Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 202K

- Politics

BillOfRights

Iconic Member

- Messages

- 1,457

“… The typical home buyer’s FICO credit score was 735 in the third quarter of this year, according to Realtor.com; that’s roughly 20 points higher than the national average. The website used data from mortgage-technology company Optimal Blue in its report.

The average credit score for typical home buyers was at the highest level in nearly a decade — a “sign that today’s market continues to favor financially strong buyers able to navigate higher prices and tighter lending standards,” Realtor.com said.

… A FICO score of 735 falls within the “good” range of 670 to 739, while a score of 740 to 799 is considered “very good.” Exceptional credit scores are 800 and over.

Most Americans have a “good” FICO score or better…

… Buyers are also much older, less likely to have young children living with them, and more likely to be repeat home buyers than in years past, according to a 2024 report by the National Association of Realtors profiling home buyers and sellers.“

The average age of U.S. homebuyers jumps to 56—homes are 'wildly unaffordable' for young people, real estate expert says

With home prices up nearly 40% since 2020, buyers are now wealthier and older, making them more likely to outbid younger buyers with all-cash offers.

The average age of homebuyers is now 56, up from 49 in 2023, according to the National Association of Realtors’ annual state-of-the-market report released Monday. That’s a historic high, up from an average age in the low-to-mid 40s in the early 2010s.

The median age of first-time buyers also rose from 35 to 38, while the share of first-timers dropped from 32% to 24% of all buyers for the year ending July 2024. That marks the lowest percentage since NAR started tracking the metric in 1981.

- Messages

- 1,568

Mulberry Heel

Inconceivable Member

- Messages

- 3,859

But, but that's not possible! I was assured that DOGE gutting all those government agencies and firing workers left and right and cutting benefits for people who need them would save us YUGE amounts of taxpayer money!

*of course we're now spending vast sums of money to buy charter jets for Trump 2.0's favorite adulterous couple, Kristi and Corey, and to build Dear Leader a gaudy ballroom at the WH and to pay for Pete Hegseth to play Maverick and all sorts of other crap, so there's that.

- Messages

- 4,045

So I am a retired person that has my accumulated wealth (lol) in CDs, treasuries-basically cash with a little interest. I know if I had it in the Stock market it would have grown a Great deal more

I can't do it-won't do it. Scares the hell out of me

I can't do it-won't do it. Scares the hell out of me

keywestheel

Exceptional Member

- Messages

- 130

Me too. My financial guy is predicting a major burst in the near future. So many unchartered events happening around the world so a major shift down seems inevitable to my somewhat trained eye.So I am a retired person that has my accumulated wealth (lol) in CDs, treasuries-basically cash with a little interest. I know if I had it in the Stock market it would have grown a Great deal more

I can't do it-won't do it. Scares the hell out of me

lawtig02

Legend of ZZL

- Messages

- 5,742

Interesting that CNBC article is from the day before the 2024 election. I wonder how much worse those numbers would look now.

The average age of U.S. homebuyers jumps to 56—homes are 'wildly unaffordable' for young people, real estate expert says

With home prices up nearly 40% since 2020, buyers are now wealthier and older, making them more likely to outbid younger buyers with all-cash offers.www.cnbc.com

The average age of homebuyers is now 56, up from 49 in 2023, according to the National Association of Realtors’ annual state-of-the-market report released Monday. That’s a historic high, up from an average age in the low-to-mid 40s in the early 2010s.

The median age of first-time buyers also rose from 35 to 38, while the share of first-timers dropped from 32% to 24% of all buyers for the year ending July 2024. That marks the lowest percentage since NAR started tracking the metric in 1981.

- Messages

- 4,045

Half my $ is in 5 year "Treasuries" I did this on purpose right after orangeturd was elected for the second time........Me too. My financial guy is predicting a major burst in the near future. So many unchartered events happening around the world so a major shift down seems inevitable to my somewhat trained eye.

- Messages

- 39,185

ChapelHillSooner

Iconic Member

- Messages

- 1,357

Not retired but I was going to ask what people are doing and expecting for the near future.Me too. My financial guy is predicting a major burst in the near future. So many unchartered events happening around the world so a major shift down seems inevitable to my somewhat trained eye.

I moved from S&P to money market (mostly) in my 401k in February and then bought back in during the rally. I bought at slightly lower prices than I had sold but certainly didn't time the bottom - nor was I trying to - though hitting it would have been a boon.

In retrospect I think I was early and got a bit lucky with liberation day. But it just seems that the headwinds are so strong. The chickens may be coming home to roost.

Still in VOO right now but debating my next move.

Edit: VOO not SPY. Slightly lower fees.

Last edited:

- Messages

- 39,185

- Messages

- 39,185

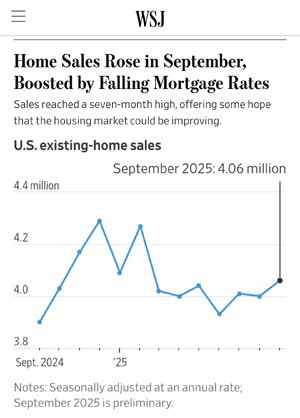

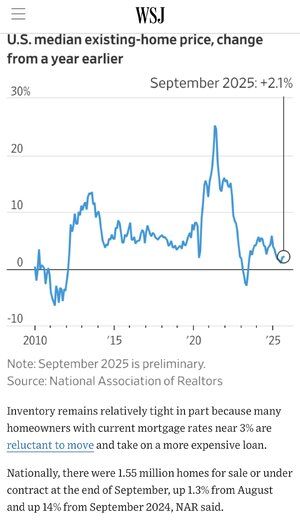

“… Sales of existing homes rose 1.5% from the prior month to a seasonally adjusted annual rate of 4.06 million, the highest level since February, the National Association of Realtors said Thursday. That was in line with economist forecasts for the month and a reversal from August’s slight decline in sales…

… Still, many home buyers see the market as too expensive. With the Federal Reserve expected to continue cutting short-term rates, these buyers are waiting for mortgage rates to come down further, real-estate agents say. The typical monthly mortgage payment for a home buyer in the four weeks ended Oct. 12 was $2,564, down about $300 from May but still up from a year earlier, according to real-estate brokerage Redfin.…”

- Messages

- 39,185

“… Sales of existing homes rose 1.5% from the prior month to a seasonally adjusted annual rate of 4.06 million, the highest level since February, the National Association of Realtors said Thursday. That was in line with economist forecasts for the month and a reversal from August’s slight decline in sales…

… Still, many home buyers see the market as too expensive. With the Federal Reserve expected to continue cutting short-term rates, these buyers are waiting for mortgage rates to come down further, real-estate agents say. The typical monthly mortgage payment for a home buyer in the four weeks ended Oct. 12 was $2,564, down about $300 from May but still up from a year earlier, according to real-estate brokerage Redfin.…”

- Messages

- 3,834

Yeah, we had the dot.com tech bubble burst in 2001 because investors were uber excited to invest in companies that were losing money or had P/E ratios of 200/1.

We had the 2008 housing bubble burst because of high risk ( subprime ) mortgage lending and selling these crap mortgages packaged within their MBS (mortgage backed securities )

and now we have what I call an AI bubble which has been fueling the stock market. I confess that I no nothing about AI as I new nothing about dot.com tech , but I feel this market is way overvalued.

The same goes for the housing bubble which was way over valuing housing prices. I decided if people were crazy enough to buy my house at the beach for $500,000 more than I had paid 8 years earlier, then I was going to sell... which is one of the best financial decisions I have ever made.

So I may be wrong thinking we have a bubble here, but I am an old codger and my focus is on preserving capital and my portfolio is 50% cash and 50% widow and orphan stocks paying reliable dividends. Whether the market continues to expand the bubble or whether we have a bubble burst, a recession, or a bear market ,me and the missus should be ok.

Younger investors can probably weather the eventual storm because they have time to recover. It's the late 50's and early 60 year old investors anticipating retirement that have to consider how aggressive to invest today..

MOUNTAINH33L

Iconic Member

- Messages

- 1,057

Alright, MAGA. Get in here and tell me how this is a good thing. Come on. I've got a little extra time on my hands. Explain to me how this is kosher.

Spoiler alert! You can't. Your MAGA God-Emporer is a fucking no good dirty chiseler and a crook. He's a straight up con man, and you're the mark. Pathetic.

Oh yeah. He's also a rapist and a pedophile, but we all know that's not a deal breaker for you either.

Share: