Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News Thread | Consumer Confidence declines

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 31K

- Politics

superrific

Legend of ZZL

- Messages

- 5,533

This is what should happen. Trump has been telling everyone what he is planning to do, so that information should have been baked into asset prices long ago. Indeed, it's why interest rates started increasing in September, when Trump really started talking crazy about tariffs.Bond yields steady ahead of looming Powell testimony, CPI data

heelinhell

Iconic Member

- Messages

- 1,214

Inflation remained stubbornly high in January, new data expected to show

Economists expect prices rose by 2.9 percent annually last month, the same gain reported in December.

I remember back in the day when 3% inflation was the norm and no big deal, but now 2.9% is considered "stubbornly high "

It will be interesting to see if the Trump election has had an anticipatory impact and nudged the inflation rate a bit higher than 2.9%

uncgriff

Esteemed Member

- Messages

- 581

Inflation comes in hot.

Trump is bringing those prices down quickly and brilliantly.

Trump is bringing those prices down quickly and brilliantly.

buzzosborne

Member

- Messages

- 23

I read that wholesale egg prices are up to $8 a dozen, which will reflect in stores in a few weeks.Inflation comes in hot.

Trump is bringing those prices down quickly and brilliantly.

heelinhell

Iconic Member

- Messages

- 1,214

and look at the price of eggs and other groceries

Such an easy layup for Democrats. Flood the zone with the talking point that the threat of Trump tariffs caused inflation to come back because business stocked up and drove prices up. The media will then start asking Trump about it. Pin the tail on that orange elephant.

aGDevil2k

Inconceivable Member

- Messages

- 3,072

You gotta stop posting/viewing X!

BillOfRights

Esteemed Member

- Messages

- 633

- Messages

- 15,127

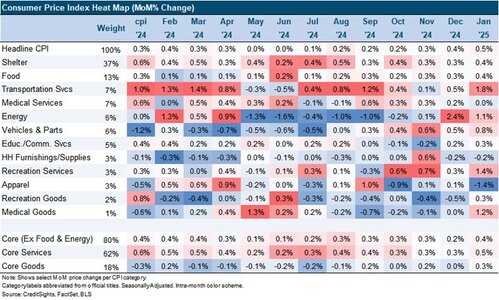

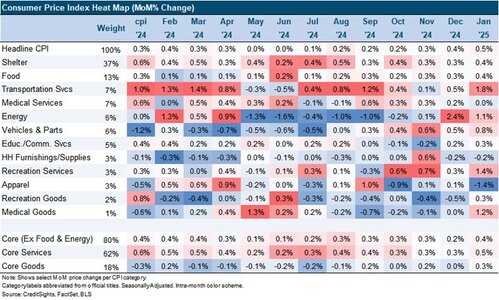

From CreditSights / LevFin Insights newsletter:

"...

"...

- Headline CPI beat consensus expectations by two-tenths with a 0.5% MoM increase. That pushed the 3m annualized rate to 4.7%, the fastest pace since November 2022 when the YoY rate of headline CPI was 7.1%. Both Food and Energy prices accelerated contributing to the upside surprise.

- Core CPI rose 0.4% MoM, besting consensus expectations by one-tenth. Core services rose 0.5% MoM, the fastest pace since March 2024, while core goods rose 0.3% MoM, the fastest pace since 2023. A sustained reversal in the core goods deflation we saw throughout 2024 will present a renewed challenge for the Fed, while key services components continue to prove sticky.

- We expect monetary policy expectations to start to reflect two-sided risk (either a hike or cut next) and this, among other factors, will begin to push credit spreads wider. The upside surprise to January 2024 CPI reported last February led to 6 bp of IG and 1 bp of HY spread tightening over the next week. Last year's moves at this time are counter intuitive, but are indicative of less overall policy uncertainty, a strong US economy and greater conviction that the next monetary policy move will be a cut, not a hike. While the US economy remains solid, fiscal policy uncertainty has reached a fever pitch, and we expect the market to begin pricing in a meaningful probability that the Fed will hike...."

CFordUNC

Inconceivable Member

- Messages

- 4,347

Wow. The Trump inflation

Ugh. I know, I know. It’s a terrible addiction and hard to break!You gotta stop posting/viewing X!

Carolina Fever

Iconic Member

- Messages

- 2,383

Inflation is worse now with Trump. Who would have guessed that?

- Messages

- 15,127

Inflation is worse now with Trump. Who would have guessed that?

- Messages

- 1,499

It’s really not. Spend 20 minutes on a flight or layover deleting your account and following a similar core of 40-50 accounts on Bluesky. You’ll gradually build up the same information diet and followings without the christonationalism and Nazi adjacent posts musk forces into your feed.Wow. The Trump inflation

Ugh. I know, I know. It’s a terrible addiction and hard to break!

Within a handful of days, I suspect you won’t think a thing of Twitter, outside of breaking the reflexive habit of clicking the app or shortcut.

Share: