Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 4,242

Have not used a Credit card in 10 years Oh I could get some cash back thing and get ahead-too much like work

Many would be better off WITHOUT credit cards. Business credit transaction fees, annual fees, excessive penalty interest and overdraft fees, the feeling that "a charge is free," and impulse buying make a card much, MUCH more expensive than using cash. Even the benefits can be illusory. I've had disputes where the card company sided with an unscrupulous vendor. My only recourse was to cancel the card and short the bill for the difference. Luckily, my credit and personal financial situation are solid enough to withstand the blowback.Have not used a Credit card in 10 years Oh I could get some cash back thing and get ahead-too much like work

I use credit for business (and pay off the balance monthly) and use cash for most everything else. I've likely saved tens of thousands of dollars over the years with that strategy.

- Messages

- 5,217

We missed one AMEX payment due to the Canada post strike. It was a $37 balance that we paid 3 weeks late and they canceled our over 15 year old account over it. They aren't screwing around.

- Messages

- 8,289

Not judging your decisions. I believe we would probably be better off without credit cards, though I do use them.Have not used a Credit card in 10 years Oh I could get some cash back thing and get ahead-too much like work

In our current society they are a built in part of doing business. The transaction cost is built into 99% of our purchases, weather one uses cash or not.

The only time I don't use a credit card is if I'm incentivized not to.

BUT, I do pay them off every month, I've not paid credit card interest in over 25 years. And I do get between $2 and $3K in cash rewards back. And, Yes, I understand that I paid hidden fees to that were probably greater than what I get back, but I believe it's better to get a little of it back, since they are not going away.

People who carry a balance, pay interest, and use credit cards to make up the difference between their cost and income at the end of the month, probably should not have access to credit cards.

Now, if there were another option. If we could strip the credit card transaction fees out of the cost of goods not purchased with a credit card, then I'm all for that.

- Messages

- 41,477

“… The shift reflects a cooling labor market, in which bosses are gaining an ever-stronger upper hand, and a new mindset on how best to run a company. Pointing to startups that command millions of dollars in revenue with only a handful of employees, many executives see large workforces as an impediment, not an asset, according to management specialists. Some are taking their cues from companies such as Amazon.com, which recently told staff that AI would likely lead to a smaller workforce.

Now there is almost a “moral neutrality” to head-count reductions, said Zack Mukewa, head of capital markets and strategic advisory at the communications firm Sloane & Co.

“Being honest about cost and head count isn’t just allowed—it’s rewarded” by investors, Mukewa said. …”

pretty much what I do here. I never pay interest, only have two cards that I used, and both are cash back. I do not get up to $3K a year, but probably half that or a bit more, so I suppose you are simply consuming more. The convenience is great, and I have had no issues with them at all. In fact, probably going to call now and do the cash=bak think. I suspect I will get a couple of hundred between them.Not judging your decisions. I believe we would probably be better off without credit cards, though I do use them.

In our current society they are a built in part of doing business. The transaction cost is built into 99% of our purchases, weather one uses cash or not.

The only time I don't use a credit card is if I'm incentivized not to.

BUT, I do pay them off every month, I've not paid credit card interest in over 25 years. And I do get between $2 and $3K in cash rewards back. And, Yes, I understand that I paid hidden fees to that were probably greater than what I get back, but I believe it's better to get a little of it back, since they are not going away.

People who carry a balance, pay interest, and use credit cards to make up the difference between their cost and income at the end of the month, probably should not have access to credit cards.

Now, if there were another option. If we could strip the credit card transaction fees out of the cost of goods not purchased with a credit card, then I'm all for that.

- Messages

- 8,289

Why is head count such an important variable? I doubt that nvestors understand the day to day needs and uses of labor.

—> https://www.wsj.com/lifestyle/caree...6?st=n6Ver9&reflink=desktopwebshare_permalink

“… The shift reflects a cooling labor market, in which bosses are gaining an ever-stronger upper hand, and a new mindset on how best to run a company. Pointing to startups that command millions of dollars in revenue with only a handful of employees, many executives see large workforces as an impediment, not an asset, according to management specialists. Some are taking their cues from companies such as Amazon.com, which recently told staff that AI would likely lead to a smaller workforce.

Now there is almost a “moral neutrality” to head-count reductions, said Zack Mukewa, head of capital markets and strategic advisory at the communications firm Sloane & Co.

“Being honest about cost and head count isn’t just allowed—it’s rewarded” by investors, Mukewa said. …”

My company is reporting low labor, great. We have had layoffs each of the past three years.

No one seems to take into consideration how short on resources we are. How many teams are stressed, overworked, and burned out because of being short handed

We are also very siloed because of the resource constraints. We struggle to cross train and have to outsource projects we would typically take on.

Is it all bound to this mythical efficiency standard that the Republicans use to convince people that the government is broken?

I'm currently budgeted for 7 direct reports, I have 5 and one of those is going out on FMLA. The moral and stress in my team is an all time high.

But the company is doing great, there is no justification for not hiring for the open positions.

- Messages

- 41,477

“Employers posted 7.4 million job vacancies last month, a sign that the American job market continues to cool.

The Labor Department reported Tuesday that job openings in June were down from 7.7 million in May.

Layoffs were little changed. But the number of people quitting their jobs — a sign of confidence in their prospects elsewhere — dropped last month.

The U.S. job market has lost momentum this year, partly because of the lingering effects of 11 interest rate hikes by the inflation fighters at the Federal Reserve in 2022 and 2023 and partly because President Donald Trump’s trade wars have created uncertainty that is paralyzing managers making hiring decisions.

On Friday, the Labor Department will put out unemployment and hiring numbers for July. They are expected to show that the unemployment rate ticked up to a still-low 4.2% in July from 4.1% in June. Businesses, government agencies and nonprofits are expected to have added 115,000 jobs in July, down from 147,000 in June, according to a survey of economists by the data firm FactSet….”

Callatoroy

Inconceivable Member

- Messages

- 2,862

1. It would appear the left's "tariffs are going to cause rampant inflation" claims were wrong

2. To date the tariffs have been a net benefit for the US economy

3. Trade deals with japan and the eu are going to drive a lot of foreign investment

4. Winning

superrific

Master of the ZZLverse

- Messages

- 12,420

You know as much about economics as you do about timeouts. It ain't the left saying tariffs will cause inflation. It's economists period. And don't declare victory in the first quarter. The bigger force has been uncertainty. Now that the TACO trade has fizzled somewhat because Trump didn't completely CO, you're going to see prices going up.

1. It would appear the left's "tariffs are going to cause rampant inflation" claims were wrong

2. To date the tariffs have been a net benefit for the US economy

3. Trade deals with japan and the eu are going to drive a lot of foreign investment

4. Winning

Trade deals will not drive any foreign investment, but anyway -- since when did you guys like foreign investment? You know what foreign investment means? It means foreigners will buy our companies and real estate.

chrissteel

Exceptional Member

- Messages

- 210

150 billion in revenue from tariffs too

chrissteel

Exceptional Member

- Messages

- 210

Plus all it took was comprehensive immigration reform to fix the border. Too bad we are in a war with Iran tho.

1. It would appear the left's "tariffs are going to cause rampant inflation" claims were wrong

2. To date the tariffs have been a net benefit for the US economy

3. Trade deals with japan and the eu are going to drive a lot of foreign investment

4. Winning

If he just had good character we wouldn't have all these problems.

chrissteel

Exceptional Member

- Messages

- 210

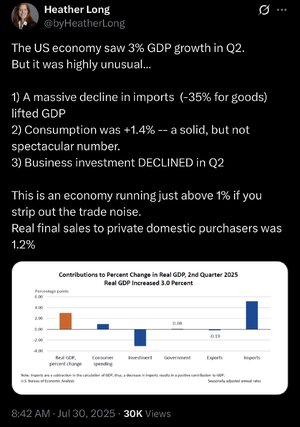

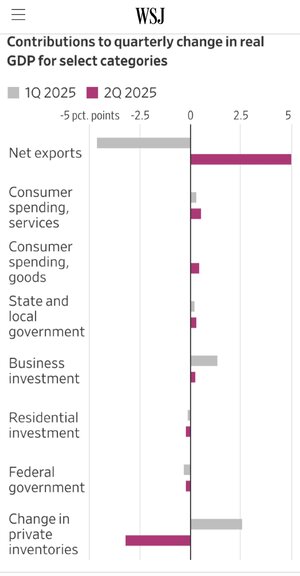

3% gdp

- Messages

- 41,477

“…Consumer spending increased at a 1.4% pace, picking up from the first quarter as a steady labor market underpinned households’ spending power. But consumer spending was offset by weaker business spending.

… Final sales to private domestic purchases, which track demand from businesses and consumers but not the more volatile government, inventory and international trade data, rose at a 1.2% rate in the second quarter. That was slower than 1.9% the prior quarter, and suggested underlying demand from businesses and consumers weakened.

- Messages

- 8,289

What comprehensive immigration reform?Plus all it took was comprehensive immigration reform to fix the border. Too bad we are in a war with Iran tho.

If he just had good character we wouldn't have all these problems.

Trump has no comprehensive immigration policy. His policy is to over fund ICE, so he'll have a small any to start removing citizens that he doesn't like when they finish removing brown people.

Share: