- Messages

- 23,307

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

U.S. Budget - OBBB | Medicare Part D premiums set to rise

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 47K

- Politics

- Messages

- 3,173

People voted for the collapse of America, why shouldn't they get what they voted for? The Democrats couldn't stop them from committing this folly - they have no power.WTH are the PROTESTORS, NOW? The Trump 2.0 Episode - 26 Hours in Iran has distracted everyone.

The Senate bill will KILL our R&D engine, responsible for 60% of new job creation since WW II. The deficit spending with the BANK ROBBERY for billionaires will cripple our economy long term.

Dems are not fighting hard enough. They think this irresponsible appropriations bill will help them in 2026. Their arrogance and fecklessness is infuriating.

Pubs are voting against the best interest of their constituents, especially in the red states. Our son is crossing the last t and dotting the last i on his dissertation in engineering, but job prospects are in Canada.

Trump, MAGA, and Project 2025 are disassembling the American science, education, and innovation infrastructure that made the US the #1 economy/capita.

- Messages

- 2,751

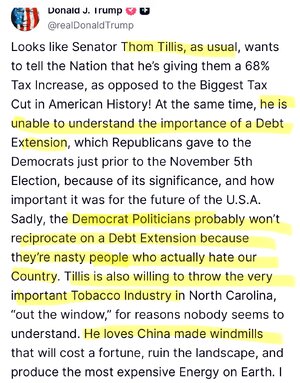

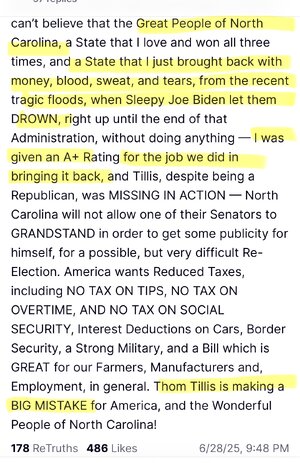

Lord I hope they fund some Nutjob in the primary Dems in NC win easier in Statewide races when they run against nutjobs

I hear Mark Robinson is available.Lord I hope they fund some Nutjob in the primary Dems in NC win easier in Statewide races when they run against nutjobs

Duke Mu

Iconic Member

- Messages

- 1,401

Of course. Dems need to scream bloody murder about the appropriations bill, and sorry if you folks offended, and put iran, Gaza, Mamadani, gender stuff on the backburner. This Big Bullsh*t Bill is the ballgame. If McConnell were the Dem leader instead of Schumer, he would have found a way to shut it down or compromise.When Trump and Heritage 2025 fucks the MAGAts, they’ll blame the Deep State, Libtards, and immigrants.

This is a science and job crusher and a great day for Xi and Putin!

Duke Mu

Iconic Member

- Messages

- 1,401

The hell they can't. THIS is the case you have to take to the American people. Show that you have their backs, especially the working and middle class. This is the ONLY major piece of legislation on the docket. You find a way.People voted for the collapse of America, why shouldn't they get what they voted for? The Democrats couldn't stop them from committing this folly - they have no power.

Dems are feckless and weak. We can't assume they will prevail as milquetoasts in 2026.

This country needs a viable 3rd party.

1moretimeagain

Iconic Member

- Messages

- 1,890

Find a way to do what?The hell they can't. THIS is the case you have to take to the American people. Show that you have their backs, especially the working and middle class. This is the ONLY major piece of legislation on the docket. You find a way.

Dems are feckless and weak. We can't assume they will prevail as milquetoasts in 2026.

This country needs a viable 3rd party.

Duke Mu

Iconic Member

- Messages

- 1,401

Find out what the chicken MAGAs need to make a deal and grow a spine. The Senate has been bartering for 250 years before the Mad Orange King.Find a way to do what?

1moretimeagain

Iconic Member

- Messages

- 1,890

Why would Republicans bother negotiating with Dems? They can pass the bill without Dem votes.Find out what the chicken MAGAs need to make a deal and grow a spine. The Senate has been bartering for 250 years before the Mad Orange King.

heelinhell

Iconic Member

- Messages

- 2,193

as did "troubled and concerned" Susan Collins. She is up for re-election next year. Dems should be doing ads and holding town halls to publicize that she voted for a 4 trillion budget bill that cuts Medicaid and other safety net programs.Murkowski sells out.

Collins, true to form, expressed her concern and said she might not vote for the bill in the end unless some changes are made before the final vote.

There is no doubt in my mind that Susan will vote for the bill without changes but let her constituents know she did so reluctantly and with deep concern.

- Messages

- 23,307

At least she got some very Alaska specific improvements for her state (Not sure Collins got anything for her vote — maybe a new string of pearls to clutch?), but not surprising.Murkowski sells out.

Exactly. Pubs have desire or intention to negotiate with Dems.Why would Republicans bother negotiating with Dems? They can pass the bill without Dem votes.

- Messages

- 23,307

GOP megabill narrowly wins first test in the Senate. Here's what's in it

Loading…

www.npr.org

“… The vote was 51 to 49. Sen. Ron Johnson, R-Wisc., originally voted no but switched his vote at the last minute, preventing the need for Vice President J.D. Vance to break a tie.

… The Senate will now start a very lengthy process before a final vote can be called. Senate Democrats requested a full reading of the nearly 1,000-page bill on the floor of the Senate in accordance with Senate rules. Once that is done, Republicans and Democrats each get 10 hours to debate the bill – though Republicans are expected to use only a small portion of their time. Once that is done, the Senate will begin an unlimited series of amendment votes, known as a vote-a-rama.

The process could stretch well into Sunday night or, more likely, sometime on Monday….”

- Messages

- 23,307

GOP megabill narrowly wins first test in the Senate. Here's what's in it

Loading…

www.npr.org

“… The vote was 51 to 49. Sen. Ron Johnson, R-Wisc., originally voted no but switched his vote at the last minute, preventing the need for Vice President J.D. Vance to break a tie.

… The Senate will now start a very lengthy process before a final vote can be called. Senate Democrats requested a full reading of the nearly 1,000-page bill on the floor of the Senate in accordance with Senate rules. Once that is done, Republicans and Democrats each get 10 hours to debate the bill – though Republicans are expected to use only a small portion of their time. Once that is done, the Senate will begin an unlimited series of amendment votes, known as a vote-a-rama.

The process could stretch well into Sunday night or, more likely, sometime on Monday….”

“… The Senate's text includes temporary changes that would allow Americans to deduct up to $25,000 for tip wages and $12,500 for overtime pay through 2028. The Senate version also says that overtime and tip deductions will be reduced for Americans with incomes higher than $150,000. Those limits were not included in the House version.

The Senate bill also increases the child tax credit from $2,000 to $2,200 per child and adjusts the amount for inflation after 2025. It's slightly different than the House plan to temporarily increase the credit to $2,500 before cutting it back to the current level and adjusting for inflation.

In addition, the Senate text would permanently expand the standard deduction, marking a key difference from the House bill, which temporarily expands it through 2028. Senators also boosted a tax deduction for people over 65 to $6,000 through 2028, compared to $4,000 in the House bill. Both chambers included a phase out for people earning over $75,000.…”

- Messages

- 3,173

At this point the Democrats are lucky to not have been locked up for "reasons." They have no power but minor annoyance.Why would Republicans bother negotiating with Dems? They can pass the bill without Dem votes.

The American people wanted to be ruled rather than governed, and well that is what they are getting.

- Messages

- 23,307

“… The bill would also force states to take on a greater share of the cost of providing food assistance. The amount a state owes would be based on a formula set by the percentage of erroneous payments reported each year. Those changes would go into effect in 2028. [I read elsewhere there is a waiver of this for states not in the co rigorous United States — the Murkowski vote concession as Alaska apparently has one of the highest error rates in the country]“… The Senate's text includes temporary changes that would allow Americans to deduct up to $25,000 for tip wages and $12,500 for overtime pay through 2028. The Senate version also says that overtime and tip deductions will be reduced for Americans with incomes higher than $150,000. Those limits were not included in the House version.

The Senate bill also increases the child tax credit from $2,000 to $2,200 per child and adjusts the amount for inflation after 2025. It's slightly different than the House plan to temporarily increase the credit to $2,500 before cutting it back to the current level and adjusting for inflation.

In addition, the Senate text would permanently expand the standard deduction, marking a key difference from the House bill, which temporarily expands it through 2028. Senators also boosted a tax deduction for people over 65 to $6,000 through 2028, compared to $4,000 in the House bill. Both chambers included a phase out for people earning over $75,000.…”

… The Senate plan would temporarily lift the [SALT] cap to $40,000 for married couples with incomes up to $500,000. But that provision would expire after 2028 — an effort to buoy the blue-state Republicans through the 2026 midterm and 2028 election cycles, while limiting the long-term impact of the cuts on federal tax revenue.

… The Senate plan would require able bodied adults to work 80 hours per month until age 65 to qualify for benefits. There are carveouts for parents of children under 14 and those with disabilities.

The plan would also cap and gradually reduce the tax states can impose on Medicaid providers. The phase out would begin in 2028, ultimately ending in a 3.5 percent cap on that tax. Several GOP senators have raised concerns that the tax is a critical funding stream for rural hospitals in particular — which could close if that income stream dries up.

In an effort to alleviate some of those concerns, Senate GOP leaders included a new $25 billion fund to support rural hospitals. That program would also begin in 2028 and funds would be spread out over five years…”

- Messages

- 3,173

Well I guess the silver lining is that the Republicans are actually expecting a 2028 election, which I am sure will go to the Democrats, but then the whole economy blows up.

Must be nice to live in a world where you can lie with impunity, steal from your voters blindly and never ever ever have to answer for it. The country deserves its collapse for repeatedly going back to this well.

Must be nice to live in a world where you can lie with impunity, steal from your voters blindly and never ever ever have to answer for it. The country deserves its collapse for repeatedly going back to this well.

Share: