Conservatives threaten to tank House budget vote needed to advance Trump agenda

Speaker Mike Johnson has been making progress with moderates who've raised concerns about potential Medicaid cuts, but a band of fiscal hawks are refusing to budge.

"...

Wary moderate Republicans appeared to be moving toward supporting the budget resolution after receiving some assurances from Johnson about Medicaid in a future package.

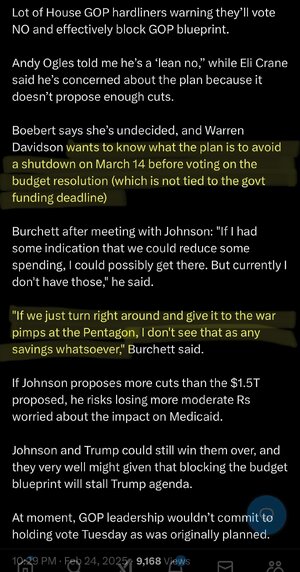

Still, at least four GOP rabble-rousers — Reps. Victoria Spartz of Indiana, Tim Burchett of Tennessee, Warren Davidson of Ohio and Thomas Massie of Kentucky — emerged from a closed-door meeting of House Republicans on Tuesday morning and said they would vote against the budget plan over concerns it doesn't cut spending enough.

"I am not voting for this," Davidson said as he left the meeting.

"I'm still a no," Burchett told NBC News, adding that he wouldn't mind a call from Trump. "I'd like to express to him some of my concerns, which is that his tax cuts aren't permanent, the trillions of dollars in debt by our own numbers that we're showing. We talked about reducing the debt — that's what we ran on."

Those four votes could be enough to kill the measure. The GOP's 218-215 House majority means Johnson can afford only a single GOP defection, unless lawmaker absences change the math. He expressed confidence about passing the resolution on Monday,

asking a conservative crowd to pray for it. ..."

-----

Note, however, that they may have a little more leeway as at least three Dems may not be present due to health concerns (one has a baby due any minute, two more have other health issues apparently).