- Messages

- 17,404

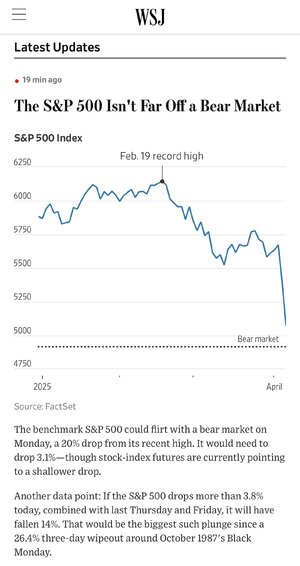

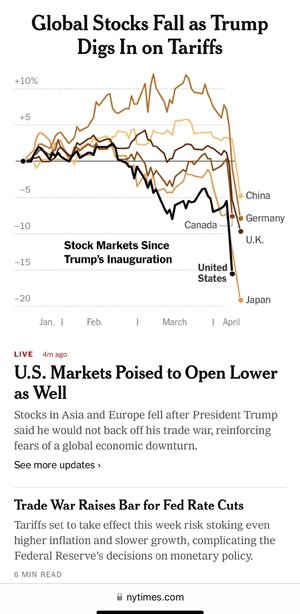

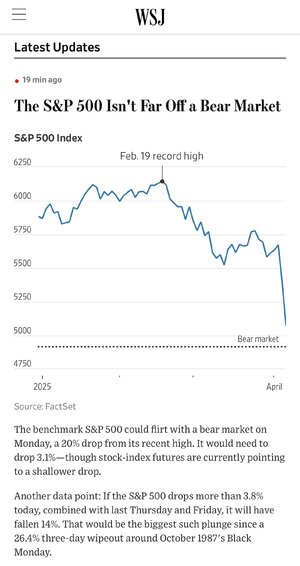

“… Turmoil in global markets snowballed into one of the worst routs in recent memory after President Trump said he will stay the course with aggressive, economically disruptive tariffs.

“What’s going to happen to the markets, I can’t tell you,” Trump said late Sunday. “I don’t want anything to go down. But sometimes you have to take medicine to fix something.”

“What’s going to happen to the markets, I can’t tell you,” Trump said late Sunday. “I don’t want anything to go down. But sometimes you have to take medicine to fix something.”