Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All | 4-week delays on many Mexico and CDN tariffs

- Thread starter BubbaOtis

- Start date

- Replies: 205

- Views: 4K

- Politics

- Messages

- 15,023

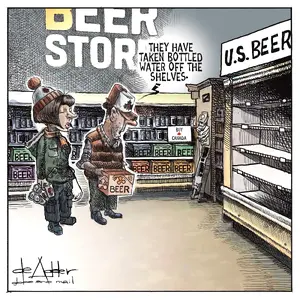

“… President Trump’s start-and-stop expansion of tariffs on major trading partners has no analog in modern history. Yet the past can still be instructive. Previous trade disputes over everything from semiconductors to lumber to chickens have sometimes dragged out for decades, rattling international markets and boosting consumer prices.

None of the presidents who pursued those policies staked his agenda on protectionism to the same extent as Trump. His measures cover an array of products: beer from Mexico, Chinese-made toys and Canadian planes.

Economists fear that Trump’s approach could unleash forces that have unintended consequences extending far beyond his time in office.

“This is the biggest change to tariff policy that we’ve seen in recent history,” Cox said.

Washington has historically had specific goals with previous import taxes, said Douglas Irwin, an economics professor at Dartmouth College. Reagan-era tariffs on Japanese semiconductors aimed to shield the U.S. technology sector from a daunting competitor. President Nixon ended short-lived across-the-board tariffs in 1971 soon after the export juggernauts of West Germany and Japan agreed to boost the value of their currencies.

Contrary to many trade spats of past decades, the Trump White House has offered conflicting rationales for taxing foreign goods now, a sign that the coming trade wars could be open-ended.

“The problem [today] is that it’s not clear what the ask is of other countries,” Irwin said. “It’s a dramatic escalation.”

The uncertainty has already dampened consumer confidence and boosted inflation expectations, with Boston Fed researchers estimating that Trump’s early tariff proposals could add 0.5 to 0.8 percentage point to core inflation depending on the response of U.S. importers. …”

- Messages

- 15,023

“… President Trump’s start-and-stop expansion of tariffs on major trading partners has no analog in modern history. Yet the past can still be instructive. Previous trade disputes over everything from semiconductors to lumber to chickens have sometimes dragged out for decades, rattling international markets and boosting consumer prices.

None of the presidents who pursued those policies staked his agenda on protectionism to the same extent as Trump. His measures cover an array of products: beer from Mexico, Chinese-made toys and Canadian planes.

Economists fear that Trump’s approach could unleash forces that have unintended consequences extending far beyond his time in office.

“This is the biggest change to tariff policy that we’ve seen in recent history,” Cox said.

Washington has historically had specific goals with previous import taxes, said Douglas Irwin, an economics professor at Dartmouth College. Reagan-era tariffs on Japanese semiconductors aimed to shield the U.S. technology sector from a daunting competitor. President Nixon ended short-lived across-the-board tariffs in 1971 soon after the export juggernauts of West Germany and Japan agreed to boost the value of their currencies.

Contrary to many trade spats of past decades, the Trump White House has offered conflicting rationales for taxing foreign goods now, a sign that the coming trade wars could be open-ended.

“The problem [today] is that it’s not clear what the ask is of other countries,” Irwin said. “It’s a dramatic escalation.”

The uncertainty has already dampened consumer confidence and boosted inflation expectations, with Boston Fed researchers estimating that Trump’s early tariff proposals could add 0.5 to 0.8 percentage point to core inflation depending on the response of U.S. importers. …”

“… On Wall Street, investors who previously viewed Trump’s trade rhetoric as a negotiating tactic are now grappling with the possibility that there are limited offramps ahead. The stock market has been thrashed over the past month, and the White House’s one-month exemption for many Canadian and Mexican imports on Thursday didn’t stanch the bleeding.

…Trump has likened his approach to a 19th-century paradigm that existed before international supply chains and foreign investment ballooned. In an address to Congress Tuesday, the president described tariffs as a means for protecting American jobs along with “protecting the soul of our country.”

… Economists generally believe Trump’s trade policy was more bark than bite the first time around. Even so, tariffs on commodities and consumer goods ushered in a new era of American protectionism that the Biden administration largely extended.

…

In 2018, import taxes on aluminum, steel and other products aimed to bring manufacturing back home, sometimes successfully. Tariffs on washing machinescreated an estimated 1,800 jobs at firms like Samsung, according to a study in the American Economic Review, but they cost consumers about $1.5 billion annually, or more than $800,000 per job.

The U.S. may be the world’s largest economy, but it isn’t so big that it can force foreign suppliers to eat the cost of import taxes, said Christine McDaniel, a senior research fellow at the Mercatus Center at George Mason University.

“The U.S. absorbed well over half of those tariffs,” she said. “We don’t have as much pricing power as you might think.”

The Biden administration relaxed some Trump-era tariffs on imports from allied countries.

But many China-focused levies remained in place, suggesting that “it is easier to ramp up tariffs than wind them down,” said Jack Zhang, a political-science professor who directs the Trade War Lab at the University of Kansas.

“The lesson of protectionism is that you end up with entrenched interest groups,” he said, adding that the complexity grows when governments retaliate.

In countries on both sides of trade wars, protected industries “will fight like hell to keep tariffs in place.” …”

- Messages

- 1,489

“Investors” need to view the tariff machinations for what they are - short term market manipulation grifts.investors who previously viewed Trump’s trade rhetoric as a negotiating tactic are now grappling with the possibility that there are limited offramps ahead. The stock market has been thrashed over the past month, and the White House’s one-month exemption for many Canadian and Mexican imports on Thursday didn’t stanch the bleeding.

- Messages

- 15,023

Share: