Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump / Musk (other than DOGE)

- Thread starter nycfan

- Start date

- Replies: 12K

- Views: 705K

- Politics

- Messages

- 615

Thank you! This is VERY helpful. I had not thought of most of this on my own.Versions of this have been implemented in several countries in Latin America. Ironically, its been by parties on the left end of the political spectrum which are usually the politicians that don't understand the impacts of price controls. I saw this process up close and personal about four years ago.

In the best of cases, a cap is put on interest rates, so banks just shift everything to fees. And like discount airlines, they start charging for everything which just makes it a nuisance for customers. Countries that came later put cap on interest rates as well as some limits on fees, that is where disaster looms.

At any given time, about 30-40% of the credit cards in a portfolio don't make any money for the bank: they cost more than what they bring in. That loss is covered by what the bank makes on the other 60-70% of the portfolio (and usually, 20% of the accounts represent 80% of the profit). So what happens when you slash the interest rate from say 25% to 10%? Just a rough estimate, but I'm guessing the cards that would lose money would probably go up to about 50-60% of the portfolio. Banks, like other business, are not in the business of losing money...so what's the next step? You cancel large swaths of the accounts that lose the most money (in CR it was estimated that the bottom 20% of CC and personal loan customers lost their accounts). Those are usually the tranches of customers that have lower level of credit ratings (and usually of income). The banks will also tighten credit to new accounts and those accounts that survived (with half the interest income...youre only willing to risk on the very best bets). That reduction in credit by itself is already bad enough...

And that's the "good" part. The thing is, those people who lost their account...their need for credit doesn't disappear. The problem is that the formal market no longer has a viable option for them (in CR the cap on interest rates was across the board for all products...usually what has been implemented in markets that do this). So the more desperate customers turn to the informal sector, the neighborhood loan shark (here known as little drop loans). In the last two years we have been flooded by cases of beatings and thefts associated to this phenomenon; its given oxygen to our local mafia.

There is a bill in the legislation to relax the cap a bit. I do believe some financial institutions charge rates that border on usury. But time after time we have seen that price controls don't work. The harsher the price control, the more collateral effects it engenders.

- Messages

- 41,071

"Melania Trump has barely been seen on the campaign trail this year. One of the few times she has appeared at a political event, she’s received a six-figure paycheck – a highly unusual move for the spouse of a candidate.

The former first lady spoke at two political fundraisers for the Log Cabin Republicans this year, and she was paid $237,500 for an April event, according to former President Donald Trump’s latest financial disclosure form. The payment was listed as a “speaking engagement.”

Trump’s latest disclosure form said Melania Trump was paid by the Log Cabin Republicans for the April fundraiser. But it’s a mystery who actually cut the check: Charles Moran, president of the Log Cabin Republicans, told CNN earlier this month the group did not put up the money for her to speak, and the disclosure form did not give any more information about the source of the payment.

... Campaign finance and government ethics experts say a payment to a presidential candidate’s spouse to appear at political fundraisers in an election is unusual, ethically questionable and should, at the very least, be properly noted in the disclosure forms.

“It seems pretty self-serving. From my own general observation, I’m not used to seeing that,” said Virginia Canter, the chief ethics counsel at Citizens for Responsibility and Ethics.

If the organization did not in fact make the payment to Melania Trump, the former president’s financial disclosure form may run afoul of ethics rules because it should have listed the sponsor who paid Melania Trump and not just where she spoke, Canter said. ..."

superrific

Master of the ZZLverse

- Messages

- 12,353

I agree with most of this. I'd put it slightly differently, though. The market for credit card receivables is extremely competitive. If the interest rate on a loan is currently 21%, it means that the market deems that price to be necessary to be profitable given the characteristics of that loan. If the maximum rate is 18%, it's unlikely that the bank will extend the loan. There is so much data out there about credit card defaults and payments that it's just not very hard for banks to predict the default rate on cards.Versions of this have been implemented in several countries in Latin America. Ironically, its been by parties on the left end of the political spectrum which are usually the politicians that don't understand the impacts of price controls. I saw this process up close and personal about four years ago.

In the best of cases, a cap is put on interest rates, so banks just shift everything to fees. And like discount airlines, they start charging for everything which just makes it a nuisance for customers. Countries that came later put cap on interest rates as well as some limits on fees, that is where disaster looms.

At any given time, about 30-40% of the credit cards in a portfolio don't make any money for the bank: they cost more than what they bring in. That loss is covered by what the bank makes on the other 60-70% of the portfolio (and usually, 20% of the accounts represent 80% of the profit). So what happens when you slash the interest rate from say 25% to 10%? Just a rough estimate, but I'm guessing the cards that would lose money would probably go up to about 50-60% of the portfolio. Banks, like other business, are not in the business of losing money...so what's the next step? You cancel large swaths of the accounts that lose the most money (in CR it was estimated that the bottom 20% of CC and personal loan customers lost their accounts). Those are usually the tranches of customers that have lower level of credit ratings (and usually of income). The banks will also tighten credit to new accounts and those accounts that survived (with half the interest income...youre only willing to risk on the very best bets). That reduction in credit by itself is already bad enough...

And that's the "good" part. The thing is, those people who lost their account...their need for credit doesn't disappear. The problem is that the formal market no longer has a viable option for them (in CR the cap on interest rates was across the board for all products...usually what has been implemented in markets that do this). So the more desperate customers turn to the informal sector, the neighborhood loan shark (here known as little drop loans). In the last two years we have been flooded by cases of beatings and thefts associated to this phenomenon; its given oxygen to our local mafia.

There is a bill in the legislation to relax the cap a bit. I do believe some financial institutions charge rates that border on usury. But time after time we have seen that price controls don't work. The harsher the price control, the more collateral effects it engenders.

On the other hand, one way of implementing a non-distorting price control would be for the government to use subsidies to the issuers to compensate them for extending a loan with a negative ex ante value. Or even more simply, the government could just buy the credit card receivables at the price that those receivables would have received under today's laws. Then it would be the government on the hook.

- Messages

- 5,936

The Trump Campaign running afoul of ethics rules?If the organization did not in fact make the payment to Melania Trump, the former president’s financial disclosure form may run afoul of ethics rules because it should have listed the sponsor who paid Melania Trump and not just where she spoke, Canter said. ..."

1moretimeagain

Inconceivable Member

- Messages

- 4,086

"Melania Trump has barely been seen on the campaign trail this year. One of the few times she has appeared at a political event, she’s received a six-figure paycheck – a highly unusual move for the spouse of a candidate.

The former first lady spoke at two political fundraisers for the Log Cabin Republicans this year, and she was paid $237,500 for an April event, according to former President Donald Trump’s latest financial disclosure form. The payment was listed as a “speaking engagement.”

Trump’s latest disclosure form said Melania Trump was paid by the Log Cabin Republicans for the April fundraiser. But it’s a mystery who actually cut the check: Charles Moran, president of the Log Cabin Republicans, told CNN earlier this month the group did not put up the money for her to speak, and the disclosure form did not give any more information about the source of the payment.

... Campaign finance and government ethics experts say a payment to a presidential candidate’s spouse to appear at political fundraisers in an election is unusual, ethically questionable and should, at the very least, be properly noted in the disclosure forms.

“It seems pretty self-serving. From my own general observation, I’m not used to seeing that,” said Virginia Canter, the chief ethics counsel at Citizens for Responsibility and Ethics.

If the organization did not in fact make the payment to Melania Trump, the former president’s financial disclosure form may run afoul of ethics rules because it should have listed the sponsor who paid Melania Trump and not just where she spoke, Canter said. ..."

Campaign pays candidate’s spouse $250k to speak at a campaign event at the candidate’s home.

- Messages

- 615

That does not sound exactly legal... certainly not ethical.Campaign pays candidate’s spouse $250k to speak at a campaign event at the candidate’s home.

- Messages

- 5,936

I doubt it's actually the campaign, my guess would be either a Pub donor or PAC.Campaign pays candidate’s spouse $250k to speak at a campaign event at the candidate’s home.

- Messages

- 5,208

If you are still using Twitter, Musk giving you extra reason to run away. They are getting rid of the block button.

www.ign.com

www.ign.com

X/Twitter Is Making More Changes to the Block Button, Making Posts From Public Accounts Visible to Everyone - IGN

X/Twitter is set to make even more changes to the block function, with Elon Musk confirming that "the block function will block that account from engaging with, but not block seeing, public post."

- Messages

- 3,299

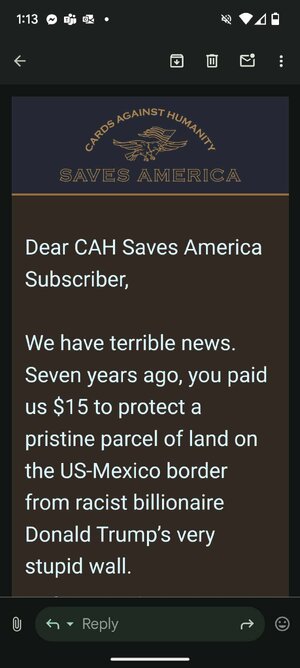

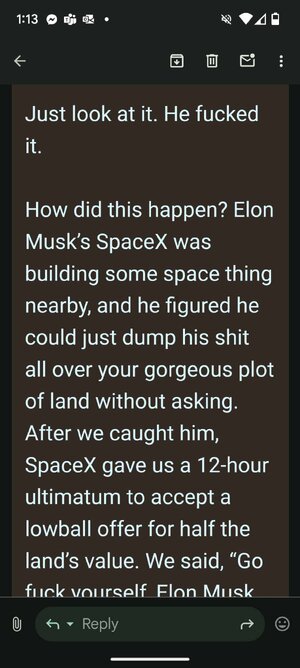

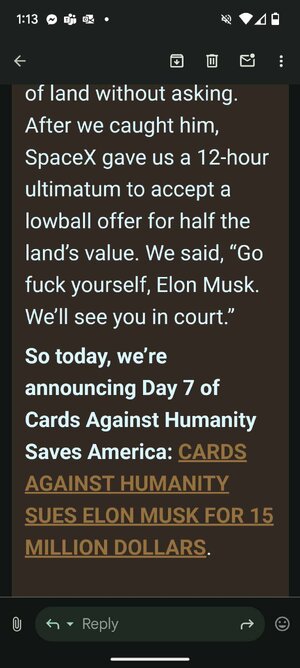

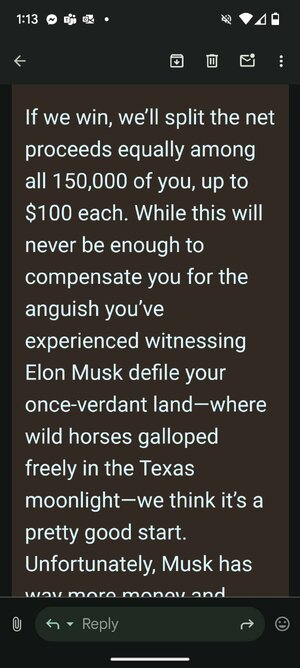

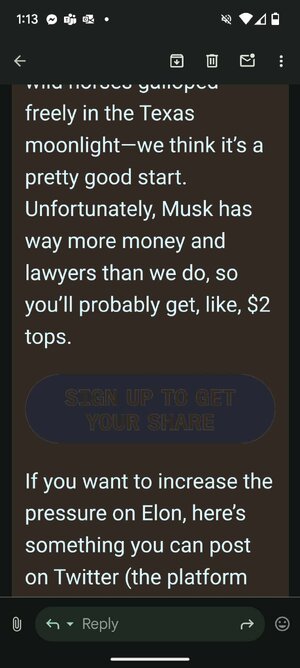

I hope they're not inadvertently running afoul of litigation funding rules here (though I suspect Texas is fairly permissive in that regard).Cards against Humanity is suing Musk

Neighbors of Starbase continue to be perplexed by some of SpaceX’s activities. Last year, a homeowner in the area, Keith Reynolds, noticed that SpaceX builders had cleared a parcel and were storing construction materials there. The parcel belonged to Cards Against Humanity, a card game company that sometimes engages in progressive political activism and bought land there to thwart a border wall with Mexico.

Reynolds said he called SpaceX to complain, but got no response. He also phoned an executive at Cards Against Humanity to inform them. The executive, who asked not to be identified by name, told Reuters that Denise Marrufo, a SpaceX real estate analyst, called afterward, asking if the company wanted to sell the property.

The executive ignored the offer.

Marrufo didn’t respond to a request for comment.

Cards Against Humanity on Thursday filed a $15 million lawsuit against SpaceX in Cameron County District Court, alleging illegal trespassing and destruction of property.

maxcrowder

Distinguished Member

- Messages

- 331

i've been gone for a year, i don't miss it. I'm sure they don't miss me either, but WGAF.Does anyone still post there? I have an account for my business from when it was still Twitter. I've had my marketing firm cancel my blogs. The amount of misinformation and vitriol was making my head spin. Trying to keep up and respond is futile.

- Messages

- 2,032

I will be among the many who is sticking it out through the election and then will finally rid myself of Twitter. I have seen this sentiment all over the place.

I guess Bluesky is where I will head next. But I will probably just take a break and read traditional new sources. Or check here

I guess Bluesky is where I will head next. But I will probably just take a break and read traditional new sources. Or check here

- Messages

- 5,208

the latter is quicker...But I will probably just take a break and read traditional new sources. Or check here

- Messages

- 5,936

I miss it when something big happens and the latest news is on twitter but the site won't load anything properly since I can't log in. But that's not worth going back.

I would probably miss it more, but I use the always awesome nycfan aggregator to keep up with most of the important topics.

I would probably miss it more, but I use the always awesome nycfan aggregator to keep up with most of the important topics.

aGDevil2k

Inconceivable Member

- Messages

- 4,688

I'm on Spoutible which is nice... If it had more celebrities news orgs etcI will be among the many who is sticking it out through the election and then will finally rid myself of Twitter. I have seen this sentiment all over the place.

I guess Bluesky is where I will head next. But I will probably just take a break and read traditional new sources. Or check here

evrheel

Esteemed Member

- Messages

- 587

Trump threatens to triple cost of John Deere tractors during event with farmers

Former President Donald Trump told farmers Monday that the cost of tractors could significantly rise if he wins the 2024 election.During a roundtable with farmers in Smithton, Pennsylvania, Trump concluded by noticing that his campaign team used John Deere tractors as props."I just noticed...

www.rawstory.com

www.rawstory.com

Trump threatens to triple cost of John Deere tractors during event with farmers

Former President Donald Trump told farmers Monday that the cost of tractors could significantly rise if he wins the 2024 election.During a roundtable with farmers in Smithton, Pennsylvania, Trump concluded by noticing that his campaign team used John Deere tractors as props."I just noticed...

www.rawstory.com

www.rawstory.com

"I just noticed behind me John Deere tractors," the former president said. "I know a lot about John Deere. I love the company. But as you know, they've announced a few days ago that they're going to move a lot of their manufacturing business to Mexico."

He continued: "I'm just notifying John Deere right now. If you do that, we're putting a 200% tariff on everything that you want to sell into the United States, so that if I win, John Deere is going to be paying a 200%."

"But if they're going to do that, we're going to put a 200% tariff on everything that they want to send back into the United States," he vowed. "Our country is going to make a lot of money, or they're not going to build – they're not going to open, and – or they're going to sell it to another country."

Last edited by a moderator:

Share: