Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

HintonJamesHeel

Esteemed Member

- Messages

- 727

I think we are saying the same thing. Being green for the year is great considering the churn we’ve had. The green would be more green without Trump’s craziness. The fact we are green shows the economy’s strength.It’s not. He has nullified what otherwise would have been a profitable period. He screwed up a fool proof situation.

HintonJamesHeel

Esteemed Member

- Messages

- 727

Agreed. That’s what I’ve seen over and over again on this thread. Go back and look at what was being said around Liberation Day. Folks were saying 20-25% down. Trump collapsed on his policies and we have rebounded. That’s not an endorsement of Trump. It’s the opposite.So it's a win since it didn't end up as bad as predicted? Money wise I was on a much better path before trumponomics started.

Bigs23

Inconceivable Member

- Messages

- 3,095

We’ll have to wait and see what happens when the impact of this idiotic plan actually kicks in.I think we are saying the same thing. Being green for the year is great considering the churn we’ve had. The green would be more green without Trump’s craziness. The fact we are green shows the economy’s strength.

- Messages

- 4,112

I would not bet my life on 4.6% GDP growth in the 2nd quarter , but that would be a positive sign that Trump's economic plan will return our economy to the greatest economy in the history of all mankind...Atlanta Federal Reserve is now predicting 4.6% economic growth in the 2nd quarter of this year. Pretty decent for an "idiotic" economic plan.

"The improved GDP predictions correlate directly with new trade agreements and the delay of tariffs. However, the political landscape remains precarious. Trump’s vocal stance on potential renewed tariffs, particularly against China and the EU, introduces significant uncertainty. Many analysts highlight the paradox of a bullish GDP outlook coupled with the looming threat of trade wars. If tariffs are reinstated, they could lead to an economic contraction that undermines the Fed’s optimistic projections."

ChileG

Inconceivable Member

- Messages

- 3,159

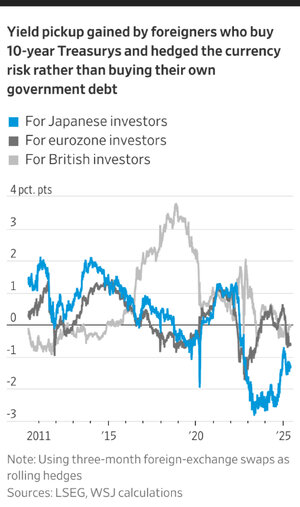

For the MAGAs lurking, this is more evidence that Trump and his administration have no fucking clue about what they are doing.Global Investors Have a New Reason to Pull Back From U.S. Debt

After hedging currency risk, foreign investors no longer make money buying American bonds

—> https://www.wsj.com/finance/investi...4?st=wLmyfo&reflink=desktopwebshare_permalink

“Foreign investors have plenty of reasons to be wary of U.S. government debt at the moment. Now there is another: They can often receive better returns buying bonds in their own countries.

The risk of a weaker U.S. dollar and the cost of protecting against that risk, are making American assets less attractive around the world. That comes at a bad time for the U.S. Treasury market, which is already contending with a darkening U.S. budget picture and the trade war….”

lawtig02

Legend of ZZL

- Messages

- 5,893

- Messages

- 4,112

Management's Services PMI registered a reading of 49.9 in May, below the 51.6 seen in April and lower than the increase to 52 economists had expected. Readings above 50 for this index indicate an expansion in activity, while readings below 50 indicate contraction. May's data marked just the fourth time the services sector has fallen into contraction in the past five years.

- Messages

- 8,287

Many seem to be missing the ripple effect of the uncertainty in business.We’ll have to wait and see what happens when the impact of this idiotic plan actually kicks in.

It's costing my company money.

- Messages

- 8,287

There's no plan. He caved and we are basically back where we started.Atlanta Federal Reserve is now predicting 4.6% economic growth in the 2nd quarter of this year. Pretty decent for an "idiotic" economic plan.

Plus the ripple effect will be lagging.

Last edited:

superrific

Master of the ZZLverse

- Messages

- 12,415

1. It is not the Atlanta Federal Reserve. It is their GDP Now estimator, which they expressly disclaim as not being anything like an official forecast. It's just a real-time data aggregator, essentially. It's useful, though no longer because . . .Atlanta Federal Reserve is now predicting 4.6% economic growth in the 2nd quarter of this year. Pretty decent for an "idiotic" economic plan.

2. The model was not calibrated for a regime of wild economic uncertainty and volatility. We already saw that in 1Q, when GDP Now was predicting -2.5% growth but it had to be adjusted for an unusually large spike in gold transfers.

Well, if you peek into the GDP Now forecast, you'll see net exports are projected to grow 2.1% -- which accounts for most of that growth. Well, it's a good thing that we're exporting more, right? Except we aren't. That 2.1% figure is almost certainly about reduced imports from China. As we've seen, those reduced imports are not positively affecting the economy, but the damage won't show up in the May numbers. And there's an explicit assumption that personal expenditures are going to remain robust even though the net import story is telling a different tale.

Again, the tool was not calibrated to an exogenous shock like tariffs. Most models fail when there are exogenous shocks.

- Messages

- 41,444

Obviously totally anecdotal but I am definitely starting to see ripples causing distress for corporate borrowers due to tariffs, hostility to green energy and related uncertainties… a noticeable uptick in calls from and about distressed borrowers this month.Many seem to be missing the ripple effect of the uncertainty in business.

It's costing my company money.

superrific

Master of the ZZLverse

- Messages

- 12,415

Yep.Obviously totally anecdotal but I am definitely starting to see ripples causing distress for corporate borrowers due to tariffs, hostility to green energy and related uncertainties… a noticeable uptick in calls from and about distressed borrowers this month.

You should be a leading economic indicator. Seriously. I mean, not you specifically but your field.

- Messages

- 41,444

I’ve had more serious conversations about Chapter 7 bankruptcy in the last 6 weeks than I had in the last several years. Chapter 11 comes up fairly regularly but it is unusual in my 25+ years to have Chapter 7 be in play this often. [For those unfamiliar, Chapter 11 generally is used to try to restructure a company to emerge from bankruptcy as a going concern (though it doesn’t always work out that way); Chapter 7 means skipping any restructuring and basically mailing the keys to the lender and wishing them best of luck liquidating the remaining assets. ]Yep.

You should be a leading economic indicator. Seriously. I mean, not you specifically but your field.

lawtig02

Legend of ZZL

- Messages

- 5,893

Yeah, companies reliant on imports, especially small businesses with low margins, are just totally FUBAR right now.I’ve had more serious conversations about Chapter 7 bankruptcy in the last 6 weeks than I had in the last several years. Chapter 11 comes up fairly regularly but it is unusual in my 25+ years to have Chapter 7 be in play this often. [For those unfamiliar, Chapter 11 generally is used to try to restructure a company to emerge from bankruptcy as a going concern (though it doesn’t always work out that way); Chapter 7 means skipping any restructuring and basically mailing the keys to the lender and wishing them best of luck liquidating the remaining assets. ]

superrific

Master of the ZZLverse

- Messages

- 12,415

Chapter 7? I guess you weren't involved in the Lehman bankruptcy? Oh who am I kidding -- every lawyer in NYC was involved with that bankruptcy in some fashion, LOL.I’ve had more serious conversations about Chapter 7 bankruptcy in the last 6 weeks than I had in the last several years. Chapter 11 comes up fairly regularly but it is unusual in my 25+ years to have Chapter 7 be in play this often. [For those unfamiliar, Chapter 11 generally is used to try to restructure a company to emerge from bankruptcy as a going concern (though it doesn’t always work out that way); Chapter 7 means skipping any restructuring and basically mailing the keys to the lender and wishing them best of luck liquidating the remaining assets. ]

On a serious note: "inquiries about Chapter 7 with lawyers" definitely should be a leading indicator.

Share: