Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It's Tariff Tuesday. How is your portfolio doing?

- Thread starter Burgawnc

- Start date

- Replies: 74

- Views: 2K

- Politics

theel4life

Iconic Member

- Messages

- 2,282

Not according to MAGAThe Trump stock market and the Trump economy are complete and utter disasters now.

- Messages

- 6,969

Most of them couldn't find the stock market with a GPS.Not according to MAGA

- Messages

- 2,315

We could be in the midst of another Great Depression and they would tell you that this is Trump playing chess.Not according to MAGA

Not just chess, 3-D chess.We could be in the midst of another Great Depression and they would tell you that this is Trump playing chess.

Burgawnc

Active Member

- Messages

- 34

Here is an odd thing I experienced yesterday.

In renewing P&C insurance on commercial properties, while agent was inputting the order yesterday afternoon, the order kicked-out because the rates increased from renewal quote provided last week.

Agent could not explain even after brlnging manager and tech support on the line. Not a significant increase, but an increase all the same.

After reflecting upon it, I am guessing the insurance market is expecting an aggregated higher risk as we head into an extended period of higher input cost and tighter money supply.

In renewing P&C insurance on commercial properties, while agent was inputting the order yesterday afternoon, the order kicked-out because the rates increased from renewal quote provided last week.

Agent could not explain even after brlnging manager and tech support on the line. Not a significant increase, but an increase all the same.

After reflecting upon it, I am guessing the insurance market is expecting an aggregated higher risk as we head into an extended period of higher input cost and tighter money supply.

Last edited:

ChileG

Inconceivable Member

- Messages

- 2,679

I think a lot of them they recognize it is a shitshow, but they blame Biden for it.Not according to MAGA

RaiGuy

Esteemed Member

- Messages

- 692

or Obama lolI think a lot of them they recognize it is a shitshow, but they blame Biden for it.

- Messages

- 7,581

Reminds me of a joke.We could be in the midst of another Great Depression and they would tell you that this is Trump playing chess.

Two men talking about the Lords Prayer.

Man1, you don't even know the lords prayer to man2.

Man2, I'll bet you $5 that I do.

Man1, ok I'll take that bet. Let's hear it.

Man2 starts: Now I lay me down to sleep...

Man1, ok here's your $5.

tarheelbillie

Distinguished Member

- Messages

- 495

If trump said it, they would blame George Washington.I think a lot of them they recognize it is a shitshow, but they blame Biden for it.

ChapelHillSooner

Iconic Member

- Messages

- 1,193

Wealth transfer from the right to the left

gtyellowjacket

Inconceivable Member

- Messages

- 2,598

Probably. Interesting that the markets didn't really seem to move much on DOGE but start dropping on tariffs. That indicates to me that the DOGE actions are at best neutral for the economy while tariffs are an iceberg.The Trump Great Depression 2.0 is headed our way!!!!

sringwal

Iconic Member

- Messages

- 1,841

Probably. Interesting that the markets didn't really seem to move much on DOGE but start dropping on tariffs. That indicates to me that the DOGE actions are at best neutral for the economy while tariffs are an iceberg.

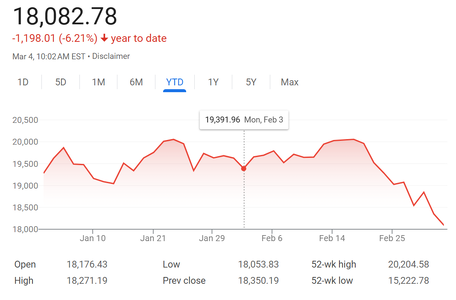

Numbers have been dropping in a variety of tech related fields pretty consistently over the last month, particularly for Nasdaq and cryptocurrency.

Nasdaq:

Bitcoin:

Last edited:

aGDevil2k

Inconceivable Member

- Messages

- 3,974

No it's because they dont really know what's going on with doge. But when the unemployment starts to shoot up, it will resonateProbably. Interesting that the markets didn't really seem to move much on DOGE but start dropping on tariffs. That indicates to me that the DOGE actions are at best neutral for the economy while tariffs are an iceberg.

- Messages

- 6,969

That's an interesting point I hadn't considered but you're right. They didn't really drop precipitously on the DOGE stuff, but the tariffs implementation is a dagger for the markets. Ugh. Won't be taking a peek at the 401K's and IRA's anytime soon, I reckon!Probably. Interesting that the markets didn't really seem to move much on DOGE but start dropping on tariffs. That indicates to me that the DOGE actions are at best neutral for the economy while tariffs are an iceberg.

JCTarheel82

Iconic Member

- Messages

- 2,062

If only there had been warning signs of this inevitability.The Trump stock market and the Trump economy are complete and utter disasters now.

Share: