump 2.0 economic plan can break this cycle, at least on the margins. Typically, Pubs plant the seeds of economic catastrophe in the hope they won't germinate for another 5-8 years, at which point the Dems will be back in power and will be blamed for what's sprouting at the time. That's exactly what the Pubs in Congress did with the BBB. But Trump's policies that do not require congressional approval (tariffs, pressure on the Fed, etc.) are so aggressive that their impacts are likely to be felt within the next 1-2 years. Which means he'll still be president and the Pubs will likely be in control of at least the Senate.

If one could be a dispassionate observer of America's economic and political life for the next 3.5 years, the intersection of those two things would be as interesting as any period in recent history. Unfortunately, all of us who live here can't afford to be dispassionate, because we'll be profoundly impacted by it one way or another. This is the chaos MAGA has inflicted upon us.

- Messages

- 41,453

“… The Producer Price Index, which measures the average change in prices paid to producers, was unchanged from May, and the annual rate of wholesale-level inflation slowed 2.3%, helped lower in part because of base effects (where the year-ago period experienced higher inflation).

Economists had expected that prices would rise 0.2% on a monthly basis and 2.5% annually, according to FactSet.

… Although gas prices went up in June, falling services prices — particularly at hotels, airlines and car dealerships — drove the overall index lower. Travel and leisure prices have been lower than they typically are, a potential indication that consumer demand dropped off amid a period of high economic uncertainty.

PPI serves as a potential bellwether for price changes consumers may see in the months ahead.…”

Purple Nurple

Exceptional Member

- Messages

- 176

If tariff inflation doesn’t ramp up, does Jay Powell’s fed go down as clueless? Remember who initially appointed him.

Last edited:

lawtig02

Legend of ZZL

- Messages

- 5,893

I think all the economic data right now is distorted because of this --I mean, the top line seems great and all, until you see that demand fell in industries reliant on consumer confidence and discretionary income.

We've been in a TACO market for several months now, but if all the economic strength we're seeing is really a result of US companies building inventories, then I don't see how growth numbers can stay positive over the next few months, regardless of what Trump does with tariffs going forward.

I'm not anything close to an expert in this and I hope I'm wrong, but I just can't find a logical justification for the markets to be where they are right now without a major correction coming in the next six months.

Purple Nurple

Exceptional Member

- Messages

- 176

More stimulus coming in BBB.I think all the economic data right now is distorted because of this --

We've been in a TACO market for several months now, but if all the economic strength we're seeing is really a result of US companies building inventories, then I don't see how growth numbers can stay positive over the next few months, regardless of what Trump does with tariffs going forward.

I'm not anything close to an expert in this and I hope I'm wrong, but I just can't find a logical justification for the markets to be where they are right now without a major correction coming in the next six months.

Share: