- Messages

- 10,803

(Continued)

"...Stephen Miran, whom Trump has tapped to lead the Council of Economic Advisers, is arguably a more interesting case. Back in November he wrote “A User’s Guide to Restructuring the Global Trading System,” which might qualify as a manifesto if it were intelligible. My sense, however, is that reporters like the Wall Street Journal’s Greg Ip writing about the document have struggled to make sense of what Miran is saying.

I, however, don’t find Miran puzzling at all, thanks to my long experience as (among other things) an economics professor at MIT, Princeton and CUNY. You see, I recognize the genre. Most years, at least one student tries to BS his way through the term paper requirement by producing something with a bunch of learned-sounding references and some gratuitous equations, hoping that you won’t notice the absence of any coherent argument.

And when I say lack of coherence I don’t mean that I disagree; I mean that the document simply doesn’t hang together. Part 3 makes the case for tariffs by arguing that they won’t be inflationary because they’ll lead to a stronger dollar, reducing import prices. Part 4 then calls for an all-out effort to weaken the dollar, using emergency powers if necessary.

Oh, and Miran’s plan for weakening the dollar involves pressuring foreign governments to stop accumulating dollar reserves — in effect, diminishing the role of the dollar as a reserve currency. (That wouldn’t work, but never mind.) Let’s hope nobody tells Trump, who has threatened to impose punitive tariffs on any country that dares move away from the dollar.

OK, I’m probably spending too much time on Miran, who is unlikely to have real policy influence. But then who will?

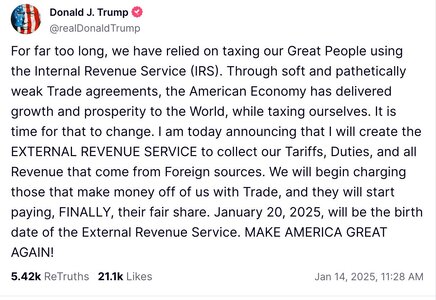

Which brings me back to my starting point: the incoming administration doesn’t seem to have any economic plan. But the ultimate reason for that absence is fear: everyone is afraid to say anything that might be taken as an implicit contradiction or criticism of Trump’s rantings. ..."

"...Stephen Miran, whom Trump has tapped to lead the Council of Economic Advisers, is arguably a more interesting case. Back in November he wrote “A User’s Guide to Restructuring the Global Trading System,” which might qualify as a manifesto if it were intelligible. My sense, however, is that reporters like the Wall Street Journal’s Greg Ip writing about the document have struggled to make sense of what Miran is saying.

I, however, don’t find Miran puzzling at all, thanks to my long experience as (among other things) an economics professor at MIT, Princeton and CUNY. You see, I recognize the genre. Most years, at least one student tries to BS his way through the term paper requirement by producing something with a bunch of learned-sounding references and some gratuitous equations, hoping that you won’t notice the absence of any coherent argument.

And when I say lack of coherence I don’t mean that I disagree; I mean that the document simply doesn’t hang together. Part 3 makes the case for tariffs by arguing that they won’t be inflationary because they’ll lead to a stronger dollar, reducing import prices. Part 4 then calls for an all-out effort to weaken the dollar, using emergency powers if necessary.

Oh, and Miran’s plan for weakening the dollar involves pressuring foreign governments to stop accumulating dollar reserves — in effect, diminishing the role of the dollar as a reserve currency. (That wouldn’t work, but never mind.) Let’s hope nobody tells Trump, who has threatened to impose punitive tariffs on any country that dares move away from the dollar.

OK, I’m probably spending too much time on Miran, who is unlikely to have real policy influence. But then who will?

Which brings me back to my starting point: the incoming administration doesn’t seem to have any economic plan. But the ultimate reason for that absence is fear: everyone is afraid to say anything that might be taken as an implicit contradiction or criticism of Trump’s rantings. ..."