- Messages

- 37,840

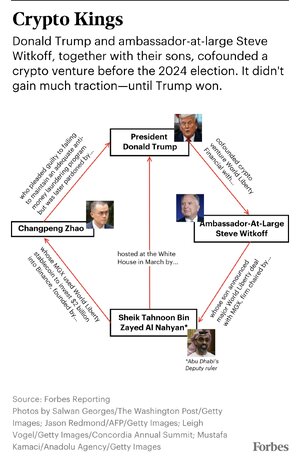

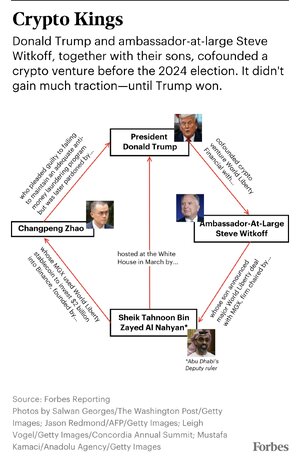

Inside Trump’s Decades-Long Relationship With The United Arab Emirates

The president has already made hundreds of millions abroad, much of it stemming from a single Middle Eastern nation. His most lucrative foreign deal may be about to begin.

www.forbes.com

www.forbes.com

“… the United Arab Emirates, home to the metropolises of Dubai and Abu Dhabi, has become a hub for the Trump Organization’s international expansion. With first sons Don Jr. and Eric serving as emissaries, the president and his family have entered into at least nine agreements with ties to the gulf nation—some involving government entities in the country, many stemming from business relationships developed there.

Together, the ventures, which include five licensing agreements and three cryptocurrency deals, will provide an estimated $500 million in 2025—and about $50 million annually for years into the future.

… Such messiness is part of life in the new Trump era. Real estate licensing, international diplomacy and meme-stock trading blend together in a mélange of dealmaking, with the first family emerging billions of dollars richer. None of it needs to involve explicit quid pro quos—business relationships lead to personal relationships that impact policy discussions. This is the way high-powered people have operated in the gulf region for decades. What’s new is that an American president has placed himself at the center of the web.

“It’s the kinds of transactionalism that these governments are very matter of fact in dealing with,” says the former diplomat in the region. “Not because they themselves are so profoundly corrupt, but rather, you need to be on the right side of Washington, come what may. This is what this Washington is requiring, so pony up.”…”