- Messages

- 5,080

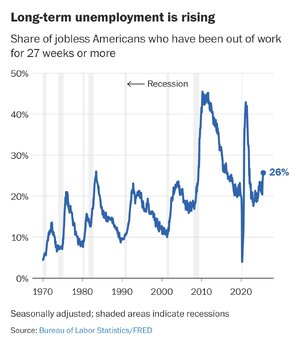

FWIW I work for a small company in a supposedly recession proof business. By the end of this week there will be only 5 people on payroll. Myself, my coordinator, two other graphic artists and the owner of the company. The coordinator works part time.

This time last year there were 8 more people on the payroll.

This time last year there were 8 more people on the payroll.