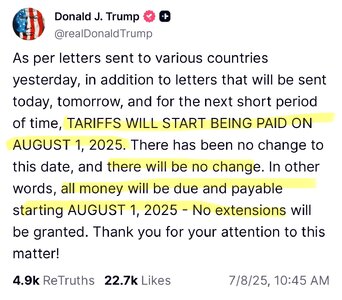

What is the status of these tariffs legally? I think there was a nationwide injunction against them, IIRC, but then the Supreme Court said no nationwide injunctions -- so would the tariffs continue to apply to all non-parties, or is this a case where complete relief requires nationwide relief. If there's a plaintiff that isn't an importer but rather a downstream buyer, it could argue that any tariffs that increase the price they pay would injure them, thus they would have standing.

But maybe the supreme court stayed the injunction. I can't even keep track any more.