Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 41,507

- Messages

- 41,507

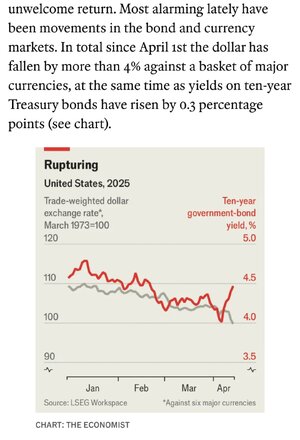

A flight from the dollar could wreck America’s finances

The currency’s dominance enables very high debts and deficits, meaning a plunge might spell disaster

“…In Japan the triple yasu was associated with national decline. Yet a flight from all Americanassets represents a far greater loss. That is because the dollar and Treasury bonds are the world’s havens, and the global financial system has been built on the assumption that they are safe.

If bond yields were rising because of stronger American economic growth, they would bring about a stronger greenback. That the dollar is falling instead suggests investors are worried about America’s economic stability.

It is an ominous repeat of a pattern that struck in Britain after Liz Truss’s disastrous “mini-budget” in 2022, which promised unaffordable tax cuts. Although Mr Trump’s tariffs raise money for the government, such revenue could be dwarfed by the higher payouts required by rising bond yields. …”

- Messages

- 41,507

- Messages

- 41,507

- Messages

- 4,112

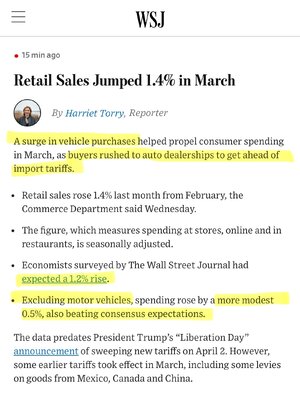

Trump is a genius !

He has inspired consumer confidence such that we are rushing to buy autos, eggs, everything !!! in the soon to be greatest economy the world has ever seen

- Messages

- 41,507

“Markets are processing what’s going on … particularly trade policies … so markets are struggling with uncertainty and that means volatility … having said that [under the challenging circumstances]!markets are functioning the way they are supposed to function …”

superrific

Master of the ZZLverse

- Messages

- 12,420

I like Powell's subtle jab. First, we have to know what the policies are. Then, even when we know, the economic effects are uncertain.

Hey Trump, he's talking to you!

Hey Trump, he's talking to you!

- Messages

- 41,507

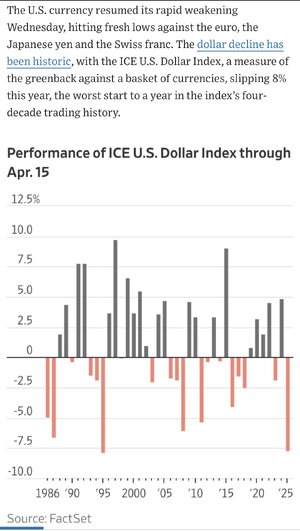

“… For foreign sellers of all manner of goods, including cars, cognac and Scottish tweed, the dollar’s steep slide is a double whammy, compounding losses caused by President Trump’s import levies. For central banks around the world, the rapid strengthening of their own currencies heaps pressure to cut interest rates more aggressively.

…

Because of its role as the primary currency used for global trade and finance, swings in the dollar have significant global consequences.

“For exporters, you’re not getting the currency eroding some of the tariff impact for the end U.S. consumer,” said Derek Halpenny, the London-based head of global markets research for the Japanese bank MUFG. “It has a bigger negative impact for sure.” …”

- Messages

- 41,507

“… For foreign sellers of all manner of goods, including cars, cognac and Scottish tweed, the dollar’s steep slide is a double whammy, compounding losses caused by President Trump’s import levies. For central banks around the world, the rapid strengthening of their own currencies heaps pressure to cut interest rates more aggressively.

…

Because of its role as the primary currency used for global trade and finance, swings in the dollar have significant global consequences.

“For exporters, you’re not getting the currency eroding some of the tariff impact for the end U.S. consumer,” said Derek Halpenny, the London-based head of global markets research for the Japanese bank MUFG. “It has a bigger negative impact for sure.” …”

“… The decline in the dollar has come as a surprise to many. Economic textbooks teach that foreign currencies tend to weaken when economies are hit with tariffs, helping to make goods cheaper to offset the cost of the levies.

Instead, investors have reacted to Trump’s back-and-forth trade policies by dumping U.S. assets, unwinding huge bets they made in recent years on the idea that the U.S. would economically outshine the rest of the world. As investors sell U.S. dollar assets, they recycle them into home currencies, pushing up their value.

The slide in the dollar has fueled questions about the damage to the American economy from Trump’s shift in trade policy and whether the currency will remain a haven for investors in times of market stress. …”

- Messages

- 41,507

p5mmr9

Distinguished Member

- Messages

- 432

Trump is almost certainly going to move on Powell. What Japan did to our 10 year in particular caught the White House off guard. It was an embarrassment and forced Trump to rescind tariffs. He will want the power to move levers - including interest rates but also dipping back into QE - so that if a foreign debt holder (or any debt hold for that matter) tries to exert pressure through the treasury markets - he can control the situation more effectively. The global markets will not react kindly to the president of the united states taking control of the federal banking system.

Also Kevin McCarthy thinks we are all dumb as fuck.

Also Kevin McCarthy thinks we are all dumb as fuck.

1moretimeagain

Inconceivable Member

- Messages

- 4,140

Classic Dem playbook. Who appointed this guy Powell anyway?

- Messages

- 5,217

wasn't weakening the dollar one of the goals they stated with the tarifs? (I know they have given a different reason for them every day but...) Something about tired of bearing the burden of being the world's reserve currency or something?“… The decline in the dollar has come as a surprise to many. Economic textbooks teach that foreign currencies tend to weaken when economies are hit with tariffs, helping to make goods cheaper to offset the cost of the levies.

Instead, investors have reacted to Trump’s back-and-forth trade policies by dumping U.S. assets, unwinding huge bets they made in recent years on the idea that the U.S. would economically outshine the rest of the world. As investors sell U.S. dollar assets, they recycle them into home currencies, pushing up their value.

The slide in the dollar has fueled questions about the damage to the American economy from Trump’s shift in trade policy and whether the currency will remain a haven for investors in times of market stress. …”

- Messages

- 41,507

Yes, it was, but economists have expressed surprise at that outcome under thee policies — pointing to countervailing forces of uncertainty and volatility of Trump’s shifting policy pronouncements and aims negatively impacting the strength of the dollar and bond markets even as his broadly described policies typically would be expected to strengthen the dollar.wasn't weakening the dollar one of the goals they stated with the tarifs? (I know they have given a different reason for them every day but...) Something about tired of bearing the burden of being the world's reserve currency or something?

The MAGA view is that the weakening dollar proves Trump is right and his madman/chaos theory of international relations also is working in international trade to produce results (weakening dollar despite significantly increasing tariffs) that traditional trade policy cannot — citing Nixon moving the dollar off the gold standard and implementing tariffs to devalue the dollar and improve the competitiveness of U.S. exports in 1971 as the model. [BTW, Nixon’s shock approach contributed to actions by OPEC that greatly strengthening OPEC’s economic power but that is a different story of unintended consequences]

- Messages

- 41,507

BTW, here is a good background article on the Nixon Administration response to the Oil Embargo that led to the petrodollar:Yes, it was, but economists have expressed surprise at that outcome under thee policies — pointing to countervailing forces of uncertainty and volatility of Trump’s shifting policy pronouncements and aims negatively impacting the strength of the dollar and bond markets even as his broadly described policies typically would be expected to strengthen the dollar.

The MAGA view is that the weakening dollar proves Trump is right and his madman/chaos theory of international relations also is working in international trade to produce results (weakening dollar despite significantly increasing tariffs) that traditional trade policy cannot — citing Nixon moving the dollar off the gold standard and implementing tariffs to devalue the dollar and improve the competitiveness of U.S. exports in 1971 as the model. [BTW, Nixon’s shock approach contributed to actions by OPEC that greatly strengthening OPEC’s economic power but that is a different story of unintended consequences]

Share: