Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

superrific

Master of the ZZLverse

- Messages

- 12,420

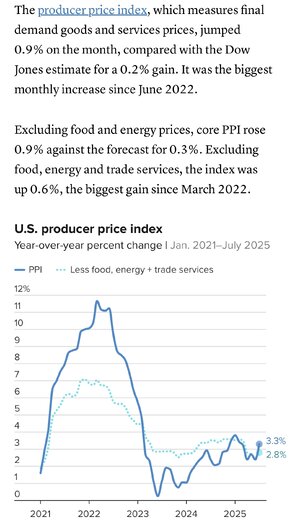

You can't try to break down a composite report like this. It's not specifically fallacy of composition, but it's related.I just heard one of the hosts on CNBC say that 80% of this increase was attributable to services (haven’t verified). That wouldn’t seem to be driven by tariffs.

1. One reason is that prices are intertwined in ways that are too complex to be analyzed. For instance: the expansion of tariffs mean that some legal questions that have been largely ignored in the area of trade law suddenly become important again. Like, what does it mean for a product to comport with the USMCTA? When tariffs are essentially zero, it doesn't matter that much. But when tariffs go to 25%, it suddenly matters a lot whether a good is compliant with the trade agreements, and thus companies need to pay lawyers to figure it out. That increases demand for lawyers and pushes the price up.

That's a weird example but one that has been chosen for illustration purposes. There are tons of other examples. Anything priced on percentage margin would also see an increase. For instance, if a shipper charges 1% of the cost of the items it ships, then tariffs increase those costs and thus what a shipper charges. Leasing office space is a service, and one that is quite obviously related to housing costs, which are related to tariffs through the monetary policy mechanism.

2. Another factor here is inflation expectations. If you're a portfolio manager, and you expect 5% inflation this year, then you need to raise your prices by 5% or you're going to take a pay cut in real terms. So if people are expecting inflation, those expectations create inflation. This was basically the story of the 1970s.

This is why central banks, especially the US central bank, put so much emphasis on their credibility. They want people to know that, when they say they are targeting 2% inflation, they mean 2%. Because if they say something like, "well, 2.5% is close enough for now," then the market doesn't know what to expect. The market might think, well, I guess I should plan for 3%, so I better start raising my prices. And it's a huge suboptimal equilibrium game, aka the prisoners' dilemma, where rational expectations of everyone else acting rationally creates a worse outcome than you'd think possible. Because everyone thinks that others will think that the central bank isn't committed to fighting inflation, everyone plans for a higher inflation future and thus creates that higher inflation future.

This raises a lot of other questions for other discussions (e.g. 'but what if 2.5% is really close enough for now, because there was a sudden economic collapse and unemployment is skyrocketing'?) but that's the gist.

3. I wouldn't say that 100% of the increase is related to tariffs. I think tariffs here are shorthand for Trump economic policies, which also include the tremendous uncertainty of economic strategy, the fear that he's going to replace the Fed chair with another one of his minion mooks, his constant pleading for inflationary policies. But the vast majority of Trumponomics is about tariffs, and it's obvious that these increases are responses to Trump.

superrific

Master of the ZZLverse

- Messages

- 12,420

Only on a ceteris paribus assumption. If inflation was accelerating unrelated to tariffs, that would likely because the economy was running hot. It doesn't really matter. It's all a huge mess.It’s just a one month print, but inflation acceleration unrelated to tariffs would be more concerning, not less.

Duke Mu

Iconic Member

- Messages

- 2,025

The Trump economy is such an unmitigated disaster.

Welp. There's the tsunami warning for tariff tidal wave currently moving through wholesalers. Look out retailers and consumers!

Duke Mu

Iconic Member

- Messages

- 2,025

The dollar will crash (even more) because no other countries will trust USA, Inc. Trump's running us into the ground (again), just like most of the businesses he ran. His branding is only a recent success because he's President and using the levers of unchecked government for PROFIT.

Purple Nurple

Exceptional Member

- Messages

- 176

Here’s a question I have. How does a softening economy, and a weaker job market, not put a cap on inflation. Look at McDowells. They just rolled out a new value menu in response to lower same store sales in an effort to regain traffic. I think I have an idea here, but I’ll hang up and listen.

Here’s a question I have. How does a softening economy, and a weaker job market, not put a cap on inflation. Look at McDowells. They just rolled out a new value menu in response to lower same store sales in an effort to regain traffic. I think I have an idea here, but I’ll hang up and listen.

The current economy has nothing to do with the late, great John Amos.

ChileG

Inconceivable Member

- Messages

- 3,159

Hopefully these leads to TACO, or for the shithead republicans in Congress to grow some spine and do their fucking jobs.

lawtig02

Legend of ZZL

- Messages

- 5,894

It probably would. But a softer economy and higher unemployment and less wage growth seems like an incredibly counterproductive way to combat inflation. I'm more than happy if the Pubs want to take that gamble, though.Here’s a question I have. How does a softening economy, and a weaker job market, not put a cap on inflation. Look at McDowells. They just rolled out a new value menu in response to lower same store sales in an effort to regain traffic. I think I have an idea here, but I’ll hang up and listen.

- Messages

- 41,504

Trump is destroying our ability to afford red meat. Thanks, Trumpers.

TBF, there are a lot of inflationary pressures on red meat — the tariffs are exacerbating longer term issues.

The screw worms are already a key cause of the skyrocketing beef costs in the USA — we tried to prevent importing infection by prohibiting buying cattle from Mexico and points south, which makes sense. But western ranchers have been under immense drought pressures, forcing them to replace virtually free grazing with costly feed, and the COVID inflation on feed and ultimately worker pay led to culling of herds. Then herds could not be resupplied with a lot of foreign cattle due to the screw worm risk.

Meanwhile, demand for beef continues to rise in the USA, especially as high protein...

Meanwhile, demand for beef continues to rise in the USA, especially as high protein...

superrific

Master of the ZZLverse

- Messages

- 12,420

1. I disagree with your discussion of "true inflation." I say this as someone who has puzzled over the question "what is true inflation" for quite a while, and generally I don't think economists have arrived at a useful definition of inflation -- at least not that I'm aware of; it's possible that advanced papers on monetary policy of which I'm unaware define it well. But I would say the following:Compared to 2022, the inflation rate is only a third of that spiked rate, but it does look like we are seeing wholesale impact of the tariffs settling and being factored into pricing (the portion attributable to tariffs is not true inflation from an economic perspective — increases attributable to tariffs are an artificial increase from tax/government policy, not truly inflationary supply/demand pressure, though beef certainly has separate supply/demand inflation issues).

If the central bank dropped interest rates to zero and inflation skyrocketed, would you call that true inflation? It would be a result of monetary policy. Well, if the fiscal authority put a system of sales taxes on goods, that's a result of fiscal policy. Which one is more artificial?

2. Inflation isn't really about supply and demand. The idea is that the dollar becomes less valuable, so it can't be supply demand mismatches on individual items. There's an old theory in which inflation is determined by supply and demand for dollars, but that theory was ripped to shreds by the great "secular stagnation" of the 2010-20 period. Remember the wags predicting hyper inflation from QE and Obama's stimulus? That didn't happen. So supply of dollars is not what determines inflation.

3. As for tariffs: my initial model of the tariffs -- as were most peoples' I think -- was a steep one-time increase in price when the tariffs took effect, with nearly immediate pass-through. Now, maybe my mental model was simply naive; I'm not an expert on prices or price theory, and in much the same way that economists didn't predict the duration of Covid supply chain disruptions, maybe us non-dirty-hands types also don't have good insight into how the prices actually get determined in a situation of exogenous shock.

But I also think that the slow pass-through was the result of the tariff uncertainty. I don't think it's a coincidence that the prices started really rising in July. That's when "the deals" started to be announced -- the deals meaning just tariff levels would stay at Trump's chosen level. In other words, TACO became TUACO (Trump Used to Always Chicken Out), and now producers are starting to treat them as semi-permanent.

4. And the implication from paragraph 3 is that Trump has managed to take a one-time tariff effect and turn it into persistent inflation. That is, the inflation being imposed gradually makes it indistinguishable from other types of inflation -- unlike, say, a one-time pop of 10%. Well, whatever else is responsible for inflation, inflation expectations are definitely a huge factor. And people have to be expecting something like 4-5% inflation now. If the economy wishes it, it will come. And next year, if inflation came in at 4-5% this year, why won't people predict 4-5% for next year? Or 5-6%? Or more. And so it shall come to pass.

- Messages

- 4,112

Which host said that ? Ranger Rick ? Larry Kudlow ?I just heard one of the hosts on CNBC say that 80% of this increase was attributable to services (haven’t verified). That wouldn’t seem to be driven by tariffs.

If a 1% spike in the PPI is not being driven by tariffs, what will the impact be on inflation once the tariffs fully kick in ?

superrific

Master of the ZZLverse

- Messages

- 12,420

You're sort of right here. A "cap" isn't the right way to think about it. That's a binary concept. Rather, the overall state of aggregate demand is one factor in determining economic equilibrium -- i.e. an equilibrium that defines prices as well as output.Here’s a question I have. How does a softening economy, and a weaker job market, not put a cap on inflation. Look at McDowells. They just rolled out a new value menu in response to lower same store sales in an effort to regain traffic. I think I have an idea here, but I’ll hang up and listen.

This is why policy makers used to believe quite rigidly that unemployment and inflation couldn't increase together. If unemployment went up, inflation would go down and vice versa. It was called the Phillips Curve and it was adherence to that curve that led the Fed astray in the 1970s. These days, the Phillips Curve is thought of like Newton's laws: a useful enough approximation so long as you don't look too closely.

In any event, there is something of an inverse relationship between inflation and unemployment, but it's neither hard-and-fast nor inviolable. It is vulnerable to exogenous shocks. Let's go back and think about the oil embargoes of the 1970s. Oil prices go way up. What does that do? Well, it pushes prices up, because most products are directly or indirectly downstream from oil. Now businesses can become insolvent, because the oil costs are being pushed on them faster than they can pass it on. So unemployment rises as a result of that oil price shock. And inflation stays high because oil prices stay high. Bang! Stagflation.

The key point there is the absence of the equilibrating factor. In the case of oil, it would be the oil price itself. As businesses fail, demand for oil should decline and thus would the price of oil fall; in addition, the high price would induce supply and that too would decrease the price. But that's not what happened, because the oil prices weren't high for economic reasons; they were high because some governments were using oil as a political weapon. If demand shrank, they would shrink supply.

And that's the parallel to the tariffs. Tariffs are not like a price increase that could rachet down with collapsing demand. They are politically determined, and as such, aren't affected by weakening demand.

superrific

Master of the ZZLverse

- Messages

- 12,420

have you had your questions answered to your satisfaction? I won't claim that everything is 100% true, as there's a lot of uncharted water here and anyway I'm not a professional economic forecaster. But I think my responses to you capture the main trends and factors, at least to the best of my knowledge.Here’s a question I have. How does a softening economy, and a weaker job market, not put a cap on inflation. Look at McDowells. They just rolled out a new value menu in response to lower same store sales in an effort to regain traffic. I think I have an idea here, but I’ll hang up and listen.

- Messages

- 41,504

Purple Nurple

Exceptional Member

- Messages

- 176

I know the rate of tariff is constant, but doesn’t collapsing demand effect the ability to pass the increase along and thus keep prices from rising as much as they would absent the collapsing. I’m relating this to the fed and the decisions they have to make juggling their dual mandate.You're sort of right here. A "cap" isn't the right way to think about it. That's a binary concept. Rather, the overall state of aggregate demand is one factor in determining economic equilibrium -- i.e. an equilibrium that defines prices as well as output.

This is why policy makers used to believe quite rigidly that unemployment and inflation couldn't increase together. If unemployment went up, inflation would go down and vice versa. It was called the Phillips Curve and it was adherence to that curve that led the Fed astray in the 1970s. These days, the Phillips Curve is thought of like Newton's laws: a useful enough approximation so long as you don't look too closely.

In any event, there is something of an inverse relationship between inflation and unemployment, but it's neither hard-and-fast nor inviolable. It is vulnerable to exogenous shocks. Let's go back and think about the oil embargoes of the 1970s. Oil prices go way up. What does that do? Well, it pushes prices up, because most products are directly or indirectly downstream from oil. Now businesses can become insolvent, because the oil costs are being pushed on them faster than they can pass it on. So unemployment rises as a result of that oil price shock. And inflation stays high because oil prices stay high. Bang! Stagflation.

The key point there is the absence of the equilibrating factor. In the case of oil, it would be the oil price itself. As businesses fail, demand for oil should decline and thus would the price of oil fall; in addition, the high price would induce supply and that too would decrease the price. But that's not what happened, because the oil prices weren't high for economic reasons; they were high because some governments were using oil as a political weapon. If demand shrank, they would shrink supply.

And that's the parallel to the tariffs. Tariffs are not like a price increase that could rachet down with collapsing demand. They are politically determined, and as such, aren't affected by weakening demand.

I think the consumer was weakling and thus the economy is softening. I think that would be the case whoever the president is. Trumps just thrown a huge wrench in the order of operations.

- Messages

- 4,112

Would it be the case whoever the president is ?I know the rate of tariff is constant, but doesn’t collapsing demand effect the ability to pass the increase along and thus keep prices from rising as much as they would absent the collapsing. I’m relating this to the fed and the decisions they have to make juggling their dual mandate.

I think the consumer was weakling and thus the economy is softening. I think that would be the case whoever the president is. Trumps just thrown a huge wrench in the order of operations.

What if another president had decided to continue the economic recovery from the previous administration ? What if another president had not threatened and implemented tariffs attacking our major trading partners and alienating our allies ? What if another president had not increased the country's anxiety that the stability of our democratic republic was in question ?

Would consumer confidence be sinking ? Would the economy be softening ?

Milk and Cookies

Esteemed Member

- Messages

- 563

Who calculated these PPI numbers? I say we fire them and then stop reporting it. Problem solved.

Share: