Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

U.S. Budget & OBBB | OCT 1 - Gov’t Shutdown Begins

- Thread starter nycfan

- Start date

- Replies: 2K

- Views: 72K

- Politics

- Messages

- 29,684

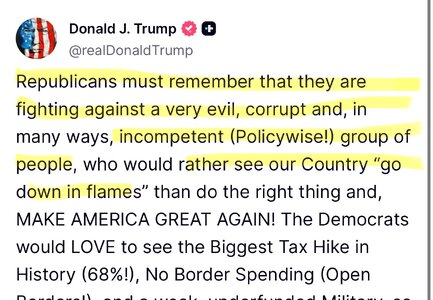

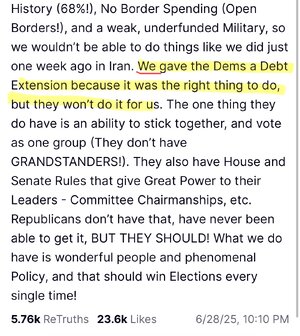

GOP megabill narrowly wins first test in the Senate. Here's what's in it

“… The vote was 51 to 49. Sen. Ron Johnson, R-Wisc., originally voted no but switched his vote at the last minute, preventing the need for Vice President J.D. Vance to break a tie.

… The Senate will now start a very lengthy process before a final vote can be called. Senate Democrats requested a full reading of the nearly 1,000-page bill on the floor of the Senate in accordance with Senate rules. Once that is done, Republicans and Democrats each get 10 hours to debate the bill – though Republicans are expected to use only a small portion of their time. Once that is done, the Senate will begin an unlimited series of amendment votes, known as a vote-a-rama.

The process could stretch well into Sunday night or, more likely, sometime on Monday….”

- Messages

- 29,684

GOP megabill narrowly wins first test in the Senate. Here's what's in it

“… The vote was 51 to 49. Sen. Ron Johnson, R-Wisc., originally voted no but switched his vote at the last minute, preventing the need for Vice President J.D. Vance to break a tie.

… The Senate will now start a very lengthy process before a final vote can be called. Senate Democrats requested a full reading of the nearly 1,000-page bill on the floor of the Senate in accordance with Senate rules. Once that is done, Republicans and Democrats each get 10 hours to debate the bill – though Republicans are expected to use only a small portion of their time. Once that is done, the Senate will begin an unlimited series of amendment votes, known as a vote-a-rama.

The process could stretch well into Sunday night or, more likely, sometime on Monday….”

“… The Senate's text includes temporary changes that would allow Americans to deduct up to $25,000 for tip wages and $12,500 for overtime pay through 2028. The Senate version also says that overtime and tip deductions will be reduced for Americans with incomes higher than $150,000. Those limits were not included in the House version.

The Senate bill also increases the child tax credit from $2,000 to $2,200 per child and adjusts the amount for inflation after 2025. It's slightly different than the House plan to temporarily increase the credit to $2,500 before cutting it back to the current level and adjusting for inflation.

In addition, the Senate text would permanently expand the standard deduction, marking a key difference from the House bill, which temporarily expands it through 2028. Senators also boosted a tax deduction for people over 65 to $6,000 through 2028, compared to $4,000 in the House bill. Both chambers included a phase out for people earning over $75,000.…”

- Messages

- 3,992

At this point the Democrats are lucky to not have been locked up for "reasons." They have no power but minor annoyance.Why would Republicans bother negotiating with Dems? They can pass the bill without Dem votes.

The American people wanted to be ruled rather than governed, and well that is what they are getting.

- Messages

- 29,684

“… The bill would also force states to take on a greater share of the cost of providing food assistance. The amount a state owes would be based on a formula set by the percentage of erroneous payments reported each year. Those changes would go into effect in 2028. [I read elsewhere there is a waiver of this for states not in the co rigorous United States — the Murkowski vote concession as Alaska apparently has one of the highest error rates in the country]“… The Senate's text includes temporary changes that would allow Americans to deduct up to $25,000 for tip wages and $12,500 for overtime pay through 2028. The Senate version also says that overtime and tip deductions will be reduced for Americans with incomes higher than $150,000. Those limits were not included in the House version.

The Senate bill also increases the child tax credit from $2,000 to $2,200 per child and adjusts the amount for inflation after 2025. It's slightly different than the House plan to temporarily increase the credit to $2,500 before cutting it back to the current level and adjusting for inflation.

In addition, the Senate text would permanently expand the standard deduction, marking a key difference from the House bill, which temporarily expands it through 2028. Senators also boosted a tax deduction for people over 65 to $6,000 through 2028, compared to $4,000 in the House bill. Both chambers included a phase out for people earning over $75,000.…”

… The Senate plan would temporarily lift the [SALT] cap to $40,000 for married couples with incomes up to $500,000. But that provision would expire after 2028 — an effort to buoy the blue-state Republicans through the 2026 midterm and 2028 election cycles, while limiting the long-term impact of the cuts on federal tax revenue.

… The Senate plan would require able bodied adults to work 80 hours per month until age 65 to qualify for benefits. There are carveouts for parents of children under 14 and those with disabilities.

The plan would also cap and gradually reduce the tax states can impose on Medicaid providers. The phase out would begin in 2028, ultimately ending in a 3.5 percent cap on that tax. Several GOP senators have raised concerns that the tax is a critical funding stream for rural hospitals in particular — which could close if that income stream dries up.

In an effort to alleviate some of those concerns, Senate GOP leaders included a new $25 billion fund to support rural hospitals. That program would also begin in 2028 and funds would be spread out over five years…”

- Messages

- 3,992

Well I guess the silver lining is that the Republicans are actually expecting a 2028 election, which I am sure will go to the Democrats, but then the whole economy blows up.

Must be nice to live in a world where you can lie with impunity, steal from your voters blindly and never ever ever have to answer for it. The country deserves its collapse for repeatedly going back to this well.

Must be nice to live in a world where you can lie with impunity, steal from your voters blindly and never ever ever have to answer for it. The country deserves its collapse for repeatedly going back to this well.

- Messages

- 29,684

“… The bill would also force states to take on a greater share of the cost of providing food assistance. The amount a state owes would be based on a formula set by the percentage of erroneous payments reported each year. Those changes would go into effect in 2028. [I read elsewhere there is a waiver of this for states not in the co rigorous United States — the Murkowski vote concession as Alaska apparently has one of the highest error rates in the country]

… The Senate plan would temporarily lift the [SALT] cap to $40,000 for married couples with incomes up to $500,000. But that provision would expire after 2028 — an effort to buoy the blue-state Republicans through the 2026 midterm and 2028 election cycles, while limiting the long-term impact of the cuts on federal tax revenue.

… The Senate plan would require able bodied adults to work 80 hours per month until age 65 to qualify for benefits. There are carveouts for parents of children under 14 and those with disabilities.

The plan would also cap and gradually reduce the tax states can impose on Medicaid providers. The phase out would begin in 2028, ultimately ending in a 3.5 percent cap on that tax. Several GOP senators have raised concerns that the tax is a critical funding stream for rural hospitals in particular — which could close if that income stream dries up.

In an effort to alleviate some of those concerns, Senate GOP leaders included a new $25 billion fund to support rural hospitals. That program would also begin in 2028 and funds would be spread out over five years…”

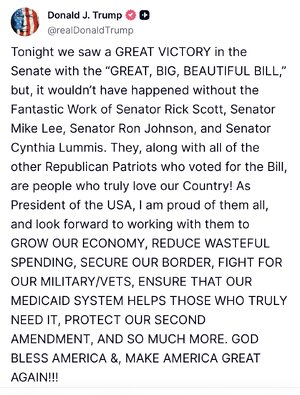

Background on Senate repayment plan: https://www.npr.org/2025/04/30/nx-s1-5381149/trump-republicans-student-loan-repayment

“… In their place will be two options: 1) a "Standard Repayment Plan" with fixed monthly payments across a range of 10 to 25 years and 2) a "Repayment Assistance Plan" that bases monthly payments on a borrower's total adjusted gross income. The plan also waives unpaid interest that isn't covered by the monthly payment, according to a Republican fact sheet. …”

1moretimeagain

Inconceivable Member

- Messages

- 2,600

- Messages

- 693

Is this graph accurate?

- Messages

- 1,999

I honestly dont know why we are stressing over it. We all knew how bad it would be and we all knew it would pass and we all knew there is zero power for Democrats to do anything about it.

Mulberry Heel

Inconceivable Member

- Messages

- 3,138

They increased the child tax credit to all of $2,200 from $2,000 per kid? Well that will certainly achieve their stated goal of encouraging young couples to have more babies! That extra $200 will pay for all of a week (or maybe just a couple of days) of child care! Oh, wait, they decided when Roe was overturned that the way to force women to have more babies was to pass extreme anti-abortion laws and go after birth control of any type. No need for any real financial or other incentives when you've got that going for you.“… The Senate's text includes temporary changes that would allow Americans to deduct up to $25,000 for tip wages and $12,500 for overtime pay through 2028. The Senate version also says that overtime and tip deductions will be reduced for Americans with incomes higher than $150,000. Those limits were not included in the House version.

The Senate bill also increases the child tax credit from $2,000 to $2,200 per child and adjusts the amount for inflation after 2025. It's slightly different than the House plan to temporarily increase the credit to $2,500 before cutting it back to the current level and adjusting for inflation.

In addition, the Senate text would permanently expand the standard deduction, marking a key difference from the House bill, which temporarily expands it through 2028. Senators also boosted a tax deduction for people over 65 to $6,000 through 2028, compared to $4,000 in the House bill. Both chambers included a phase out for people earning over $75,000.…”

- Messages

- 3,992

Well Billy, we can't afford to eat, but we could see a space shuttle that can't fly anymore.

lawtig02

Inconceivable Member

- Messages

- 4,982

Agree. I’m not stressing about it. I’m just looking forward to the political fallout.I honestly dont know why we are stressing over it. We all knew how bad it would be and we all knew it would pass and we all knew there is zero power for Democrats to do anything about it.

- Messages

- 6,378

Yep. I like Tillis and have met him personally on several occasions as he and my FIL are close, and I truly wish there were 50 more Republican Senators just like him, but his getting primaried by some far right extremist insane asylum candidate (aren’t they all anymore) is great news for a Democratic senate seat pick up.All anyone needs to know about the political impact of this bill and its economic impact on poor and rural communities can be learned from a quick look at Tillis’s vote.

Share: