It's fascinating to me that so many want to change radically how SS works. It's worked incredibly well for almost 100 years. Its only real issue is that it's currently underfunded due to a significant increase in SSI claims. To fix it, you either increase contributions (taxes) or make it harder to get SSI, or a combination of the two.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Battle over Mandatory (aka “Entitlement”) Spending

- Thread starter nycfan

- Start date

- Replies: 199

- Views: 5K

- Politics

The issue with SS is completely manageable. Its always been interesting how low of an interest rate the Federal Government pays to the SS Trust fund to borrow form it. In fact, one reason the Trust fund has eroded and thus lost solvency is that we've had 15 years or so of lower interest rates. If we had bumped the interest rate paid on the SS funds when the cycle started, then we wouldn't be near as close to as we are today to the fund running out..It's fascinating to me that so many want to change radically how SS works. It's worked incredibly well for almost 100 years. Its only real issue is that it's currently underfunded due to a significant increase in SSI claims. To fix it, you either increase contributions (taxes) or make it harder to get SSI, or a combination of the two.

- Messages

- 1,990

ONCE, I tried to explain to my sister-in-law the difference between an entitlement and right, when she was arguing that she had a "right" to Social Security. When I tried to explain that Social Security was an entitlement and voting was a right, she was NOT interested in the distinction I was making. She was all "rights good," "entitlements bad."

Last edited:

Then the issue is really whether the grass gets cut or not. I prefer a nice, cut yard for SS. As you pointed out, so many people want to radically change how SS works. Not necessary if the grass gets cut and the husband gets paid.The interest rate the government "pays" to the trust fund is an accounting trick. It's like my wife paying me to cut the grass.

To quote George Costanza, it's all pipes...

- Messages

- 8,086

I watched an interview the other day of an author that wrote a book about poverty.That's just a statute. Congress can change that at any point. Legislation would be necessary to increase the retirement age. Suppose you're a member of the House, and you're presented with two bills:

1. Raise the retirement age for Americans by two more years;

2. Fund the IRS, go after tax evasion by the rich, and allow general revenues to be used for SS.

Which one do you choose? You don't get to evade or ask for other options. You have to vote. You can, if you would like, vote for both or neither.

He made the statement that if we could simply collect all of the unpaid taxes that it would be enough money to ensure that no one lives in poverty.

Today, I was listening to a podcast about how you actually go about change. How the burn it down approach is slow and painful. While a better approach is to evaluate then either replace, repair, or eliminate.

If it were up to me, I'd start with a focus on the IRS. Ensure that it is funded properly and has the proper directives to go after unpaid taxes and other issues/concerns where tax money is being avoided or not paid, like fraud, tax cheats, etc. Repairing the IRS and bringing in all of the expected and owed tax revenues would be a good start in my opinion as it would establish the baseline of what we really have to work with. Then if that isn't enough congress could choose to eliminate programs, make them more efficient so the money is enough, or raise taxes to secure enough revenues.

- Messages

- 1,745

... and also, shrinkage!The interest rate the government "pays" to the trust fund is an accounting trick. It's like my wife paying me to cut the grass.

To quote George Costanza, it's all pipes...

- Messages

- 2,830

The "norm" is that most people are NOT able to work into their 70s. They just are not. Most people into their early 70s are able to manage their household and daily activities.I don't think 65 is as old as many want to portray it. There are plenty of people who are fully functional well into their 70's. On the subject of head coaches, Pete Carroll is 73.

Sure, there are people who may not be able to work, but we can address those as exceptions, not the norm, right?

Past 75, even daily activities and household management is compromised for many/most.

There might be "many people who are fully functional well into their 70s" but they are NOT the majority of that cohort by a very long shot.

- Messages

- 4,000

This is very trueThe "norm" is that most people are NOT able to work into their 70s. They just are not. Most people into their early 70s are able to manage their household and daily activities.

Past 75, even daily activities and household management is compromised for many/most.

There might be "many people who are fully functional well into their 70s" but they are NOT the majority of that cohort by a very long shot.

- Messages

- 8,086

Not that I disagree, but the key here is how do we define earned.Do not raise the retirement age

Collect SS on all income

Raise the tax rate to 45% above $1M earned, 50% above $10 million earned, 75% above $500M earned and 100% above $999M earned

- Messages

- 38,612

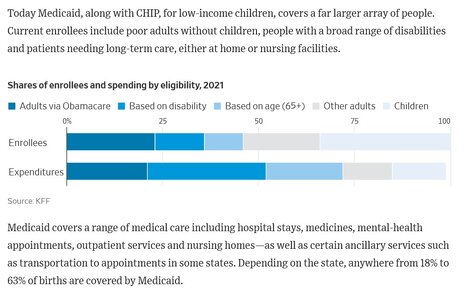

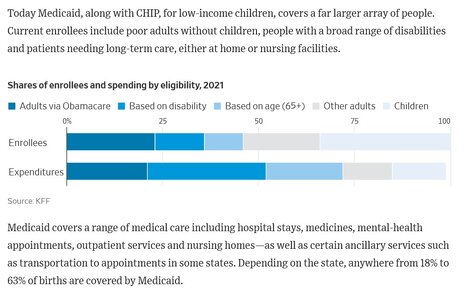

GIFT LINK --> https://www.wsj.com/politics/policy...3?st=pymTuk&reflink=desktopwebshare_permalink

Good background article on how Medicaid works and how cuts would impact Americans

"... Medicaid is the biggest government health insurance program in the U.S., covering around 72 million people as of October 2024, or about 79 million when the affiliated Children’s Health Insurance Program, or CHIP, is included—more than Medicare.

... Begun in 1965 as a program for needy Americans, including low-income children with caretakers, as well as elderly, blind and disabled people, Medicaid has grown over the years. It cost $872 billion in 2023, most of it state and federal government spending, or about 18% of what the nation paid for healthcare.

Enrollment rose during the pandemic, when periodic eligibility reviews were suspended, but since then, millions have been removed from the rolls as reviews resumed. ..."

Good background article on how Medicaid works and how cuts would impact Americans

"... Medicaid is the biggest government health insurance program in the U.S., covering around 72 million people as of October 2024, or about 79 million when the affiliated Children’s Health Insurance Program, or CHIP, is included—more than Medicare.

... Begun in 1965 as a program for needy Americans, including low-income children with caretakers, as well as elderly, blind and disabled people, Medicaid has grown over the years. It cost $872 billion in 2023, most of it state and federal government spending, or about 18% of what the nation paid for healthcare.

Enrollment rose during the pandemic, when periodic eligibility reviews were suspended, but since then, millions have been removed from the rolls as reviews resumed. ..."

gtyellowjacket

Inconceivable Member

- Messages

- 2,933

I think the interesting one there is he is saying he won't touch medicaid. I don't think there was much way that he was going to take away social security or Medicare benefits for anybody already on them. I thought Medicaid might be an issue and it still may be.

He told Congress when they're working out their budget don't touch Medicare, don't touch social security and Medicaid you could do something like a work requirement, but it mostly stays in place. We'll see if he sticks to that, sticks to his tax pledges or sticks to his deficit reduction pledges. One of them probably has to break unless he is willing to gut defense.

My guess is it will end up being some Medicaid cuts, some defense cuts and not getting keeping his deficit reduction promise but blame the democrats.

- Messages

- 38,612

Yeah, he will cut Medicaid and say we are just cutting “waste”. Then claim they cut fraud but mostly will have cut programs they consider wasteful.I think the interesting one there is he is saying he won't touch medicaid. I don't think there was much way that he was going to take away social security or Medicare benefits for anybody already on them. I thought Medicaid might be an issue and it still may be.

He told Congress when they're working out their budget don't touch Medicare, don't touch social security and Medicaid you could do something like a work requirement, but it mostly stays in place. We'll see if he sticks to that, sticks to his tax pledges or sticks to his deficit reduction pledges. One of them probably has to break unless he is willing to gut defense.

My guess is it will end up being some Medicaid cuts, some defense cuts and not getting keeping his deficit reduction promise but blame the democrats.

gtyellowjacket

Inconceivable Member

- Messages

- 2,933

That's probably not a bad guess but you can only do so much of that without hitting some of these rural hospitals that his voters use. I guess you could potentially move the money around but at the end of the day everybody wants hospitals.Yeah, he will cut Medicaid and say we are just cutting “waste”. Then claim they cut fraud but mostly will have cut programs they consider wasteful.

- Messages

- 38,612

WSJ with an animated explainer on genuine waste in the Medicaid system (that arises in large part due to each state running their own program):

GIFT LINK —> https://www.wsj.com/health/healthca...41?st=14XE9A&reflink=mobilewebshare_permalink

—> https://www.wsj.com/health/healthca...41?st=14XE9A&reflink=mobilewebshare_permalink

“… Private insurers oversee Medicaid benefits for more than 70% of the about 72 million low-income and disabled people in the program. The companies get paid each month for each person they cover. They aren’t supposed to get paid if a patient leaves for another state.

… From 2019 to 2021, states made duplicative payments for an average of about 660,000 patients a year totalling $4.3 billion dollars in payments.

…

A spokesman for Centene said the Journal’s analysis overstates the financial impact of the issue and “ignores the financial safeguards in place to address potential overpayments,” including profit caps and a rule that requires insurers to refund premiums to states when medical costs are lower than expected. Centene said it repaid states about $2 billion during the period the Journal studied.

A UnitedHealth spokesman called the Journal’s analysis “incomplete and misleading.” He said it didn’t account for payments the company had returned to states, which he declined to quantify. “Many of the duplicates are children, typically due to parental separation,” he said, and are “reconciled as part of our standard audit process.” …”

GIFT LINK

“… Private insurers oversee Medicaid benefits for more than 70% of the about 72 million low-income and disabled people in the program. The companies get paid each month for each person they cover. They aren’t supposed to get paid if a patient leaves for another state.

… From 2019 to 2021, states made duplicative payments for an average of about 660,000 patients a year totalling $4.3 billion dollars in payments.

…

A spokesman for Centene said the Journal’s analysis overstates the financial impact of the issue and “ignores the financial safeguards in place to address potential overpayments,” including profit caps and a rule that requires insurers to refund premiums to states when medical costs are lower than expected. Centene said it repaid states about $2 billion during the period the Journal studied.

A UnitedHealth spokesman called the Journal’s analysis “incomplete and misleading.” He said it didn’t account for payments the company had returned to states, which he declined to quantify. “Many of the duplicates are children, typically due to parental separation,” he said, and are “reconciled as part of our standard audit process.” …”

Medicaid has been a target for years. The cuts have mostly been incremental. This administration is going to gut the program. If they do, the ramifications will reach well beyond just impacting people who are on Medicaid.Yeah, he will cut Medicaid and say we are just cutting “waste”. Then claim they cut fraud but mostly will have cut programs they consider wasteful.

Couldn’t agree more. Medicaid doesn’t just cover nursing home payments and trips to the doctor. There are also programs that help people who are challenged function within their communities. If Trump does indeed gut Medicaid, the desert you mentioned will get more barren.Rural healthcare, as a whole, is already rough. This country has healthcare deserts, and the seemingly inevitable cuts to medicaid will make it substantially worse, while concurrently threatening the large, specialist-laden, urban systems. You know, the ones maga relies upon when they get lung cancer or lymphoma or a MRSA infection from an unaddressed diabetic foot wound or need a mitral valve replacement or or or ...

Share: