- Messages

- 41,508

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

BillOfRights

Iconic Member

- Messages

- 1,593

FAFOThe latter. Trump is killing Nevada right now. If things don’t turn around in the Fall, Nevada will be in recession.

- Messages

- 4,113

It's ok if you are a GQPer

BillOfRights

Iconic Member

- Messages

- 1,593

Hypocrisy is the last remaining principle of "conservatives" and "Republicans".It's ok if you are a GQPer

- Messages

- 4,113

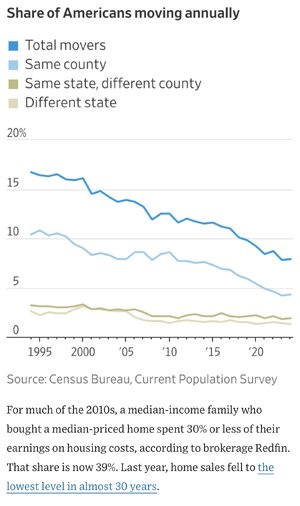

A year ago, homes in my neighborhood were never on the market for more than a week and several were sold for more than the asking price after a bidding war.

My wife, children, and grandchildren "pressured" me to agree to buying a one level house in Hillsborough where they live which is a 20 minute from where we live today Their concern was that my spinal stenosis and living in a 3 story house was "too risky" to be going up and down the stairs.

Because I am a beta male and have lived by the " happy wife, happy life " credo we bought the house in Hillsborough. Knowing this was not a good time to be selling in this uncertain chaotic economy, I still thought our house would sell within a week or two.

It has not sold so I am now the not proud owner of two houses. I told the missus and the kids we have no problem waiting a year or two, but it may mean spending the kid's inheritance.

My older daughter said she didn't care about her inheritance

My younger daughter said " You aren't spending mine ! "

Sorry for the long story; the short story is that, yes, the market sucks for home sales.

Last edited:

- Messages

- 41,508

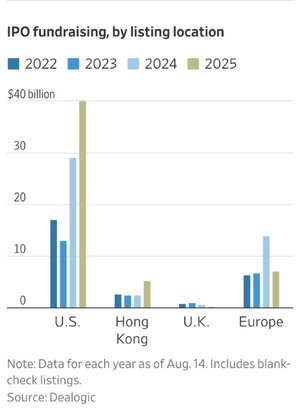

America’s Stock-Market Dominance Is an Emergency for Europe

Some of Europe’s most notable companies are moving to the U.S., deepening the region’s economic woes

- Messages

- 41,508

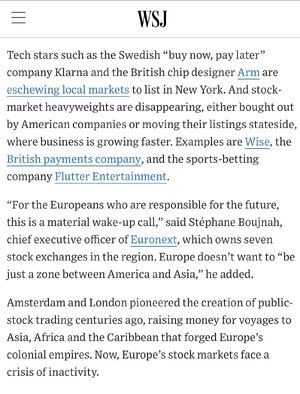

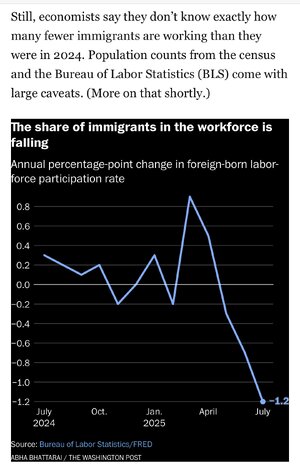

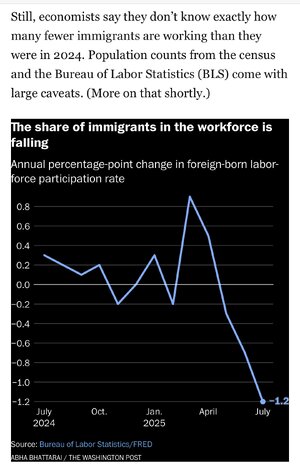

White House says jobs surging among U.S.-born. Here’s what economists say.

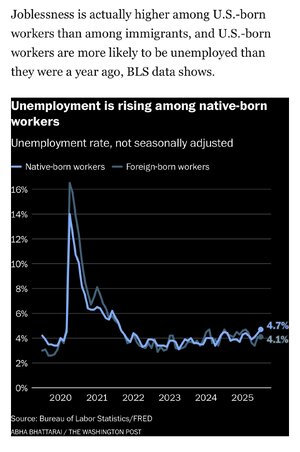

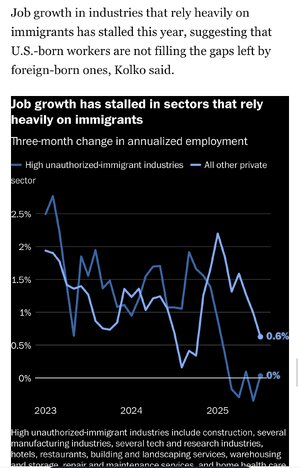

A quirk in survey calculations is muddying the data on just how immigration policies are upending the labor market.“… “Right now we’re seeing American workers are being put first — native-born workers account for all of the job growth, and that’s key,” Labor Secretary Lori Chavez-DeRemer said this month on Fox Business. “The American worker is going to win in this occasion because the president has their back.”

… But so far, economists on both sides of the aislesay, they have seen no evidence that American-born workers are picking up jobs vacated by immigrants. They also say figures for native- and foreign-born workers should not be used to gauge the current state of the labor force.

“Looking at the number of native-born workers is not the correct way to read the jobs report,” said Jed Kolko, a senior fellow at the Peterson Institute for International Economics and a former Commerce Department economist….”

- Messages

- 41,508

“…White House says jobs surging among U.S.-born. Here’s what economists say.

A quirk in survey calculations is muddying the data on just how immigration policies are upending the labor market.

“… “Right now we’re seeing American workers are being put first — native-born workers account for all of the job growth, and that’s key,” Labor Secretary Lori Chavez-DeRemer said this month on Fox Business. “The American worker is going to win in this occasion because the president has their back.”

… But so far, economists on both sides of the aislesay, they have seen no evidence that American-born workers are picking up jobs vacated by immigrants. They also say figures for native- and foreign-born workers should not be used to gauge the current state of the labor force.

“Looking at the number of native-born workers is not the correct way to read the jobs report,” said Jed Kolko, a senior fellow at the Peterson Institute for International Economics and a former Commerce Department economist….”

The funky math behind counts of native-born workers

Looking at BLS-reported counts for July, it appeared that more than 2 million native-born workers had joined the labor force over the past year. The number of foreign-born workers, meanwhile, appeared to have fallen by 237,000.Trump officials have touted that statistic. E.J. Antoni, Trump’s nominee to lead the BLS, also posted the figure on X this month, after the latest jobs numbers came out.

But BLS and census officials warn against using that data to draw conclusions about population counts — or comparing it with figures from previous years. Doing so would be “a multiple-count data felony,” Kolko wrote this past week.

One big reason is that the data is hemmed in by a population estimate set by the Census Bureau in January, before anyone had any idea how immigration enforcement was going to play out.

Basically, the number of foreign-born and native-born workers have to add up to a total based on the census estimate, according to several economists consulted by The Post. As a result, any drop in foreign-born workers artificially boosts the number of native-born workers reported each month….

… As an extreme illustration, Kolko said that if the entire foreign-born population vanished at the end of July, this dataset would show the population of native-born residents skyrocketing by tens of millions of people.

… In addition, the government’s data surveys rely on self-reporting. Economists note that immigrants nervous about their status could be reporting that they are native-born, which could also skew the numbers….”

superrific

Master of the ZZLverse

- Messages

- 12,420

Why does it matter whether European companies list in Europe or the US?

- Messages

- 41,508

Theoretically, it can create a capital drain spiral - the fewer companies listing on an EU market discouraging future companies from doing so, which can cause the valuations of the already listed companies to decline as well.Why does it matter whether European companies list in Europe or the US?

I think Europe is already freaking about failing to develop AI start-ups, which I think is the source of the concern.

superrific

Master of the ZZLverse

- Messages

- 12,420

I mean, maybe, but 1) that violates even weak form efficiency and 2) the companies' HQs and facilities don't have to move. It's just a stock listing. The capital still goes to/stays with Europe.Theoretically, it can create a capital drain spiral - the fewer companies listing on an EU market discouraging future companies from doing so, which can cause the valuations of the already listed companies to decline as well.

I think Europe is already freaking about failing to develop AI start-ups, which I think is the source of the concern.

- Messages

- 4,113

I'm not an economist, but I wonder if those numbers reflect Obama and Biden inheriting crap economies from Bush and Trump and Trump inheriting golden economies from Obama and Biden.

- Messages

- 41,508

- Messages

- 41,508

“

At the moment, the American economy feels a little bit like a hot August afternoon. The air is heavy and still, as lightning flashes on the horizon. The storm could sweep through and leave destruction in its wake. It could set in for a brief drizzle.

Or it could pass by in the distance, and take its fury elsewhere.

In this very humid metaphor, the electricity in the sky is the steep tariffs that President Trump has now imposed on most goods coming into the United States. It’s also his strict immigration curbs, mass firings of government employees and the pullback in government spending.

Economists have been waiting for that multifaceted storm system to start showing up in the economic data. The signs are now unmistakable, but the severity of the impact remains unclear.…”

Share: