Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump proposes 50-Year Mortgage

- Thread starter nycfan

- Start date

- Replies: 68

- Views: 868

- Politics

- Messages

- 31,534

- Messages

- 2,159

- Messages

- 6,598

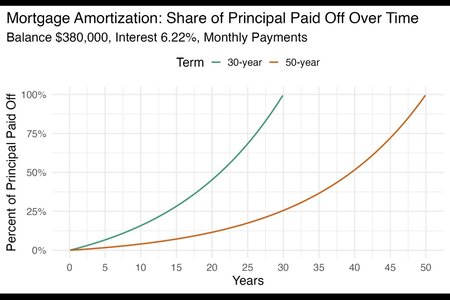

So after spending the first 20 years paying almost all interest and virtually no principle, you then get to spend the next 30 years living in a house that the bank still owns having made virtually no progress toward ownership of it yourself. Brilliant!

- Messages

- 31,534

Related:

The current 620 minimum representative or average median credit score will be removed for new loan casefiles created on or after Nov. 16, 2025

www.mpamag.com

www.mpamag.com

“… The change, detailed in the latest DU Version 12.0 release notes and Selling Guide update, represents a major shift in mortgage eligibility and could help more borrowers with lower credit scores but solid finances qualify for loans.

… Instead of relying on a hard credit score cutoff, DU will now evaluate a broader set of credit risk factors, including a borrower’s credit history, income, debt levels, property characteristics, and loan purpose.

… Fannie Mae clarified that lenders must still request credit scores for all borrowers, as required for loan sales, and certain loan types or private mortgage insurers may continue to impose their own minimums.

The update also expands Fannie Mae’s Day 1 Certainty program, offering lenders relief from enforcement of representations and warranties for certain undisclosed non-mortgage liabilities.

Additionally, documentation and homebuyer education requirements for borrowers without traditional credit will now be triggered only when no borrower has at least one credit or installment account reported.…”

The current 620 minimum representative or average median credit score will be removed for new loan casefiles created on or after Nov. 16, 2025

Fannie Mae scraps minimum credit score for DU loans

Pulte touts move as 'big deal for consumers' but 'small or nothing deal for underwriting'

“… The change, detailed in the latest DU Version 12.0 release notes and Selling Guide update, represents a major shift in mortgage eligibility and could help more borrowers with lower credit scores but solid finances qualify for loans.

… Instead of relying on a hard credit score cutoff, DU will now evaluate a broader set of credit risk factors, including a borrower’s credit history, income, debt levels, property characteristics, and loan purpose.

… Fannie Mae clarified that lenders must still request credit scores for all borrowers, as required for loan sales, and certain loan types or private mortgage insurers may continue to impose their own minimums.

The update also expands Fannie Mae’s Day 1 Certainty program, offering lenders relief from enforcement of representations and warranties for certain undisclosed non-mortgage liabilities.

Additionally, documentation and homebuyer education requirements for borrowers without traditional credit will now be triggered only when no borrower has at least one credit or installment account reported.…”

TangledUpInBlue06

Distinguished Member

- Messages

- 423

- Messages

- 31,534

Donald Trump Proposing 50-Year Mortgages Sparks Backlash

Donald Trump proposing 50-year mortgages sparks MAGA backlash

Federal Housing Finance Agency Director Bill Pulte said on Saturday that the Trump administration is working on a plan to introduce the longer-term mortgages.

Housing director confirms administration ‘working on’ 50-year mortgage after Trump hint

Federal Housing Finance Agency (FHFA) Director Bill Pulte on Saturday said the Trump administration is “working on” a plan to introduce 50-year mortgage terms for home buyers. “Thanks to President…

thehill.com

Trump administration 'working on' 50-year mortgage to boost affordability

Trump teased the loan term in a Truth Social graphic picturing him alongside Roosevelt, whose New Deal legislation offered housing relief during the Great Depression.

tarheelbillie

Distinguished Member

- Messages

- 463

Antithesis! FDR uplift the people. Trump screw the people.

theel4life

Iconic Member

- Messages

- 2,150

Pure insanity

- Messages

- 2,159

As bad as many of these examples of amortization schedules are, they’re all flawed by the assumption that you could even sniff an interest rate for 50 years that would be close to the 30 year rate. The current difference between 15 and 30 yr rates is roughly 0.75-0.875%. I’d expect the 50 year rates to be at least another 1.0-1.5% above the 30 year rate.

Interest expense is the wrong way to look at this. Let's take the starter home market which is the part of the market where the issue really is. You want the home buyer to build up equity as soon as possible for a number of reasons. But most importantly, you want the buyer to build up equity as soon as possible so that buyer can quickly sell and move up, but then that same house becomes available to the next starter home buyer.

So lets assume that starter home was financed at 300,000 and 6.5% over 30 years. it would pay down by 29,000 in 7 years. But do it over 50 years and it only pays down by 7,000 in 7 years.

Nuts.

- Messages

- 2,973

Related:

The current 620 minimum representative or average median credit score will be removed for new loan casefiles created on or after Nov. 16, 2025

Fannie Mae scraps minimum credit score for DU loans

Pulte touts move as 'big deal for consumers' but 'small or nothing deal for underwriting'www.mpamag.com

“… The change, detailed in the latest DU Version 12.0 release notes and Selling Guide update, represents a major shift in mortgage eligibility and could help more borrowers with lower credit scores but solid finances qualify for loans.

… Instead of relying on a hard credit score cutoff, DU will now evaluate a broader set of credit risk factors, including a borrower’s credit history, income, debt levels, property characteristics, and loan purpose.

… Fannie Mae clarified that lenders must still request credit scores for all borrowers, as required for loan sales, and certain loan types or private mortgage insurers may continue to impose their own minimums.

The update also expands Fannie Mae’s Day 1 Certainty program, offering lenders relief from enforcement of representations and warranties for certain undisclosed non-mortgage liabilities.

Additionally, documentation and homebuyer education requirements for borrowers without traditional credit will now be triggered only when no borrower has at least one credit or installment account reported.…”

subprime mortgages coming back baby ! Bad credit ? We don't need no stinkin' credit scores ! Still can't afford your dream house ? Grab this 50 year mortgage before it's too late !

Remember 2008 ?

good times...

theel4life

Iconic Member

- Messages

- 2,150

The sad part is MAGA will support this and say it’s a brilliant idea. Fucking morons.

- Messages

- 1,972

This is just permanent debt slavery.

- Messages

- 2,159

Yeah, it’s like they’re trying to make rent something you cover through credit.This is just permanent debt slavery.

Don’t forget that Trump’s housing director and the guy behind this is Bill Pulte, who inherited Pulte Group from his dad. One of the largest home builders in the country. He stands to benefit massively from this because prices will stay high while making homes more “affordable.”

Share: