- Messages

- 8,302

So more expensive stuff and having less is a good thing?

Silence had better purchase a few gallons of lotion now or he will have to ration as he celebrates all the misfortune that's heading toward America on the trump depress.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

cdllife.com

cdllife.com

I’m still waiting for someone in this administration to provide an explanation of how these shifting tariffs are supposed to counter a trade deficit. Our trade deficits are due to domestic spending that exceeds production. There is an insatiable appetite for consumer goods. Tariffs can slow spending but that isn’t a solution without a method to increase competitive production. There doesn’t seem to be any kind of rational plan for this.I’m now down to under 20% pure US market exposure, after selling out of a REIT etf at close, today. I still have modest positions in international income producing and India etfs - otherwise, it’s short term bonds and money market. I’m undoubtedly going to miss some spectacular days, some good weeks, and probably some up months, but there is literally nothing suggesting the US economy will have responsible stewardship, for the duration of Trump. In fact, even if he reverses all this voodoo economic and constantly contradictory bullshit, the destruction to our trade relationships will endure for years.

Yeah, even if we do still have free elections and somehow manage to elect a Democratic POTUS in 2028 (a big assumption at this point) then it will not magically fix the damage Trump has already done to our global relationships. Other nations aren't going to stop treating us like a threat and pariah just because we lucked into electing a Democratic POTUS. We elected Biden and Trump just returned four years later and has already caused even more damage to the global economy than he did in his first term. It is very likely that foreign governments will simply assume going forward that Trumpism is now a dominant factor of American politics and any Democratic POTUS is just a temporary sane interruption between Trumpist administrations and Congresses that will continue to treat them like shit. It may well take decades of sane and competent presidential administrations to fully recover from the damage to our international reputation Trump has caused, which is unlikely to happen as long as Trumpism continues its hold over the GOP.I’m now down to under 20% pure US market exposure, after selling out of a REIT etf at close, today. I still have modest positions in international income producing and India etfs - otherwise, it’s short term bonds and money market. I’m undoubtedly going to miss some spectacular days, some good weeks, and probably some up months, but there is literally nothing suggesting the US economy will have responsible stewardship, for the duration of Trump. In fact, even if he reverses all this voodoo economic and constantly contradictory bullshit, the destruction to our trade relationships will endure for years.

Or hear me out. The American people suffer just enough economically to rid us of the MAGA virus.Yeah, even if we do still have free elections and somehow manage to elect a Democratic POTUS in 2028 (a big assumption at this point) then it will not magically fix the damage Trump has already done to our global relationships. Other nations aren't going to stop treating us like a threat and pariah just because we lucked into electing a Democratic POTUS. We elected Biden and Trump just returned four years later and has already caused even more damage to the global economy than he did in his first term. It is very likely that foreign governments will simply assume going forward that Trumpism is now a dominant factor of American politics and any Democratic POTUS is just a temporary sane interruption between Trumpist administrations and Congresses that will continue to treat them like shit. It may well take decades of sane and competent presidential administrations to fully recover from the damage to our international reputation Trump has caused, which is unlikely to happen as long as Trumpism continues its hold over the GOP.

Trust me, I hope it happens as well. But I do think it's going to be a long while before most other nations trust us or see us as an ally again.Or hear me out. The American people suffer just enough economically to rid us of the MAGA virus.

I am not rooting for that as I don’t want suffering of any type but it could have that effect.

“… Now, there is a second leg to the rush. The president’s decision on April 9 to pause so-called reciprocal tariffs for 90 days on every trading partner except China has presented businesses around the world with a new deadline to beat. The stakes are high: Many Asian imports could face tariffs of more than 40% while goods from the European Union are in line for a 20% levy.The Rush to Beat Tariffs Is Distorting the Economy. There’s More to Come.

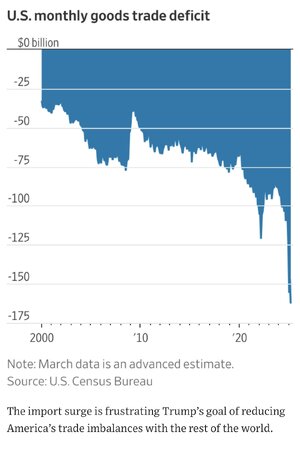

Surging U.S. imports, while likely temporary, are frustrating the president’s goal of reducing America’s trade imbalances

—> https://www.wsj.com/economy/trade/t...1f?st=rg7uL7&reflink=mobilewebshare_permalink

Really hard to make sense of that graph. The reverse color and choice to show bigger trade deficits as lower on the graph is confusing.“… Now, there is a second leg to the rush. The president’s decision on April 9 to pause so-called reciprocal tariffs for 90 days on every trading partner except China has presented businesses around the world with a new deadline to beat. The stakes are high: Many Asian imports could face tariffs of more than 40% while goods from the European Union are in line for a 20% levy.

Roger Lund has a container full of Christmas decorations from Germany that he needs in Baltimore port by July 8, after which the tariff he pays on the cargo is set to double. …

…”