Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

BillOfRights

Iconic Member

- Messages

- 1,589

Somebody's gonna get fired

- Messages

- 41,454

Cash Windfall From Trump’s Tax Law Is Starting to Show Up at Big Companies

Investors are watching boosts to free cash flow as estimates of tax savings trickle out

- Messages

- 41,454

“…In short, changes like allowing upfront depreciation of assets and immediate expensing of research-and-development expenses will bring swift windfalls to American corporations but also lasting tailwinds. This in turn has provided incremental fuel to stock markets, a counterweight to risks from tariffs and other policy uncertainty.Cash Windfall From Trump’s Tax Law Is Starting to Show Up at Big Companies

Investors are watching boosts to free cash flow as estimates of tax savings trickle out

—> https://www.wsj.com/finance/investi...9?st=mLJiCU&reflink=desktopwebshare_permalink

The cash savings won’t affect reported earnings, which are calculated using different accounting rules than taxes. It won’t all ultimately end up in free cash flow either, because AT&T plans to reinvest much of the savings in new capital projects. But the change is still a positive for the company’s shareholders and valuation, all other things being equal….”

- Messages

- 487

Sounds like he's pulling for his own economic self interest to me. Surprised you seem offended by it since that's exactly what you've repeatedly told the board that's what you do.At least you admit it - many here won’t!

Last edited:

Milk and Cookies

Esteemed Member

- Messages

- 563

- Messages

- 41,454

“…

Even before the new cuts, several markers show that households with children are falling behind, though statistics around poverty have been complicated by the upheaval the pandemic brought to jobs and living arrangements, and the unprecedented federal aid distributed in response.

The share of families with children living in poverty jumped to 12.9% in 2023, the most recent year available, after plummeting to a record low of 5.6% in 2021, driven down by temporary pandemic programs like the expanded Child Tax Credit and extra unemployment insurance, according to census data compiled by the Center on Poverty and Social Policy at Columbia University.

Poverty for all ages has inched up, but no other age demographic has seen a sharper rise in poverty between 2021 and 2023 than children, data compiled by the center show. …”

- Messages

- 41,454

—> https://www.wsj.com/economy/earning...0?st=s5Si9Y&reflink=desktopwebshare_permalink

“…

Even before the new cuts, several markers show that households with children are falling behind, though statistics around poverty have been complicated by the upheaval the pandemic brought to jobs and living arrangements, and the unprecedented federal aid distributed in response.

The share of families with children living in poverty jumped to 12.9% in 2023, the most recent year available, after plummeting to a record low of 5.6% in 2021, driven down by temporary pandemic programs like the expanded Child Tax Credit and extra unemployment insurance, according to census data compiled by the Center on Poverty and Social Policy at Columbia University.

Poverty for all ages has inched up, but no other age demographic has seen a sharper rise in poverty between 2021 and 2023 than children, data compiled by the center show. …”

“…

Millions more kids live in households that are just barely scraping by. Around 35 million kids—nearly half of all in the U.S.—lived in households under the line that many economists view as the bottom rung of the middle class, according to 2023 census data compiled by Luke Shaefer, a University of Michigan economist who studies child poverty. That number of children is the highest in five years, Shaefer said.

For a family of two adults and two kids, the dividing line is a maximum net income of about $75,000, including government benefits. …”

- Messages

- 41,454

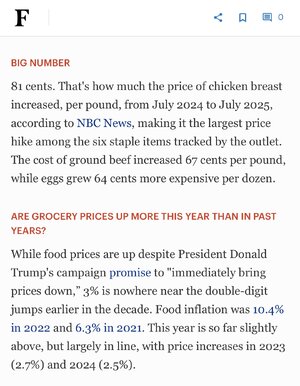

“…Low-income earners spend a greater portion of their money on housing and food, which have both seen prices rise dramatically, noted a recent report from the Federal Reserve Bank of New York.“…

Millions more kids live in households that are just barely scraping by. Around 35 million kids—nearly half of all in the U.S.—lived in households under the line that many economists view as the bottom rung of the middle class, according to 2023 census data compiled by Luke Shaefer, a University of Michigan economist who studies child poverty. That number of children is the highest in five years, Shaefer said.

For a family of two adults and two kids, the dividing line is a maximum net income of about $75,000, including government benefits. …”

Some working families in Broome County are now leaning more on public assistance for help. But if their salaries increase, even slightly, their eligibility for state and federal assistance could be reduced.

…

Felica Allen, a 39-year-old nursing assistant and single mom, works the graveyard shift in the emergency room at UHS Wilson Medical Center near Binghamton before returning home each morning to care for her four children, ages 3, 12, 14 and 17. A fifth, 22, moved out in September.

Allen’s $20 an hour salary rose last year to $22.90, which amounted in 2024 to about $39,000 for the hours she worked, including bonuses and overtime. That’s more money than she’s ever made and not far above the federal government’s supplemental poverty threshold for her family size.

It still doesn’t come close to covering her expenses, she said, and her financial situation has worsened despite earning more.

… In March, she decided to reduce her official weekly work hours from 32 to 26 so she could get back $220 in food benefits. She has managed to take on extra shifts when they pop up at the hospital, to make up the difference in salary.…”

- Messages

- 41,454

- Messages

- 41,454

“… The upshot: Insurers are learning the hard way that restoring profitability means accepting lower growth or shrinkage in their Medicare Advantage rolls. And the pullback isn’t limited to Medicare. Similar retreats are under way in Medicaid and the Affordable Care Act (ACA) exchanges.

Insurers say they aren’t pulling back by choice. For years, Medicare Advantage was the golden goose—delivering relatively high margins and steady growth. That spurred a flood of increasingly generous plans aimed at winning seniors and market share. Now that strategy is unraveling, as Wall Street grows wary of just how unpredictable profits in government programs have become.

Medicare Advantage, long championed by Republicans as a cost-saving alternative to traditional Medicare, was supposed to save taxpayers money. But as allegations mounted that insurers were being overpaid, bipartisan scrutiny of the program intensified and the Biden administration moved to rein in costs. The timing couldn’t have been worse for investors: Lower payments collided with soaring medical expenses, creating a perfect storm of lower revenue, higher costs and shrinking profits.…”

- Messages

- 41,454

“… when they say that nobody was involved, it wasn’t political, you know, give me a break. Look, before the election I had this massive, massive outflow of uh BEAUTY for Biden, I mean he didn’t know he was alive [host chuckles] and so Biden I mean the economy was roaring it was a beautiful thing. And I said there is no way this is happening, it’s going the opposite direction and two weeks later they said I was right. But even if you look at the original, the ones from the other day, the numbers were very timid and then they announced something that made them even more timid on top of it on [sort of a reporting day (unclear)] I don’t know why it just seemed a little more important than most times when they announce these numbers [host interrupts]”

Last edited:

- Messages

- 4,112

I've been 50% in cash since Trump took office. The cash has been earning 4.5% The majority of the cash is in a Roth so the interest paid is tax free. Compared to what the markets have done up until now being in cash has held up pretty well.I’m rooting for the markets to tank. I went all cash last week and decided to take August off. Will get back in when the tariff craziness is a little more settled.

You are taking August off and so am I. I'm not hoping for the markets to tank, but I think things will look ugly for the markets and the economy come October. I hope I am wrong, but I will continue to take a better safe than sorry perspective.

1moretimeagain

Inconceivable Member

- Messages

- 4,130

When Trump was complaining about the negative 800k benchmark job revision that took place after the election, it would’ve been nice for the interviewer to point out that number was released in August 2024.

Purple Nurple

Exceptional Member

- Messages

- 176

She leaving like $18k on the table by not working full time. Perhaps she should work more instead of less. WTF?“…Low-income earners spend a greater portion of their money on housing and food, which have both seen prices rise dramatically, noted a recent report from the Federal Reserve Bank of New York.

Some working families in Broome County are now leaning more on public assistance for help. But if their salaries increase, even slightly, their eligibility for state and federal assistance could be reduced.

…

Felica Allen, a 39-year-old nursing assistant and single mom, works the graveyard shift in the emergency room at UHS Wilson Medical Center near Binghamton before returning home each morning to care for her four children, ages 3, 12, 14 and 17. A fifth, 22, moved out in September.

Allen’s $20 an hour salary rose last year to $22.90, which amounted in 2024 to about $39,000 for the hours she worked, including bonuses and overtime. That’s more money than she’s ever made and not far above the federal government’s supplemental poverty threshold for her family size.

It still doesn’t come close to covering her expenses, she said, and her financial situation has worsened despite earning more.

… In March, she decided to reduce her official weekly work hours from 32 to 26 so she could get back $220 in food benefits. She has managed to take on extra shifts when they pop up at the hospital, to make up the difference in salary.…”

Purple Nurple

Exceptional Member

- Messages

- 176

This is why I noted this is a stimulus bill and the economy will not be tanking in the near future. Just like the first time around.Cash Windfall From Trump’s Tax Law Is Starting to Show Up at Big Companies

Investors are watching boosts to free cash flow as estimates of tax savings trickle out

—> https://www.wsj.com/finance/investi...9?st=mLJiCU&reflink=desktopwebshare_permalink

- Messages

- 41,454

“… when they say that nobody was involved, it wasn’t political, you know, give me a break. Look, before the election I had this massive, massive outflow of uh BEAUTY for Biden, I mean he didn’t know he was alive [host chuckles] and so Biden I mean the economy was roaring it was a beautiful thing. And I said there is no way this is happening, it’s going the opposite direction and two weeks later they said I was right. But even if you look at the original, the ones from the other day, the numbers were very timid and then they announced something that made them even more timid on top of it on [sort of a reporting day (unclear)] I don’t know why it just seemed a little more important than most times when they announce these numbers [host interrupts]”

[Host these numbers aren’t so bad, unemployment only 4.2%]

Trump: “It’s fine. I’m not saying it was terrible. I will say this, the numbers before the election were earth-shattering. I’m not saying these were earth-shattering [hist crosstalk “No I understand”] then they announced something a couple hundred thousand to make it look a little bit worse from you know months before and I said where did those numbers come from?

So [host crosstalk “as much as you wanna …”] look it’s a highly political, it’s a highly political situation [host OK], it’s totally rigged, smart people know it, people with common sense know it [host crosstalk - OK but … let’s try to move on] a lot of people try to keep their head under the covers and just not believe it.”

Share: