Let’s revisit this discussion in 2029.Also, by ‘92, Russian citizens had a small taste of what it was like to live under semi-democratic capitalism. The Berlin Wall had fallen and everyone was happy to buy Levi’s and leave the bread lines and shortages of toilet paper behind.

This is different. Trump supplied MAGA white folks with a tantalizing vision of what can be. They’re not gonna suddenly shirk him.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

EyeballKid

Honored Member

- Messages

- 871

I mean, sure. We obviously can’t know how things will shake out 3 1/2 years from now.Let’s revisit this discussion in 2029.

My point is that your current argument kinda falls flat in a number of areas. That may well change between now and 2028/9, but for now your points seem pretty flimsy.

Duke Mu

Iconic Member

- Messages

- 2,025

Chyna and now the US are moving toward National Socialism.In 10 years after some time has passed following our economic collapse, Republicans will refuse to claim Trump. There is precedent. Nixon was for a long time called a liberal by many conservatives though I think the attitude toward him has again improved among conservatives. Bush 2 is no longer considered the right kind of conservative. (They certainly were plenty happy with him before.)

Trump will be labeled as a liberal because of his government intervention in the economy.

Bank on it.

- Messages

- 41,495

With Billions at Risk, Nvidia CEO Buys His Way Out of the Trade Battle

Jensen Huang tried diplomacy to sell chips in China, but it took a last-minute deal with the White House

“…

Huang told President Trump that restrictions on U.S. chip sales to China would backfire by pushing Chinese technology champions to achieve self-reliance. He advised the president to keep China hooked on American tech. As a sweetener, Huang said the company would invest as much $500 billion in the U.S.

Huang’s argument, along with the half-trillion-dollar offer from the world’s most valuable company, appeared to seal the deal.

The Trump administration decided last month to allow China to buy Nvidia’s H20 artificial-intelligence chip, a surprising reversal that came shortly after Huang met with Trump. Nvidia had developed the H20 to comply with past export restrictions as a less powerful chip specially designed for China. The news sent Nvidia’s stock up 4%, pushing its market capitalization further above the record $4 trillion mark.

Beijing reciprocated by allowing a $35 billion deal involving U.S. chip-software makers that it had held up for about a year. In a previously unreported development, Chinese officials also froze an inquiry into an already-completed Nvidia deal. With both moves, China’s leaders hoped Huang would keep lobbying Washington for loosened export controls.

… There was one last hitch.

At a meeting with Huang in the White House last week, Trump made one more demand—that Nvidia give the federal government 20% of its chip sales to China in exchange for issuing the export licenses. “If I’m going to do that, I want you to pay us something,” Trump said, recounting the exchange at a news conference Monday.

… The unusual pay-to-play proposal, which hadn’t been vetted by White House tech policy staff before Trump offered it, is expected to face legal and security questions.

Huang, facing a choice of paying for long-term access to a market vital to his company or walking away, countered with 15%….”

- Messages

- 41,495

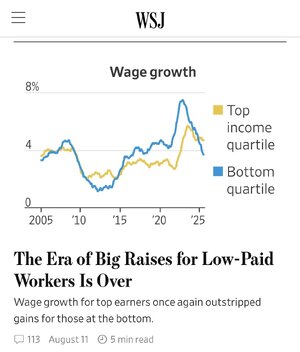

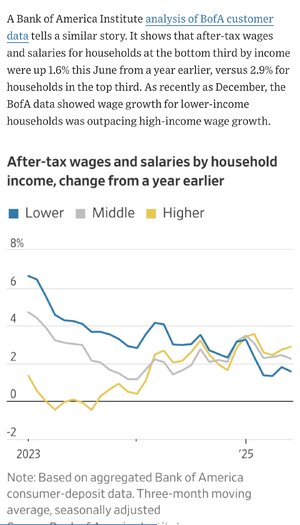

“Something remarkable happened in the years immediately preceding and, especially, following the pandemic: Wages for poor workers began rising much faster than they did for the rich.

That era may have now come to at least a temporary halt. And with worries about the health of the job market heightened following the disappointing July jobs report, it may have ended altogether.

Wage growth for low-income workers looks to have significantly deteriorated in recent months, while wage growth for their higher-income counterparts has held up much better. It is a shift that could matter not just for low-paid workers, but the overall economy.

The jobs report released at the start of this month was revealing. It showed that average earnings for leisure and hospitality workers, at $22.83 an hour, were up 3.5% from a year earlier. Meanwhile, average hourly earnings for workers in the information sector were up 5.4%, to $52.61.

It is a far cry from, for example, December 2021. Back then, earnings for workers in leisure and hospitality—the lowest paying of the broad sectors tracked by the Labor Department—were up 14%. Earnings in the high-paying information sector were up less than 2%.…”

- Messages

- 41,495

“…

—> https://www.wsj.com/economy/jobs/lo...6?st=RjdmQo&reflink=desktopwebshare_permalink

“Something remarkable happened in the years immediately preceding and, especially, following the pandemic: Wages for poor workers began rising much faster than they did for the rich.

That era may have now come to at least a temporary halt. And with worries about the health of the job market heightened following the disappointing July jobs report, it may have ended altogether.

Wage growth for low-income workers looks to have significantly deteriorated in recent months, while wage growth for their higher-income counterparts has held up much better. It is a shift that could matter not just for low-paid workers, but the overall economy.

The jobs report released at the start of this month was revealing. It showed that average earnings for leisure and hospitality workers, at $22.83 an hour, were up 3.5% from a year earlier. Meanwhile, average hourly earnings for workers in the information sector were up 5.4%, to $52.61.

It is a far cry from, for example, December 2021. Back then, earnings for workers in leisure and hospitality—the lowest paying of the broad sectors tracked by the Labor Department—were up 14%. Earnings in the high-paying information sector were up less than 2%.…”

A wage tracker developed by the Federal Reserve Bank of Atlanta, using data that underlies the Labor Department’s employment report, showed that annual wage growth for the median worker in the bottom quarter by income had shot up to 7.5% in November 2022. That compared with 4.8% for the median worker in the top quarter.

Not all low-wage workers benefited. Wage growth among older people, who were less likely to switch jobs, wasn’t as strong. Inflation, of course, took a bite. But in aggregate, an analysis of Labor Department data conducted by economists David Autor, Arindrajit Dube and Annie McGrew found that real or inflation-adjusted wages for those at the bottom rose relative to those at the top.

That doesn’t appear to be the case anymore.

As of July, wage growth at the bottom quarter was 3.7% according to the Atlanta Fed, around the lowest since 2017. For the top quarter, it was 4.7%….”

- Messages

- 41,495

“…

A wage tracker developed by the Federal Reserve Bank of Atlanta, using data that underlies the Labor Department’s employment report, showed that annual wage growth for the median worker in the bottom quarter by income had shot up to 7.5% in November 2022. That compared with 4.8% for the median worker in the top quarter.

Not all low-wage workers benefited. Wage growth among older people, who were less likely to switch jobs, wasn’t as strong. Inflation, of course, took a bite. But in aggregate, an analysis of Labor Department data conducted by economists David Autor, Arindrajit Dube and Annie McGrew found that real or inflation-adjusted wages for those at the bottom rose relative to those at the top.

That doesn’t appear to be the case anymore.

As of July, wage growth at the bottom quarter was 3.7% according to the Atlanta Fed, around the lowest since 2017. For the top quarter, it was 4.7%….”

“… But the current labor-market environment, where employers have been reluctant to fire but also reluctant to hire, puts many poorer workers in particular at a disadvantage. That is because they are more likely to work jobs where turnover is frequent, often because employment is highly seasonal, such as hotels, restaurants and retail. …”

BillOfRights

Iconic Member

- Messages

- 1,593

CPI comes in less than expected at 2.7%.

Concerns that trump firing the Commissioner of BLS is rigging the numbers.

Core CPI comes in hotter at 3.1%

Concerns that trump firing the Commissioner of BLS is rigging the numbers.

Core CPI comes in hotter at 3.1%

Last edited:

- Messages

- 4,112

CPI comes in less than expected at 2.7%.

Concerns that trump firing the Commissioner of BLS is rigging the numbers.

Core CPI comes in hotter at 3.1%

Damn. Even with made up numbers, they can't get their story straight.

- Messages

- 5,217

President Donald Trump on Tuesday threatened to allow a “major lawsuit” against Federal Reserve Chairman Jerome Powell to proceed, escalating his pressure on the central bank leader to cut interest rates.

Trump said in a Truth Social post that the suit would relate to Powell’s management of pricey renovations at the Fed’s headquarters in Washington, D.C., which the president has previously criticized.

Trump did not say when that suit could be filed or by whom.

“Jerome ‘Too Late’ Powell must NOW lower the rate,” Trump wrote in the post.

“Steve ‘Manouychin’ really gave me a ’beauty’when he pushed this loser,” Trump wrote, referring to his first-term Treasury Secretary Steven Mnuchin having encouraged him to nominate Powell as Fed chair in 2017.

“The damage he has done by always being Too Late is incalculable. Fortunately, the economy is sooo good that we’ve blown through Powell and the complacent Board,” Trump claimed.

“I am, though, considering allowing a major lawsuit against Powell to proceed because of the horrible, and grossly incompetent, job he has done in managing the construction of the Fed Buildings.”

Duke Mu

Iconic Member

- Messages

- 2,025

Just more extortion. Funny how China is not paying for it.With Billions at Risk, Nvidia CEO Buys His Way Out of the Trade Battle

Jensen Huang tried diplomacy to sell chips in China, but it took a last-minute deal with the White House

—> https://www.wsj.com/world/china/nvi...7?st=2xnsEt&reflink=desktopwebshare_permalink

“…

Huang told President Trump that restrictions on U.S. chip sales to China would backfire by pushing Chinese technology champions to achieve self-reliance. He advised the president to keep China hooked on American tech. As a sweetener, Huang said the company would invest as much $500 billion in the U.S.

Huang’s argument, along with the half-trillion-dollar offer from the world’s most valuable company, appeared to seal the deal.

The Trump administration decided last month to allow China to buy Nvidia’s H20 artificial-intelligence chip, a surprising reversal that came shortly after Huang met with Trump. Nvidia had developed the H20 to comply with past export restrictions as a less powerful chip specially designed for China. The news sent Nvidia’s stock up 4%, pushing its market capitalization further above the record $4 trillion mark.

Beijing reciprocated by allowing a $35 billion deal involving U.S. chip-software makers that it had held up for about a year. In a previously unreported development, Chinese officials also froze an inquiry into an already-completed Nvidia deal. With both moves, China’s leaders hoped Huang would keep lobbying Washington for loosened export controls.

… There was one last hitch.

At a meeting with Huang in the White House last week, Trump made one more demand—that Nvidia give the federal government 20% of its chip sales to China in exchange for issuing the export licenses. “If I’m going to do that, I want you to pay us something,” Trump said, recounting the exchange at a news conference Monday.

… The unusual pay-to-play proposal, which hadn’t been vetted by White House tech policy staff before Trump offered it, is expected to face legal and security questions.

Huang, facing a choice of paying for long-term access to a market vital to his company or walking away, countered with 15%….”

Duke Mu

Iconic Member

- Messages

- 2,025

President Donald Trump on Tuesday threatened to allow a “major lawsuit” against Federal Reserve Chairman Jerome Powell to proceed, escalating his pressure on the central bank leader to cut interest rates.

Trump said in a Truth Social post that the suit would relate to Powell’s management of pricey renovations at the Fed’s headquarters in Washington, D.C., which the president has previously criticized.

Trump did not say when that suit could be filed or by whom.

“Jerome ‘Too Late’ Powell must NOW lower the rate,” Trump wrote in the post.

“Steve ‘Manouychin’ really gave me a ’beauty’when he pushed this loser,” Trump wrote, referring to his first-term Treasury Secretary Steven Mnuchin having encouraged him to nominate Powell as Fed chair in 2017.

“The damage he has done by always being Too Late is incalculable. Fortunately, the economy is sooo good that we’ve blown through Powell and the complacent Board,” Trump claimed.

“I am, though, considering allowing a major lawsuit against Powell to proceed because of the horrible, and grossly incompetent, job he has done in managing the construction of the Fed Buildings.”

“The damage he has done by always being Too Late is incalculable. Fortunately, the economy is sooo good that we’ve blown through Powell and the complacent Board,” Trump claimed.

So...the Biden economy was pretty good. Trump started on 3rd base again, just like 2017.

- Messages

- 5,217

Meanwhile the Dow is popping off like the 4th of July because the inflation numbers were so bad that they think they will get a fed rate cut out of it.“The damage he has done by always being Too Late is incalculable. Fortunately, the economy is sooo good that we’ve blown through Powell and the complacent Board,” Trump claimed.

So...the Biden economy was pretty good. Trump started on 3rd base again, just like 2017.

The world is too stupid for my taste.

lawtig02

Legend of ZZL

- Messages

- 5,894

As with Trump 1.0, the equity markets have lots of reason to love all of this, regardless of what it's doing to our long term economic health.Meanwhile the Dow is popping off like the 4th of July because the inflation numbers were so bad that they think they will get a fed rate cut out of it.

The world is too stupid for my taste.

- Corporate tax cuts? Check.

- Emerging AI that will drastically cut labor costs? Check.

- Cheap money? Check.

- No federal regulation? Check.

- The ability to buy access and/or preferential treatment? Check.

EyeballKid

Honored Member

- Messages

- 871

Trump’s nominee to lead BLS thinks we should just stop reporting the jobs numbers.

No bad news will be tolerated by the regime.

No bad news will be tolerated by the regime.

1moretimeagain

Inconceivable Member

- Messages

- 4,140

“Bad” inflation numbers don’t tend to favor rate cuts.Meanwhile the Dow is popping off like the 4th of July because the inflation numbers were so bad that they think they will get a fed rate cut out of it.

The world is too stupid for my taste.

Yep.“Bad” inflation numbers don’t tend to favor rate cuts.

ChileG

Inconceivable Member

- Messages

- 3,159

Trump is bad for business.Wall Street is concerned about the reliability of inflation data on eve of CPI

"This week’s inflation data will be huge for markets, and not just for the numbers.

Beneath the Bureau of Labor Statistics’ reports on consumer and producer prices will be simmering questions over the data’s validity.

Those concerns have accelerated as budget cutbacks have forced the agency to change the way it collects data. On top of that, President Donald Trump’s decision to fire the BLS commissioner after the July nonfarm payrolls data was released raised worries that the bureau could be politicized.

Doubt over the accuracy and integrity of the data is a serious issue considering how much BLS work is used to formulate policy, calculate Social Security payments and inform any number of other political and economic decisions."

Share: