- Messages

- 39,928

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 206K

- Politics

- Messages

- 39,928

“… Companies had raised prices last year after tariffs hoisted costs. Yet starting in the fall, many firms held off on increases and sometimes offered discounts to capture holiday shoppers.

The pricing break is over. Many companies typically raise prices at the start of the new year. Yet increases appeared to be stronger than normal for January for electronics, appliances and other durable goods, said UBS economist Alan Detmeister.

Some companies have pointed a finger at tariffs for their increases, while others, especially small businesses, also blame higher wages and hefty health-insurance costs that firms said they can’t absorb or share with suppliers.…”

- Messages

- 39,928

“… The Adobe Digital Price Index found that online prices posted their largest monthly increase in a dozen years in January, driven by higher prices for electronics, computers, appliances, furniture and bedding. …”“… Companies had raised prices last year after tariffs hoisted costs. Yet starting in the fall, many firms held off on increases and sometimes offered discounts to capture holiday shoppers.

The pricing break is over. Many companies typically raise prices at the start of the new year. Yet increases appeared to be stronger than normal for January for electronics, appliances and other durable goods, said UBS economist Alan Detmeister.

Some companies have pointed a finger at tariffs for their increases, while others, especially small businesses, also blame higher wages and hefty health-insurance costs that firms said they can’t absorb or share with suppliers.…”

lawtig02

Legend of ZZL

- Messages

- 5,801

Revisiting this. We're now at Year 1.2 or so of the 4 years we have to endure. Trump's policies have been so disastrous that we have a very real chance of breaking this cycle. Will the next nine months before the midterms be sufficient to make Trump -- and only Trump, not the Republicans in Congress -- responsible for Americans' economic dissatisfaction? What happens if we head into 2028 with a Democratic Congress trying to fix things and Trump in the White House saying no to everything? Is this the breaking point, where people get so unhappy so quickly that they associate the economic malaise with the Republican president who caused it and not the Democratic president elected to clean up the mess?I'm cautiously optimistic that the aggressiveness and defensiveness of the Trump 2.0 economic plan can break this cycle, at least on the margins. Typically, Pubs plant the seeds of economic catastrophe in the hope they won't germinate for another 5-8 years, at which point the Dems will be back in power and will be blamed for what's sprouting at the time. That's exactly what the Pubs in Congress did with the BBB. But Trump's policies that do not require congressional approval (tariffs, pressure on the Fed, etc.) are so aggressive that their impacts are likely to be felt within the next 1-2 years. Which means he'll still be president and the Pubs will likely be in control of at least the Senate.

If one could be a dispassionate observer of America's economic and political life for the next 3.5 years, the intersection of those two things would be as interesting as any period in recent history. Unfortunately, all of us who live here can't afford to be dispassionate, because we'll be profoundly impacted by it one way or another. This is the chaos MAGA has inflicted upon us.

- Messages

- 5,153

UK bank bosses plan to set up Visa and Mastercard alternative amid Trump fears

Exclusive: First meeting to be held over domestic payments system aimed at reducing reliance on US networks

- Messages

- 3,927

Here's my shocked face“… Companies had raised prices last year after tariffs hoisted costs. Yet starting in the fall, many firms held off on increases and sometimes offered discounts to capture holiday shoppers.

The pricing break is over. Many companies typically raise prices at the start of the new year. Yet increases appeared to be stronger than normal for January for electronics, appliances and other durable goods, said UBS economist Alan Detmeister.

Some companies have pointed a finger at tariffs for their increases, while others, especially small businesses, also blame higher wages and hefty health-insurance costs that firms said they can’t absorb or share with suppliers.…”

superrific

Master of the ZZLverse

- Messages

- 12,121

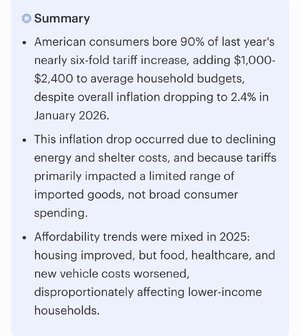

And yet they claim inflation dropped to 2.4%. Not a chance. There is no chance that inflation was 2.4%, unless seasonal adjustments are doing A LOT of work.“… Companies had raised prices last year after tariffs hoisted costs. Yet starting in the fall, many firms held off on increases and sometimes offered discounts to capture holiday shoppers.

The pricing break is over. Many companies typically raise prices at the start of the new year. Yet increases appeared to be stronger than normal for January for electronics, appliances and other durable goods, said UBS economist Alan Detmeister.

Some companies have pointed a finger at tariffs for their increases, while others, especially small businesses, also blame higher wages and hefty health-insurance costs that firms said they can’t absorb or share with suppliers.…”

- Messages

- 3,927

White House National Economic Council Director Kevin Hassett says 1.6%And yet they claim inflation dropped to 2.4%. Not a chance. There is no chance that inflation was 2.4%, unless seasonal adjustments are doing A LOT of work.

"We've got high growth, and we have core inflation running at 1.6% if you look at the last quarter, and I think that's about where we should be,"

- Messages

- 39,928

- Messages

- 39,928

“… A new study by the New York Federal Reserve doesn’t directly weigh in on the hawk-versus-dove debate. But researchers at the bank use a proprietary price measure to try to pinpoint the underlying rate of inflation by stripping out any temporary factors, including the effects of the shutdown and limited data collection.

What did New York Fed researchers Martin Almuzara and Geert Mesters find? The rate of inflation in the U.S. stood frozen at 2.83% at the end of 2025 — still well above the Fed’s 2% target.

What’s more, the recent slowdown as suggested by gauges such as the CPI could be ”largely transitory,” they said….”

Pretty much wait and see mode.

1moretimeagain

Inconceivable Member

- Messages

- 3,987

Duke Energy seeks a 15% price hike to celebrate The Golden Age.

- Messages

- 39,928

“… A new study by the New York Federal Reserve doesn’t directly weigh in on the hawk-versus-dove debate. But researchers at the bank use a proprietary price measure to try to pinpoint the underlying rate of inflation by stripping out any temporary factors, including the effects of the shutdown and limited data collection.

What did New York Fed researchers Martin Almuzara and Geert Mesters find? The rate of inflation in the U.S. stood frozen at 2.83% at the end of 2025 — still well above the Fed’s 2% target.

What’s more, the recent slowdown as suggested by gauges such as the CPI could be ”largely transitory,” they said….”

Pretty much wait and see mode.

In the clip above, Hassett calls this Fed study an “embarrassment … the worst paper I’ve ever seen in the history of the Federal Reserve System. The people associated with this paper should presumably be disciplined because what they’ve done is put out a conclusion that’s created a lot of news that is highly partisan based on analysis that wouldn’t be accepted in a first semester Econ class. … They’re basically only looking at changes in prices, so they’re assuming that quantities don’t move at all but guess what quantities did move at all….”

- Messages

- 39,928

In the clip above, Hassett calls this Fed study an “embarrassment … the worst paper I’ve ever seen in the history of the Federal Reserve System. The people associated with this paper should presumably be disciplined because what they’ve done is put out a conclusion that’s created a lot of news that is highly partisan based on analysis that wouldn’t be accepted in a first semester Econ class. … They’re basically only looking at changes in prices, so they’re assuming that quantities don’t move at all but guess what quantities did move at all….”

lawtig02

Legend of ZZL

- Messages

- 5,801

So I'm not an economist, but I did take a first semester Econ class back in the day. If I'm remembering correctly, price, in most cases, is determined by where the supply and demand curves intersect. So if the Fed paper is looking at changes in prices, it's by definition taking into consideration the movement of "quantities," which would be measured by changes in the curves.In the clip above, Hassett calls this Fed study an “embarrassment … the worst paper I’ve ever seen in the history of the Federal Reserve System. The people associated with this paper should presumably be disciplined because what they’ve done is put out a conclusion that’s created a lot of news that is highly partisan based on analysis that wouldn’t be accepted in a first semester Econ class. … They’re basically only looking at changes in prices, so they’re assuming that quantities don’t move at all but guess what quantities did move at all….”

Am I missing something, or is my recollection of an Econ 101 class from 30 years ago more accurate than public statements made by the current NEC Director?

Share: