Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

U.S. Budget - OBBB | Medicare Part D premiums set to rise

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 47K

- Politics

Duke Mu

Iconic Member

- Messages

- 1,417

I'd rather have the personal exemptions back. Losing that sent our taxes soaring.

Duke Mu

Iconic Member

- Messages

- 1,417

$500B Medicare cuts. Deep Medicaid cuts. ACA cuts. 13M will lose insurance.

It doesn't mean that a more efficient system wasn't needed. Health Care Coverage needed to be folded into one entity. Redundancy is costly. A public option for those under 65 could compete with private insurance to drive down costs.

Mini Mike's bill is just a hatchet.

It will still barely subsidize tax breaks to billionaires.

Debtor countires are running for the hills as the dollar loses status and sound fiscal backing.

It certainly seems like...

The Californians want the SALT. We have a silly passive income workaround right now for business owners. But with the high property tax and state income tax, the SALT cap hits pretty hard out here - especially given that $200k is middle class.I'd rather have the personal exemptions back. Losing that sent our taxes soaring.

- Messages

- 2,768

I wonder if the Republicans from Cali will hold out-I guess notThe Californians want the SALT. We have a silly passive income workaround right now for business owners. But with the high property tax and state income tax, the SALT cap hits pretty hard out here - especially given that $200k is middle class.

TangledUpInBlue06

Distinguished Member

- Messages

- 279

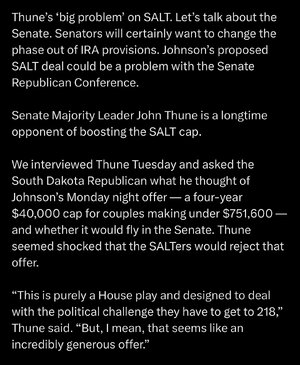

The SALT caucus reportedly has agreed to this. Let's see how much it costs and whether there is pushback from the deficit hawks. The original proposal ($30k cap phasing out above $400k income) earned $915 billion from 2025-2034.

Last edited:

p5mmr9

Distinguished Member

- Messages

- 347

Social Security isn't the problem. Healthcare cost is the biggest issue affecting Federal, State, and individual budgets. Cutting Medicaid will increase healthcare costs for everyone. Want to fix the budget? Fix healthcare.The elephant in the room for Democrats, is what are they going to run on in 2028 to fix the budget and fix social security to have any credibility and win?

A huge tax increase?

- Messages

- 2,768

YeaThe elephant in the room for Democrats, is what are they going to run on in 2028 to fix the budget and fix social security to have any credibility and win?

A huge tax increase?

Of course the "plan" is to tax rich people-rich Corporations

Messaging that correctly is hard

And I don't know the "math"-it may not exist

EDIT

Soc sec is pretty easy compared to Healthcare or National defense

For high income earners with a tax break for bottom 75%The elephant in the room for Democrats, is what are they going to run on in 2028 to fix the budget and fix social security to have any credibility and win?

A huge tax increase?

By 2029 SS Trust fund depletes to around 1 Trillion. Much of what keeps it going is the revenue derived from the trust fund which will be gone by around 2033. By that point, it would take an extra 300 B to 350B to make up the difference annually if I can remember the math correctly.Social Security isn't the problem. Healthcare cost is the biggest issue affecting Federal, State, and individual budgets. Cutting Medicaid will increase healthcare costs for everyone. Want to fix the budget? Fix healthcare.

Perhaps you're are saying, fix healthcare and the general revenue can be transferred to make up the difference? If so, then that's a heck of a difference to make up.

Yea

Of course the "plan" is to tax rich people-rich Corporations

Messaging that correctly is hard

And I don't know the "math"-it may not exist

EDIT

Soc sec is pretty easy compared to Healthcare or National defense

Take away Trump Corporate tax cuts would help the math. The effective tax rates on many large corporations is in the single digits. That's a travesty. And we by far have the lowest Corporate tax rates of all the G-7 countries. And I bet their corporations don't have all the tax loopholes like ours have.

Interestingly, of the large, publicly traded corporations its estimated that up to 40% of their stock is foreign owned.

I suspect every Democrat will offer this as a solution. However, without closing loopholes and deductions you can't tax high income earners. They will escape every time. Sure, the lottery winners will have to pay.For high income earners with a tax break for bottom 75%

superrific

Legend of ZZL

- Messages

- 9,218

Tax capital gains. That's the solution in my view. We can start with baby steps: treat the use of equity as collateral as a realization event.I suspect every Democrat will offer this as a solution. However, without closing loopholes and deductions you can't tax high income earners. They will escape every time. Sure, the lottery winners will have to pay.

- Messages

- 3,105

However the fix for SS is simple. Remove the withholding cap.By 2029 SS Trust fund depletes to around 1 Trillion. Much of what keeps it going is the revenue derived from the trust fund which will be gone by around 2033. By that point, it would take an extra 300 B to 350B to make up the difference annually if I can remember the math correctly.

Perhaps you're are saying, fix healthcare and the general revenue can be transferred to make up the difference? If so, then that's a heck of a difference to make up.

TangledUpInBlue06

Distinguished Member

- Messages

- 279

The Budget Lab at Yale had interesting proposals on how to accomplish this: https://budgetlab.yale.edu/research...reatment-borrowing-against-appreciated-assetsTax capital gains. That's the solution in my view. We can start with baby steps: treat the use of equity as collateral as a realization event.

Option (1): Deemed Realization for Borrowing

This option, based on a proposal by Liscow and Fox (2024), would treat loan proceeds as a “deemed realization” of unrealized capital gains. That is, borrowing would be treated as a realization event. After tax is paid, the basis of the affected assets would reset to fair market value, preventing double taxation if the assets are later sold.

Option (2): Withholding Tax on Borrowing

This option would apply a simple flat-rate “withholding” tax on loan proceeds, with the withheld amount creditable against future capital gains tax liability. Under the proposed 10% withholding rate, a $10 million loan would trigger an immediate $1 million tax payment regardless of the taxpayer's basis in their assets.

Option (3): Annual Excise Tax on Loan Balances

This reform, based in part on a Bipartisan Policy Center proposal, would impose a 0.5% annual tax on the outstanding balance of covered loans.1 In contrast with the prior two reform options, which would apply to net new flows of borrowing, this option would apply to the stock of debt. For example, a $10 million loan balance would incur an annual liability of $50,000.

Share: