- Messages

- 15,094

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News Thread | Consumer Confidence declines

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 31K

- Politics

- Messages

- 15,094

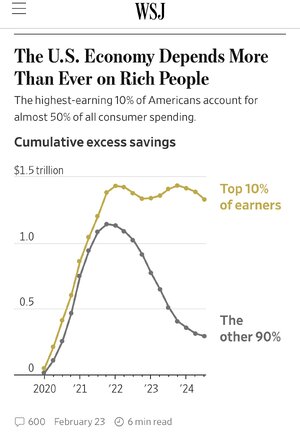

“…The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate and other assets.

Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%.

All this means that economic growth is unusually reliant on rich Americans continuing to shell out. Mark Zandi, chief economist at Moody’s Analytics, estimated that spending by the top 10% alone accounted for almost one-third of gross domestic product.

… Taken together, well-off people have increased their spending far beyond inflation, while everyone else hasn’t. The bottom 80% of earners spent 25% more than they did four years earlier, barely outpacing price increases of 21% over that period. The top 10% spent 58% more. …”

What do you expect when they have an increased share of the money AND favorable tax cuts?

- Messages

- 947

I predict those spending levels will not continue.“…The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate and other assets.

Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%.

All this means that economic growth is unusually reliant on rich Americans continuing to shell out. Mark Zandi, chief economist at Moody’s Analytics, estimated that spending by the top 10% alone accounted for almost one-third of gross domestic product.

… Taken together, well-off people have increased their spending far beyond inflation, while everyone else hasn’t. The bottom 80% of earners spent 25% more than they did four years earlier, barely outpacing price increases of 21% over that period. The top 10% spent 58% more. …”

- Messages

- 15,094

Starbucks to Lay Off More Than 1,000 Workers

New CEO Brian Niccol says corporate cuts are needed to streamline the business

“… As of September, Starbucks had 16,000 corporate employees, including those supporting store operations, store development and roasting. The company said the layoffs wouldn’t affect roasting, manufacturing, warehousing and distribution workers.

Cafe workers also wouldn’t be affected by the cuts, Starbucks said. …”

ChileG

Iconic Member

- Messages

- 1,229

A single data point but worth monitoring

Shocking!

- Messages

- 15,094

OPINION:

Biden’s Mortgage ‘Relief’ Fuels Higher Housing Prices

It has created another subprime housing bubble and put taxpayers at risk. Trump should end it.

GIFT LINK

——

A case of good intentions helping folks buy and stay in their homes creating other issues (growing the principal on the mortgage of defaulting homeowners, albeit without subjecting the additional debt to interest) — the Trump Administration is under pressure to end the program, but doing so would exacerbate house affordability issues for a lot of Americans.

ChileG

Iconic Member

- Messages

- 1,229

YikesOPINION:

Biden’s Mortgage ‘Relief’ Fuels Higher Housing Prices

It has created another subprime housing bubble and put taxpayers at risk. Trump should end it.

GIFT LINK—> https://www.wsj.com/opinion/bidens-...74?st=46wuzN&reflink=mobilewebshare_permalink

——

A case of good intentions helping folks buy and stay in their homes creating other issues (growing the principal on the mortgage of defaulting homeowners, albeit without subjecting the additional debt to interest) — the Trump Administration is under pressure to end the program, but doing so would exacerbate house affordability issues for a lot of Americans.

JCTarheel82

Iconic Member

- Messages

- 1,157

- Messages

- 15,094

Consumer confidence registers biggest monthly decline since August 2021 as inflation fears take hold

“… Economic jitters are showing up across various sentiment surveys as the Trump administration aims to reconfigure America’s trade relationship with the world and inflation shows signs of getting stuck.

The latest evidence comes from The Conference Board’s Consumer Confidence Index for February, released Tuesday morning. The index fell to 98.3, falling for the third-straight month and marking the largest monthly decline since August 2021, as expectations for inflation in the year ahead climbed. That coincides with the trends reflected in the University of Michigan’s consumer survey for February.

Homebuilders are also growing worried, according to the National Association of Home Builders; even US small businesses, which remain somewhat optimistic about deregulation and tax cuts, are in doubt about the economy’s future. The National Federation of Independent Business’ Uncertainty Index rose in January to its third-highest reading on record. …”

heelinhell

Iconic Member

- Messages

- 1,211

Consumers beginning to wonder if egg prices are going to get back to $2/dozen and gas prices are going to get back to $2/gallon ?

- Messages

- 1,676

seems sustainable“…The top 10% of earners—households making about $250,000 a year or more—are splurging on everything from vacations to designer handbags, buoyed by big gains in stocks, real estate and other assets.

Those consumers now account for 49.7% of all spending, a record in data going back to 1989, according to an analysis by Moody’s Analytics. Three decades ago, they accounted for about 36%.

All this means that economic growth is unusually reliant on rich Americans continuing to shell out. Mark Zandi, chief economist at Moody’s Analytics, estimated that spending by the top 10% alone accounted for almost one-third of gross domestic product.

… Taken together, well-off people have increased their spending far beyond inflation, while everyone else hasn’t. The bottom 80% of earners spent 25% more than they did four years earlier, barely outpacing price increases of 21% over that period. The top 10% spent 58% more. …”

- Messages

- 15,094

Economists are starting to worry about a serious Trump recession

Tariffs on America’s neighbours and assault on federal government will hit US economy

Economists are starting to worry about a serious Trump recession

Tariffs on America’s neighbours and assault on federal government will hit US economy

[paywall]

- Messages

- 1,676

As Trump Tries to Stall Clean Energy Progress, UK’s Version is Running Circles Around the Rest of Its Economy

A report released on Monday found that the United Kingdom’s ‘net zero economy’ is growing three times as fast as the rest of the country’s economy, at around 10 percent from 2023 to 2024.“These numbers speak for themselves,” said energy secretary Ed Miliband, to The Guardian. “Net zero is essential to growth, a strong economy and money in working people’s pockets.”

The report, commissioned by the non-profit Energy & Climate Intelligence Unit and conducted by the Confederation of British Industry, found that the net zero economy generates more than £83 billion (around $105 billion) in “gross added value” to the country. Over 22,000 individual businesses employe almost one million people (of around 33 million total in the UK workforce), and every pound generated specifically in this sector creates £1.89 in the wider economy.

“It is clear, you can’t have growth without green – 2025 is the year when the rubber really hits the road, where inaction is indisputably costlier than action,” said CBI’s chief economist Louise Hellem.

heelinhell

Iconic Member

- Messages

- 1,211

The stock market hates uncertainty and so do I so I'm heavy in cash. I may miss out on the next greatest Trump economy ever, but tonight and tomorrow night I will get a good night's sleepEconomists are starting to worry about a serious Trump recession

Tariffs on America’s neighbours and assault on federal government will hit US economy

Economists are starting to worry about a serious Trump recession

Tariffs on America’s neighbours and assault on federal government will hit US economywww.telegraph.co.uk

[paywall]

heelinhell

Iconic Member

- Messages

- 1,211

Thank you Sleepy Joe. Just as Obama did, you have handed Trump a very good economy on a silver platter.

Trump dropped the platter Obama served him; Let's hope he doesn't fuck up this time around...

- Messages

- 1,496

Yeah, I’m 2/3 money market at this point. I’m also researching hard assets, as I’m confident we’re going to see an unprecedented infiltration of various financial systems. doge is the greatest information security failure in human history, and most of our assets are just 1s and 0s on a server.The stock market hates uncertainty and so do I so I'm heavy in cash. I may miss out on the next greatest Trump economy ever, but tonight and tomorrow night I will get a good night's sleep

- Messages

- 2,164

You must be talking about retirement accounts. You can’t just get out of securities and into cash without creating some big capital gains issues in a taxable account.Yeah, I’m 2/3 money market at this point. I’m also researching hard assets, as I’m confident we’re going to see an unprecedented infiltration of various financial systems. doge is the greatest information security failure in human history, and most of our assets are just 1s and 0s on a server.

Share: