I think the media likes to compartmentalize issues like "arbitrary arrest of lawful residents" and "the economy is crashing" as if they are separate. I don't think they are.

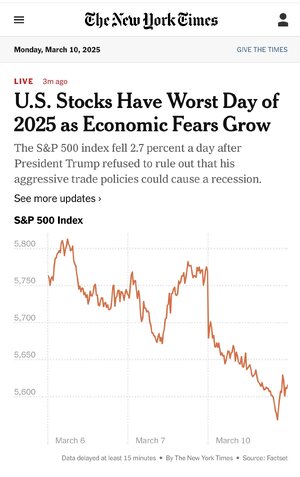

1. Obviously the economic uncertainty and the tariffs and the firings are the proximate cause for much of the current downturn.

2. BUT, one of the advantages of the US economy has always been the country's commitment to the rule of law. It's one thing for Trump to pardon people corruptly. That's bad but it doesn't necessarily weaken confidence in the economy.

However, the most recent punitive measures would give anyone pause. Why would you invest when:

1. The EPA is trying to steal back $20B from climate groups who already received an award validly;

2. Student loan repayment programs are being used to target political dissent;

3. Trump is going after law firms who have done nothing but represent people Trump doesn't like

4. The government is breaking or terminating contracts left and right?

So with this backdrop, stories like the Columbia student being arbitrarily detained (with Rubio promising more targeted illegal detentions) have to be having some effect on the economy. It's obviously not going to be a single person's detention that will make a huge difference (though if Biden or Harris are arrested, the world economy will probably implode). But these stories add up. They are telling a story about the sudden elimination of the rule of law.

3. SOOO, when Trump took aim at the CHIPS Act, I suspect that's causing a lot of indigestion. It's not because anyone thinks it will actually be repealed (there are definitely not 60 votes in the Senate for that; there are very likely not 50; and it's doubtful it could pass the House). It's because they fear Trump trying to claw back money already given, or target these firms in other ways. According to the Times,

"Chip company executives, worried that funding could be clawed back, are calling lawyers to ask what wiggle room the administration has to terminate signed contracts, said eight people familiar with the requests."

It's all related. The best we can hope for, I think, is a gradual unwinding of the US government as the implicit guarantor of international financial commitments. That will probably damage the economy long-term, but a non-gradual unwinding will cause a Great Depression v.2.0.

The election of Trump in 2024 is going to go down in history as one of the most consequential own-goals. Time will tell if it will rival the Japanese attack on Pearl Harbor, or the German invasion of the Soviet Union.