Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

- Messages

- 4,242

Oh yea Texas gonna eliminate income taxYes, I was being a little sarcastic. I just get annoyed that when stories like this are reported, they often omit the blatant hypocrisy of the GOP taking credit for revenue gains from one form of tax, which disproportionately harms poorer Americans, while prioritizing the reduction of revenue by reducing other forms of tax, which disproportionately benefits richer Americans.

I can't for the life of me figure out why so many poorer Americans have been convinced the GOP is better for them from an economic perspective.

So it’s just sales tax out the ears now I guess. Investor folks happy

- Messages

- 41,499

Innumeracy

- Messages

- 487

Trump will throw them a bone with a few hundred dollars tariffs rebate check with some bullshit name attached to it and they will think it's the greatest thing in the world and praise his genius. Even it there's a moderate income cutoff to receive it, it will be so little that the wealthy won't even give a second thought about not receiving it because they came out like bandits with the tax cuts.Yes, I was being a little sarcastic. I just get annoyed that when stories like this are reported, they often omit the blatant hypocrisy of the GOP taking credit for revenue gains from one form of tax, which disproportionately harms poorer Americans, while prioritizing the reduction of revenue by reducing other forms of tax, which disproportionately benefits richer Americans.

I can't for the life of me figure out why so many poorer Americans have been convinced the GOP is better for them from an economic perspective.

Edited to add - As I mentioned recently, my parents have already started talking about how excited they are for the DOGE checks supposedly being considered. And they aren't wealthy by any stretch of the imagination and fall for all of the GOP talking points.

Last edited:

- Messages

- 4,112

Lee Atwater said " Perception is reality " and his Southern strategy, campaign advisor to Reagan in 1980 and 1984 and campaign manager for Poppy Bush proved that to be true then and even today.Yes, I was being a little sarcastic. I just get annoyed that when stories like this are reported, they often omit the blatant hypocrisy of the GOP taking credit for revenue gains from one form of tax, which disproportionately harms poorer Americans, while prioritizing the reduction of revenue by reducing other forms of tax, which disproportionately benefits richer Americans.

I can't for the life of me figure out why so many poorer Americans have been convinced the GOP is better for them from an economic perspective.

Lee Atwater and Roger Ailes who was a media consultant for Nixon, Reagan, and Poppy Bush, and CEO of Fox News understood that perception is reality and used media to influence perception.

I know youngsters are loathe to look to history in order to understand where we find ourselves today but reading The Selling of the President 1968 by Joe McGinniss is a classic piece of political journalism...and I am assuming lawtig02 is older than 30yo so he doesn't count as a youngster

It would be nice if all Americans lived their lives in accordance with objective reality, but Lee Atwater's perception is reality sadly is where we are today.

Last edited:

- Messages

- 5,217

I am eager to see the chart that tracks US exports in a couple of years. Especially when "services" start getting taxed by other countries as reprisal.

- Messages

- 4,112

"If the goal of the tariffs is to shift America's tax burden onto the middle class, they're working. Otherwise, they are not"

GQPers have always believed that the economic problem in this country is that the rich have too little and the poor have too much.

With tariffs and the BBB GQPers continue working to solve this problem.

USA !

ChileG

Inconceivable Member

- Messages

- 3,159

There seems to be a sudden downtick in the “I thought Trump’s policies were supposed to hurt the economy, durr,” posts here.What’s the next maga-sphere talking point(s) for:

- increasing inflation

- soft job market

- increasing trade deficits

- decreasing consumer sentiment

- decreasing discretionary spending

- housing at near all time highs, despite persistently elevated interest rates

- manufacturing jobs tanking

- according to Becker’s, 18 hospitals have closed to date, on top of 25 in 2024; the healthcare crisis is here and Medicaid cuts haven’t kicked in

Oh, what’s that? They don’t need talking points, they’ll just invent statistics.

superrific

Master of the ZZLverse

- Messages

- 12,420

Yes you do. In fact, it's a word that rhymes with figures.I can't for the life of me figure out why so many poorer Americans have been convinced the GOP is better for them from an economic perspective.

Molotov Mocktail

Distinguished Member

- Messages

- 307

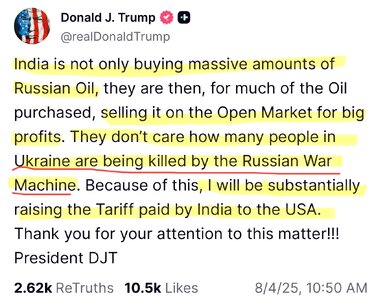

Yeah he’s raising the tariffs on India because they didn’t lie to the world about trump being solely responsible for ending the India/Pakistan conflict.

Pubs don’t seem to grasp the damage they’ve done by handing trump the power to throw out tariffs for whatever reason strikes him today. It’s probably a completely normal human reaction pubs are having because when you fuck up this horrendously it’s going to take awhile to come to terms that this was your fault.

Pubs don’t seem to grasp the damage they’ve done by handing trump the power to throw out tariffs for whatever reason strikes him today. It’s probably a completely normal human reaction pubs are having because when you fuck up this horrendously it’s going to take awhile to come to terms that this was your fault.

ChileG

Inconceivable Member

- Messages

- 3,159

High-interest loans is what Trump specializes in.

- Messages

- 5,217

Las Vegas resorts’ efforts to welcome visitors can’t bring back tourism alone

President Donald Trump’s “America First” bluster may play well on social media, but it is hammering tourism-dependent cities like Las Vegas.

But even as resorts take steps to fix their own mistakes, they cannot solve Las Vegas’ or the nation’s deeper tourism problem alone. The decline in international visitors, especially from Canada and Mexico, Nevada’s two largest foreign markets, has been catastrophic. No number of discounted room rates will fix it as long as the White House keeps waging war on foreign tourism.

President Donald Trump’s “America First” bluster may play well on social media, but it is hammering tourism-dependent cities like Las Vegas. Canadians, who once poured 1.49 million visitors into Nevada each year, are increasingly staying home. International visitors, who typically stay longer and spend more, are crucial to the city’s economy — and they are being driven away.

Keep in mind, it’s not just Las Vegas or even large cities generally that rely on tourism dollars. Outdoor recreation brings $8.1 billion into Nevada’s economy and employs 58,000 people in the Silver State. Much of that money goes to places like the Moapa Valley, Mesquite and Laughlin, which serve as gateways to the Lake Mead National Recreation Area, Utah’s national parks and Northern Arizona’s canyon country, respectively.

The reasons international tourists are staying away aren’t a mystery. Trump’s new “visa integrity fee,” which forces foreign tourists to hand over $250 in addition to existing visa costs, is the latest unnecessary barrier. Add to that Trump’s tariffs, his habit of insulting foreign leaders and companies, and his Justice Department’s aggressive immigration tactics that round up anyone who looks like they might not be a U.S. citizen, and you get a simple truth: People are less likely to spend their hard-earned vacation dollars in a country whose president seems to view them with disdain.

The damage goes beyond economics. Travel is, at its heart, an act of goodwill. It is a declaration that people want to experience American culture, spend their money here and share a little of their own culture in return. When a president mocks other nations, treats allies like adversaries and slaps unnecessary taxes and fees on travelers, he poisons that spirit.

Las Vegas can’t afford that kind of poison. No U.S. city can. Tourism is one of America’s greatest exports and international visitors are among its best customers. In 2026, when the United States co-hosts the World Cup, millions of foreign fans will decide whether to spend their time and money in cities like Las Vegas. If they are greeted with insults, they will simply go elsewhere.

ChileG

Inconceivable Member

- Messages

- 3,159

Trump is bad for business.

Las Vegas resorts’ efforts to welcome visitors can’t bring back tourism alone

President Donald Trump’s “America First” bluster may play well on social media, but it is hammering tourism-dependent cities like Las Vegas.lasvegassun.com

But even as resorts take steps to fix their own mistakes, they cannot solve Las Vegas’ or the nation’s deeper tourism problem alone. The decline in international visitors, especially from Canada and Mexico, Nevada’s two largest foreign markets, has been catastrophic. No number of discounted room rates will fix it as long as the White House keeps waging war on foreign tourism.

President Donald Trump’s “America First” bluster may play well on social media, but it is hammering tourism-dependent cities like Las Vegas. Canadians, who once poured 1.49 million visitors into Nevada each year, are increasingly staying home. International visitors, who typically stay longer and spend more, are crucial to the city’s economy — and they are being driven away.

Keep in mind, it’s not just Las Vegas or even large cities generally that rely on tourism dollars. Outdoor recreation brings $8.1 billion into Nevada’s economy and employs 58,000 people in the Silver State. Much of that money goes to places like the Moapa Valley, Mesquite and Laughlin, which serve as gateways to the Lake Mead National Recreation Area, Utah’s national parks and Northern Arizona’s canyon country, respectively.

The reasons international tourists are staying away aren’t a mystery. Trump’s new “visa integrity fee,” which forces foreign tourists to hand over $250 in addition to existing visa costs, is the latest unnecessary barrier. Add to that Trump’s tariffs, his habit of insulting foreign leaders and companies, and his Justice Department’s aggressive immigration tactics that round up anyone who looks like they might not be a U.S. citizen, and you get a simple truth: People are less likely to spend their hard-earned vacation dollars in a country whose president seems to view them with disdain.

The damage goes beyond economics. Travel is, at its heart, an act of goodwill. It is a declaration that people want to experience American culture, spend their money here and share a little of their own culture in return. When a president mocks other nations, treats allies like adversaries and slaps unnecessary taxes and fees on travelers, he poisons that spirit.

Las Vegas can’t afford that kind of poison. No U.S. city can. Tourism is one of America’s greatest exports and international visitors are among its best customers. In 2026, when the United States co-hosts the World Cup, millions of foreign fans will decide whether to spend their time and money in cities like Las Vegas. If they are greeted with insults, they will simply go elsewhere.

Share: