lawtig02

Legend of ZZL

- Messages

- 5,853

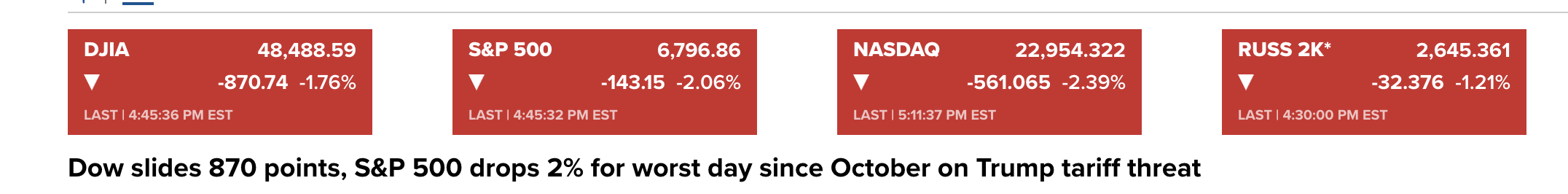

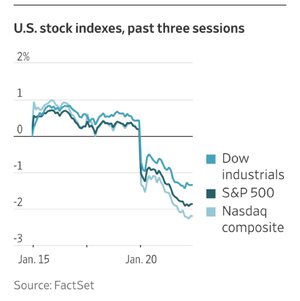

Yeah, I've shifted a good bit to international equities as well, but this particular fight over Greenland seems to me to threaten those types of funds. But I won't even pretend I have a clue what's the best allocation right now.I moved a good chunk of my equity mix into VDIPX when the tariff nonsense started in earnest. I’m quite pleased with how that’s gone.