US consumer sentiment plummets to second-lowest level on records going back to 1952

“Americans are rarely this pessimistic about the economy.

Consumer sentiment plunged 11% this month to a preliminary reading of 50.8, the University of Michigan said in its latest survey released Friday, the second-lowest reading on records going back to 1952. April’s reading was lower than anything seen during the Great Recession.

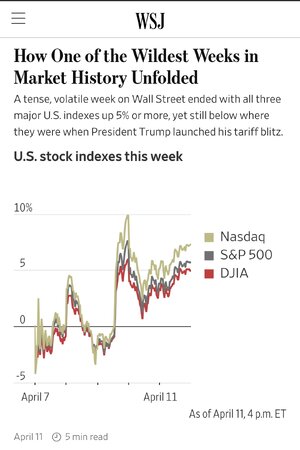

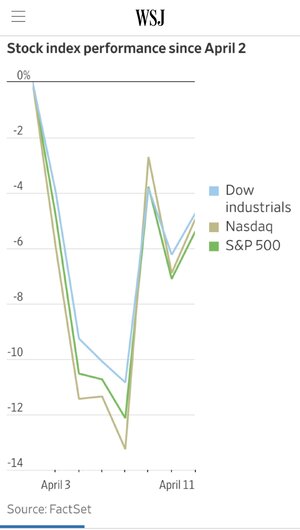

President Donald Trump’s volatile trade war, which threatens higher inflation, has significantly weighed on Americans’ moods these past few months. That malaise worsened leading up to Trump’s announcement last week of sweeping tariffs, according to the survey.

“This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation,” Joanne Hsu, the survey’s director, said in a release. …”

——

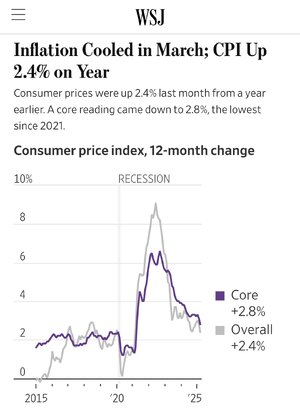

I think Trump is causing all kinds of unjustified self-inflicted wounds on the U.S. economy short term and like long term, BUT the economy is nowhere near the catastrophic state of the Great Recession. Inflation is reasonable and employment rates are strong …

I said it under Biden and it remains true under Trump a lot more than I actually expected, Americans seem to have lost sight of what a strong economy looks like. I get that when government officials predict “pain” and a need to “take your medicine” in the short term that was going to drive down sentiment and certainly the rational and erratic tariff nonsense that Trump has launched is scrambling the markets, which is in turn understandably freaking out Americans.

It really is shocking political malpractice by Trump, no matter how sure he is that he is always right (as he frequently insists everyone tells him), that he could have basked in an uptick in consumer confidence without tinkering with the economy at all just by replacing Biden. People had blamed Biden for real and perceived economic issues and were ready to give Trump a honeymoon. Businesses assumed his trade war rhetoric was mostly bluster and were ready for a deregulatory splurge. All Trump had to do was …. nothing! Just sit tight and take credit for improving trends and blame Biden for any negative blips.

Instead, he chose to radically remake the world trade system at the same time he was radically dismantling government at the same time he was radically reorienting foreign policy to invent disputes with neighbors and allies and promise 19th century Manifest Destiny expansionist plans out of the blue.

The big deal he made about Liberation Day means he owns all of it now. Just shockingly stupid from a purely political perspective.