No, even more detached ... stocks have been going UP. The only times the markets acted rationally during Trump's tenure were the beginning of Covid and the announcement of tariffs. Otherwise, he seems immune from all the dumb stuff he says and does. It's almost like he could shoot someone on 5th Avenue, and stocks would increase.We’re in the fully casino-fied stock market, where consumer sentiment nears historic lows and inflation forecasts rival the late 70s, but stocks barely move.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 4,242

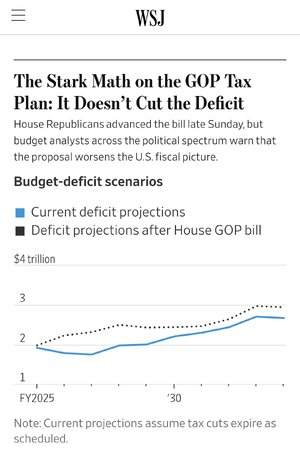

I assume big investors are still excited about Bigly tax cuts and killing off the poorWe’re in the fully casino-fied stock market, where consumer sentiment nears historic lows and inflation forecasts rival the late 70s, but stocks barely move.

- Messages

- 4,112

You nailed it !I assume big investors are still excited about Bigly tax cuts and killing off the poor

- Messages

- 5,217

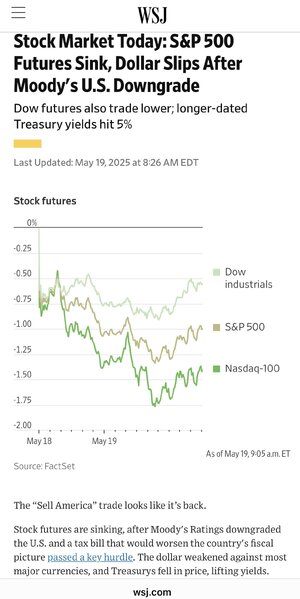

Moody’s strips US of top-notch triple-A credit rating

Agency warns of rising debt and deficit payments

- Messages

- 41,477

“Moody’s Ratings downgraded the United States’ debt on Friday, stripping the country of its last perfect credit rating.

The move could rattle financial markets and push up interest rates, potentially creating an additional financial burden for Americans already struggling with tariffs and inflation.

Of the three major credit rating agencies, Moody’s was the lone holdout, maintaining its outstanding rating of AAA for US debt. Moody’s held a perfect credit rating for the United States since 1917.

It now ranks US creditworthiness one notch below that, at Aa1, joining Fitch Ratings and S&P, which lowered their credit ratings for US debt in 2023 and 2011, respectively. …”

- Messages

- 41,477

“Moody’s Ratings downgraded the United States’ debt on Friday, stripping the country of its last perfect credit rating.

The move could rattle financial markets and push up interest rates, potentially creating an additional financial burden for Americans already struggling with tariffs and inflation.

Of the three major credit rating agencies, Moody’s was the lone holdout, maintaining its outstanding rating of AAA for US debt. Moody’s held a perfect credit rating for the United States since 1917.

It now ranks US creditworthiness one notch below that, at Aa1, joining Fitch Ratings and S&P, which lowered their credit ratings for US debt in 2023 and 2011, respectively. …”

- Messages

- 4,112

It will be interesting to see how investors and traders will react this week.“Moody’s Ratings downgraded the United States’ debt on Friday, stripping the country of its last perfect credit rating.

The move could rattle financial markets and push up interest rates, potentially creating an additional financial burden for Americans already struggling with tariffs and inflation.

Of the three major credit rating agencies, Moody’s was the lone holdout, maintaining its outstanding rating of AAA for US debt. Moody’s held a perfect credit rating for the United States since 1917.

It now ranks US creditworthiness one notch below that, at Aa1, joining Fitch Ratings and S&P, which lowered their credit ratings for US debt in 2023 and 2011, respectively. …”

a flight to safety once again ? In this chaotic environment I continue to believe cash is king...

ChapelHillSooner

Iconic Member

- Messages

- 1,370

I believed that too after moving most of my 401k to cash in February.It will be interesting to see how investors and traders will react this week.

a flight to safety once again ? In this chaotic environment I continue to believe cash is king...

I relented two days ago. Thought that I at least bought cheaper than I sold.

But f’ me on my timing.

superrific

Master of the ZZLverse

- Messages

- 12,420

I doubt they will react at all. Nobody cares about Moody's rating of US debt. Credit rating agencies like Moody's provide a valuable service when rating corporate debt. That's because they have a gigantic database will millions of bond issues, financial and other information about the issuers, and the results of the bond offerings. That data is proprietary. They also do simulations where they stress test bond issues against a number of different macro situations, industry developments, etc.It will be interesting to see how investors and traders will react this week.

a flight to safety once again ? In this chaotic environment I continue to believe cash is king...

But what does Moody's know about the US government that we don't? Nothing. All the finances for the US government are already public. There are few if any comparable sovereign issues for comparison, and even if there were, that information would be public as well. So basically Moody's, when it comes to sovereign debt, is offering a formula. There's no reason to believe its formula over a hedge fund's.

Not coincidentally, Moody's track record with sovereign debt -- this is true of all the CRAs -- is poor. They consistently underrate sovereign debt, almost to a comical degree at times.

I don't think many bond traders pay much attention to CRAs even for corporate issues. They have their own credit models that they trust more. The CRA ratings are often to determine what pension funds are allowed to invest in, but I would be shocked if the states didn't allow fiduciaries to buy US debt regardless of its credit rating. So I don't know how relevant Moody's actually is in today's economy. I'm confident that their ratings of US debt are more or less meaningless -- as demonstrated by the market shrug last couple of downgrades. Like, the market didn't move at all in response.

- Messages

- 41,477

The aftermarket reaction was not positive, but people have the weekend to consider what it means and fine ways to convince themselves it’s fine.It will be interesting to see how investors and traders will react this week.

a flight to safety once again ? In this chaotic environment I continue to believe cash is king...

ChapelHillSooner

Iconic Member

- Messages

- 1,370

But aren’t there stipulations on what some pensions can invest in? Do any require AAA and does it make a difference that it is now 3/3 meaning they can no longer argue US debt is AAA since it is now 0/3?I doubt they will react at all. Nobody cares about Moody's rating of US debt. Credit rating agencies like Moody's provide a valuable service when rating corporate debt. That's because they have a gigantic database will millions of bond issues, financial and other information about the issuers, and the results of the bond offerings. That data is proprietary. They also do simulations where they stress test bond issues against a number of different macro situations, industry developments, etc.

But what does Moody's know about the US government that we don't? Nothing. All the finances for the US government are already public. There are few if any comparable sovereign issues for comparison, and even if there were, that information would be public as well. So basically Moody's, when it comes to sovereign debt, is offering a formula. There's no reason to believe its formula over a hedge fund's.

Not coincidentally, Moody's track record with sovereign debt -- this is true of all the CRAs -- is poor. They consistently underrate sovereign debt, almost to a comical degree at times.

I don't think many bond traders pay much attention to CRAs even for corporate issues. They have their own credit models that they trust more. The CRA ratings are often to determine what pension funds are allowed to invest in, but I would be shocked if the states didn't allow fiduciaries to buy US debt regardless of its credit rating. So I don't know how relevant Moody's actually is in today's economy. I'm confident that their ratings of US debt are more or less meaningless -- as demonstrated by the market shrug last couple of downgrades. Like, the market didn't move at all in response.

superrific

Master of the ZZLverse

- Messages

- 12,420

1. It used to be that AAA was required in pretty much most fiduciary contexts. Then after 2008, states and associations began loosening the coupling to AAA ratings. I don't know how far they got or whether it was completed.But aren’t there stipulations on what some pensions can invest in? Do any require AAA and does it make a difference that it is now 3/3 meaning they can no longer argue US debt is AAA since it is now 0/3?

I would be shocked if there were states requiring AAA for US debt. The statute or regulation could read something like, "a fiduciary may only invest in a) debt securities rated AAA; b) US Treasury Debt; c) [ . . . ]." It could be state regulators who issue regs on this issue. Maybe the courts interpret AAA to include US Treasury debt. But I really have trouble believing that fiduciaries will not be able to hold US debt.

First: it would be the most idiotic of policies. Everyone knows that everyone holds Treasuries. If suddenly every fiduciary had to unload the treasury debt, it would cause a fire sale, and the last thing a regulator wants to do is force companies to panic sell into a fire sale. Second , if I'm wrong and there will be mass unloading of Treasuries, it would be a much bigger story right now. It's not exactly a debt default, but a panic sale on treasuries would induce chaos.

- Messages

- 4,112

It was a bright cold day in April ,and the clocks were striking thirteen...

www.rawstory.com

www.rawstory.com

Rule change would allow Trump to 'cook the books' and hide collapsing economy: report

As part of Donald Trump's administration's purge of federal employees who are believed to not be willing to support his agenda, there is a new move afoot to make it permissible to fire federal financial analysts if their reports don't paint the pretty picture the president demands.According to a...

www.rawstory.com

www.rawstory.com

1moretimeagain

Inconceivable Member

- Messages

- 4,134

First drop in inflation in 4 years? What is he talking about?

HintonJamesHeel

Esteemed Member

- Messages

- 727

Stocks go up. The whims of investors might impact for a month or even 6 months but stocks go up. That will continue.

- Messages

- 41,477

- Messages

- 41,477

Share: