lawtig02

Iconic Member

- Messages

- 2,066

Johnson = capoCont’d)

“… A handshake agreement was made Friday to address the debt ceiling in the new year.

Johnson flashed the draft agreement in a House GOP conference meeting that afternoon that said they would raise the debt ceiling by $1.5 trillion in a packaged deal that would include Trump’s border security and economic reform asks, “with an agreement that we will cut $2.5 trillion in net mandatory spending” throughout the legislative process.

Many House Republicans, particularly those responsible for allotting government spending, knew that was an impossible goal unless the party went against its campaign promise to not cut Medicare or Social Security.

Hard-liners also knew an agreement in principle would likely be broken, but could no longer protest as the train was leaving the station on a funding bill that mirrored Thursday’s failed proposal, except that it no longer included the debt ceiling hike.

“They call that a gentleman’s agreement, but there are no gentlemen out here,” Rep. Tim Burchett (R-Tennessee) said. …”

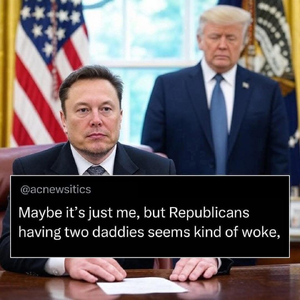

Trump = consigliere

Elon = don

There’s no honor, or honesty, among thieves.